Sentinel

Monitor your token’s ecosystem with confidence

Gain a comprehensive view of your token’s ecosystem by analyzing risk exposure across more than 35 categories. Monitor daily transactions, identify and assess risk trends over time, and take proactive measures to ensure a safe and compliant environment.

Monitor ecosystem usage

Understand how your asset is being transacted and with which types of holders.

Reduce illicit activity

Take data-driven actions to freeze tokens that are interacting with illicit sources.

Maintain compliance

Integrate and enforce compliance to maintain regulatory standards and prevent illicit activities.

React proactively

Build ecosystem transfer alerts into your workflows so that you can respond quickly to illicit activity.

Proactive monitoring for a safer token ecosystem

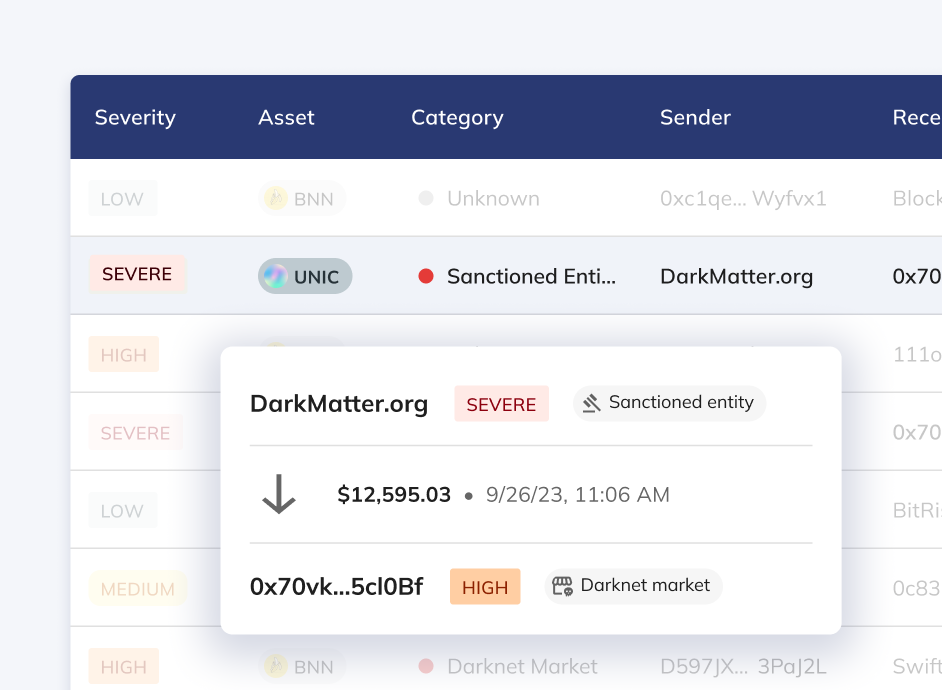

Monitor transactions daily

Identify and monitor risky market activity, such as transactions with sanctioned entities or high-risk addresses, enabling proactive measures like freezing or burning tokens to maintain the integrity of the ecosystem.

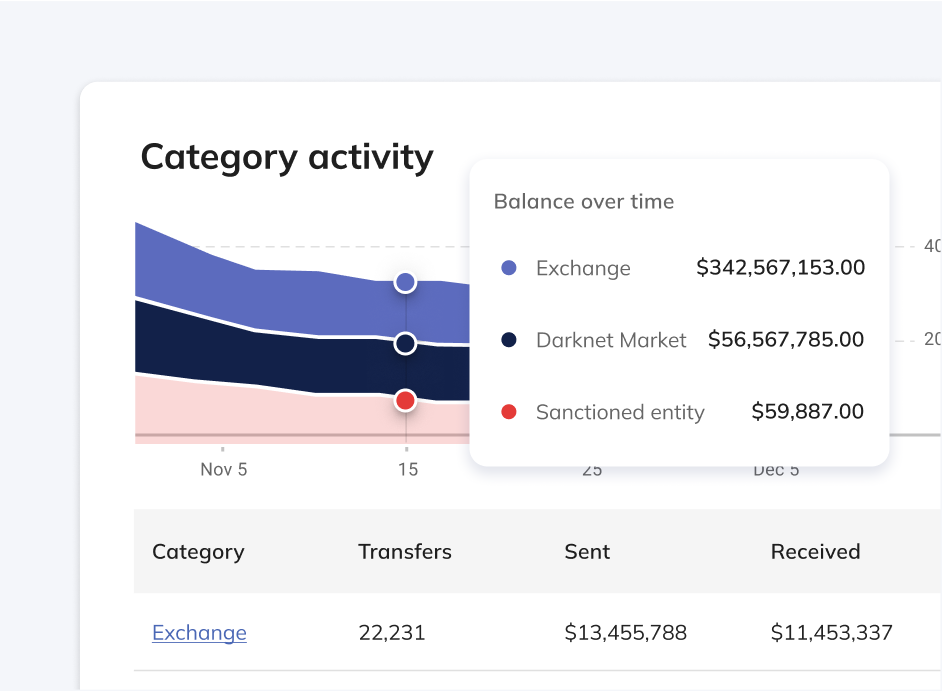

Spot trends and assess historical activity

Determine if certain categories are increasing or decreasing in activity over time. Identify movement of tokens within each category and focus on categories that require further attention.

