Law Enforcement

Detect, disrupt, and deter crypto crime with blockchain insights

From reactive to proactive, monitor fraud, pursue illicit activity, and detect and deter threat actors.

9/10

Nine of the top ten crypto exchanges use Chainalysis

$34 billion

illicit funds frozen or recovered by law enforcement agencies worldwide trusting Chainalysis data, software, and services

45+

regulators worldwide use Chainalysis to inform regulation, protect consumers, and detect national security threats

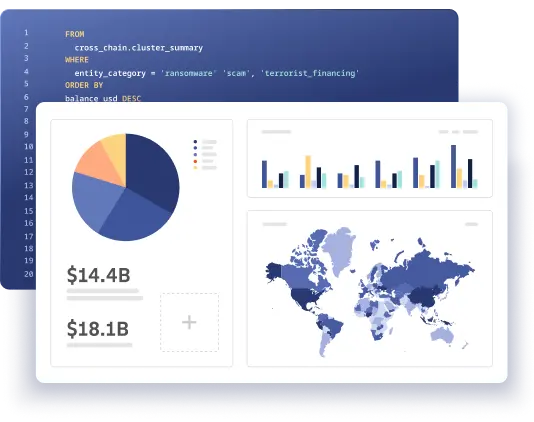

Understand the entire flow of funds from source to destination. Discover leads, analyze activities, and pursue threats across chains, web3 infrastructure, and more. Visualize illicit networks and gather actionable intelligence to combat crypto crime.

Ensure compliance and prevent illicit activity with continuous and real-time screening of crypto transactions. Tailor your risk settings, assess deposits and withdrawals, and audit suspicious user activity.

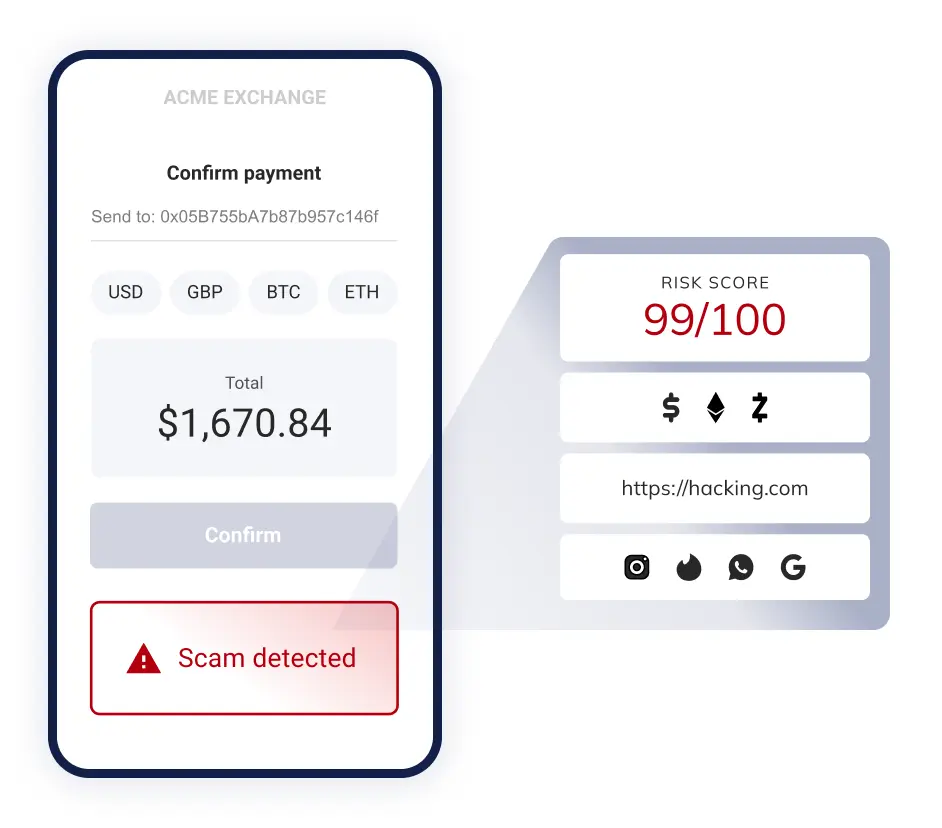

Leverage on-chain intelligence to screen wallet addresses, virtual asset service providers (VASPs), or entire token ecosystems to identify and respond to potential risks and ensure compliance with regulations.

Leverage enterprise-grade security to prevent cyber exploits, scams, financial risks and more for protocols, chains, asset managers, and exchanges.

Prevent evolving threats with AI-powered fraud detection to reduce payments-related fraud, build customer trust, and protect your reputation.

Build bespoke analyses and alerting with the industry’s most trusted blockchain intelligence to generate new leads and take action on data-driven insights to advance your mission.

Using sophisticated machine learning techniques coupled with proprietary architecture, we are built to handle hundreds of clustering heuristics, ingest data at scale, and verify data accuracy with the lowest tolerance for error in the industry.

Chainalysis seamlessly onboards new blockchains and automatically supports all tokens that follow widely adopted standards. This approach guarantees instant compatibility and the most comprehensive blockchain coverage in the industry.

Chainalysis simplifies the complex and makes it effortless to trace the flow of funds through bridges, mixers, DEX swaps, and more.

Chainalysis data is court admissible and has uniquely helped customers take ground-breaking actions in court.

Our global team supports you along your journey bringing 24/7 unmatched experience, localized guidance, an understanding of diverse threat typologies, as well as how to execute on advanced investigative techniques.

Chainalysis pioneered blockchain intelligence, and we continue to build on our tradition of innovation. Chainalysis Labs, our R&D initiative dedicated to advancing cutting edge technology, brings new features and capabilities that are unique to Chainalysis.

Detect, disrupt, and deter crypto crime with blockchain insights

Protect consumers, establish safe markets, and maintain financial stability

Generate new revenue opportunities with digital assets

Optimize crypto exchange operations through data insights

Advance crypto casework with greater speed and efficiency.

Scale projects securely with low-lift integrations

Start your brand’s seamless transition into web3

Proactive threat hunting and prevention