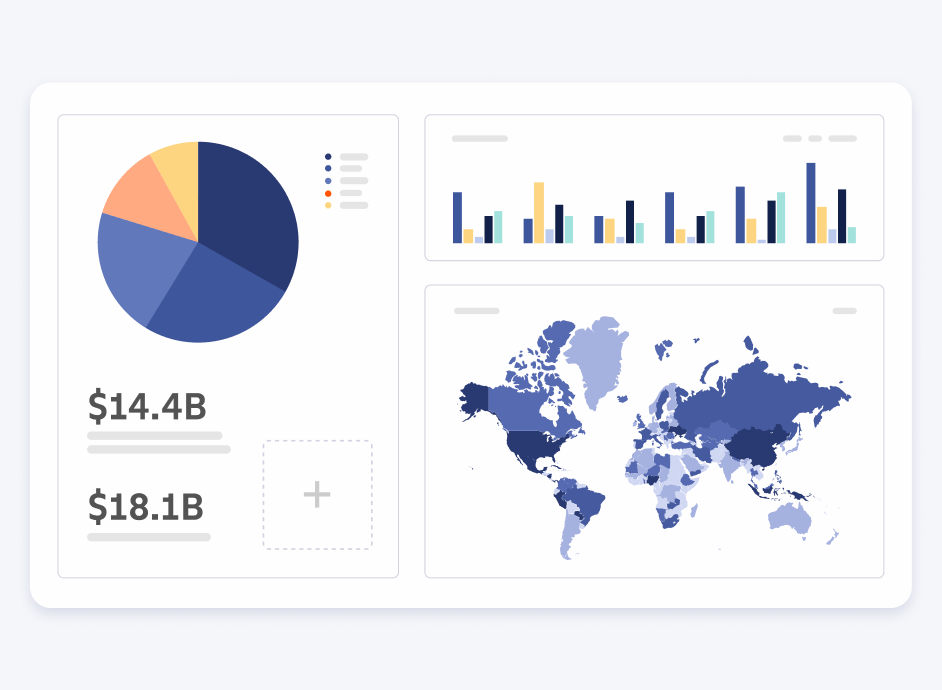

Powering compliant digital custody

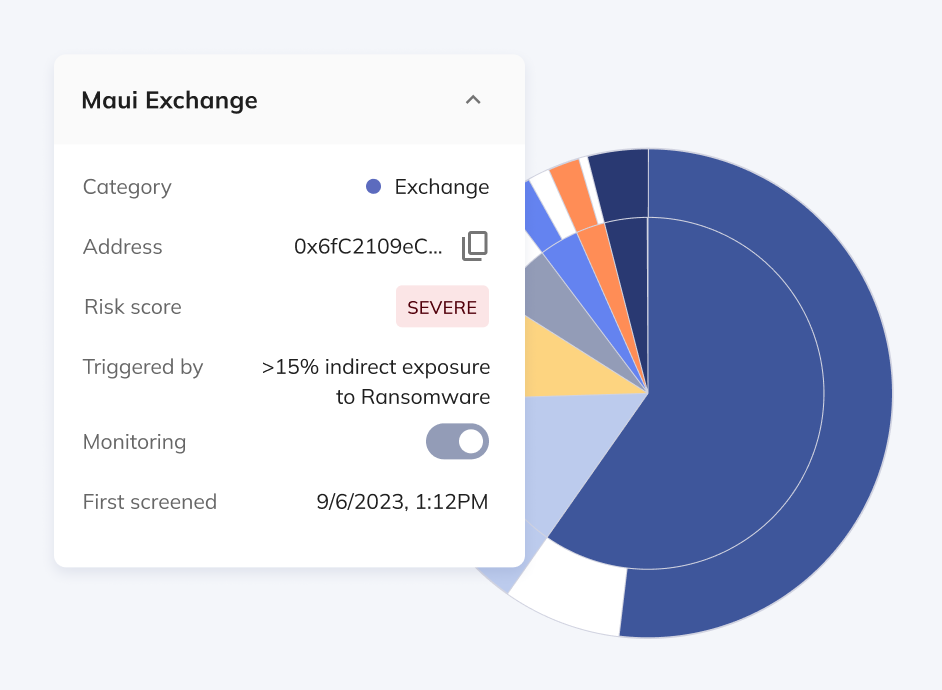

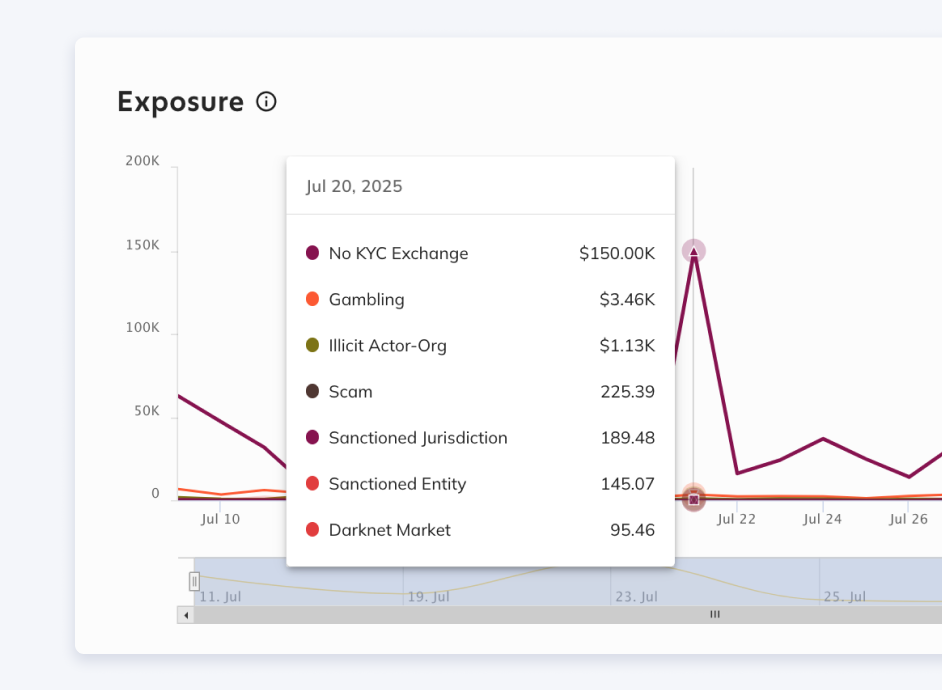

BNY Mellon integrated the full Chainalysis compliance suite into its risk management program to safely launch a multi-asset digital custody and administration platform that meets stringent regulatory and due diligence standards for institutional clients.