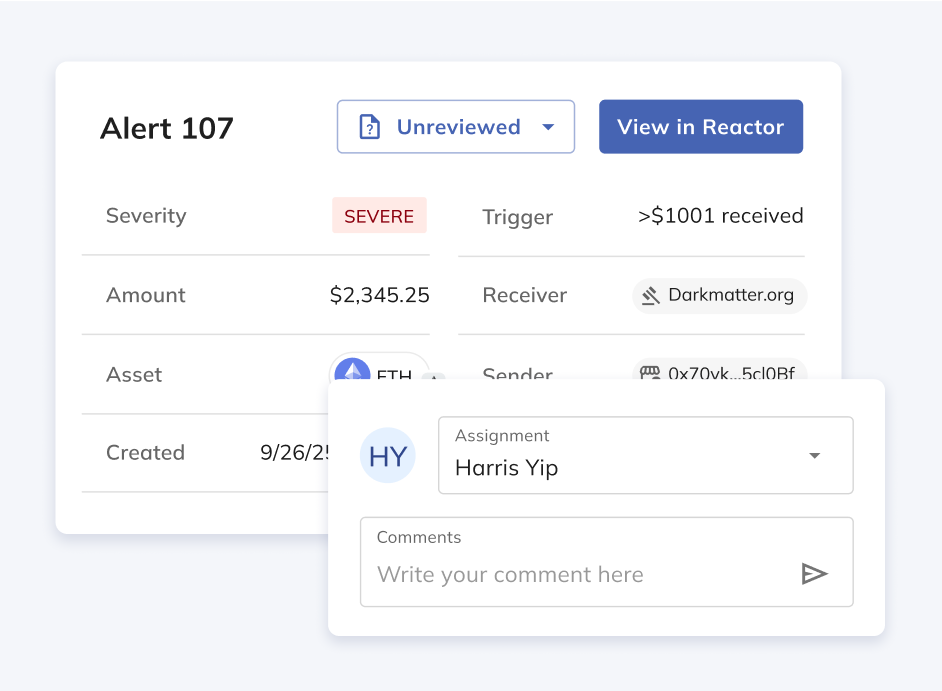

Risk direct counterparties for issuance and redemption

Customize risk settings, assign alerts for review and assess the transaction in KYT, and even perform deeper due diligence in Reactor.

Webinar

Stablecoin Regulation & Compliance: What Organizations Need to Know

Purpose-built capabilities for securing token ecosystems

Examine service holdings

Understand the risk exposure of specific services holding your token

Exposure

Understand the general risk exposure of your token’s ecosystem across categories

Time-based views

Narrow analysis of a VASP to key time periods, to fully assess activity.

Bulk exports

Bulk export specific addresses and balances for further analysis and view in graphs.

Category views

Narrow to specific categories of exposure to understand trends in activity.

Real-time alerts

Get alerted in real-time on specific activity of interest

Why token issuers choose Chainalysis

Superior data

Chainalysis ingests data intelligence at scale, uses hundreds of clustering heuristics, and verifies accuracy using the most rigorous standards in the industry.

Greater control and speed

Chainalysis provides greater tools for customizing risk settings and managing alerts in bulk, enabling you to tailor your risk posture and prioritize focus more effectively.

Leverage a community

Collaborate with a dedicated community of thousands of crypto investigators and compliance professionals.

Align with regulators

Regulators around the world use Chainalysis and collaborate with private sector companies.

FAQ

Who should use Sentinel and how does it differ from compliance tools aimed at exchanges or wallets?

Sentinel is purpose-built for token issuers and tokenized-asset providers looking to secure their token ecosystem. Sentinel is not used for high throughput transaction monitoring like KYT. Sentinel monitors how your token is being transacted, held, and moved across secondary markets and addresses, helping issuers maintain integrity and regulatory readiness.

What insights and workflows can I run in Sentinel?

Sentinel lets you examine service holdings, assess overall exposure across categories, drill into specific category views, and bulk export addresses and balances for further analysis. It also enables data-driven, actionable workflows for freezing tokens.

How can I understand historical trends or patterns in my token’s ecosystem?

Sentinel provides time-based views that let you filter by date, category or service type, and bulk export address or balance data for deeper analysis

How does Sentinel integrate with other Chainalysis tools I may already use?

Does Sentinel have alerting functionality?

Yes, you can create rules and get alerted on activity tailored for your compliance needs.

Ensure a safe and compliant token ecosystem

Gain comprehensive insights to manage risk and ensure regulatory compliance with a holistic and accurate view of your token’s ecosystem.