Alterya

Connect crypto fraud across financial identifiers and block scams instantly

Safeguard your customers from authorized push-payment (APP) fraud and secure your platform with AI-powered threat intelligence.

Prevent crypto scams

Detect and block authorized push-payment fraud before funds leave your customer’s account. $8B+ monthly transactions monitored.

Grow your business

With reliable data, reduce false declines for legitimate transactions incorrectly flagged as cryptocurrency scams and increase approval rates.

Increase customer trust

Build strong reputation and support customers by flagging potentially fraudulent cryptocurrency transactions. Alterya protects 100M+ users.

Comply with regulations

Meet regulatory requirements and expectations for managing fraud.

360° protection from scams and money mules

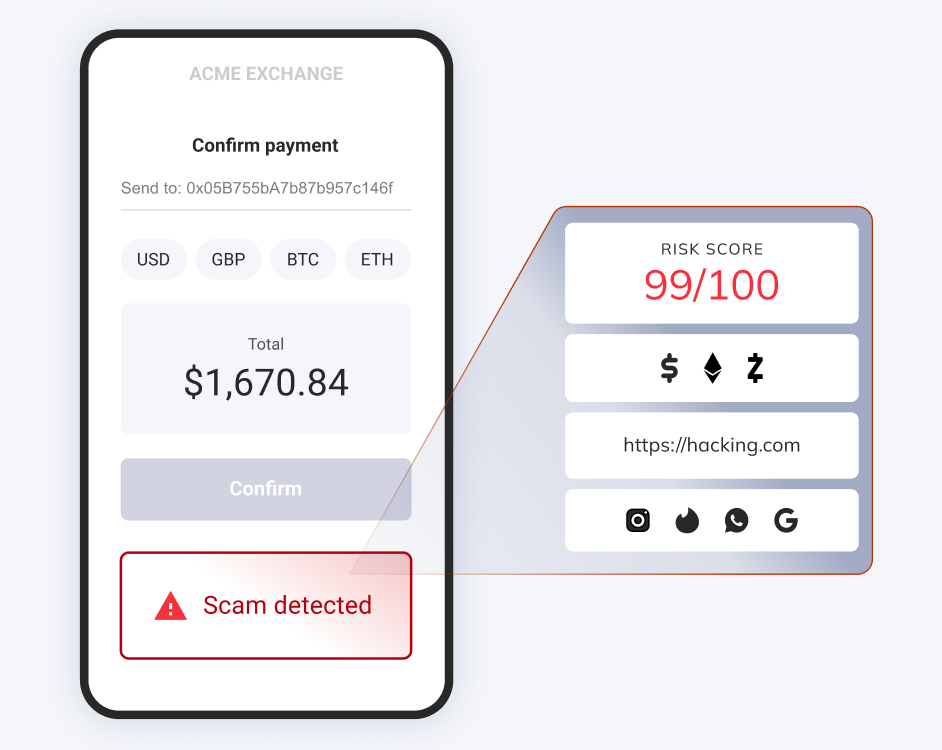

Protect customers from fraudulent payments

Automatically prevent payments to scammers with AI-powered intelligence that detects transactions related to fraudulent entities.

Detect fraudulent money mule accounts and more

Identify money mules, synthetic identities, and fraudulent accounts during your KYC process. Block and remove fraudsters from your platform.

Link scam activity across network

Back-up your decisions and your platform’s actions with reliable intelligence gathered across financial identifiers.

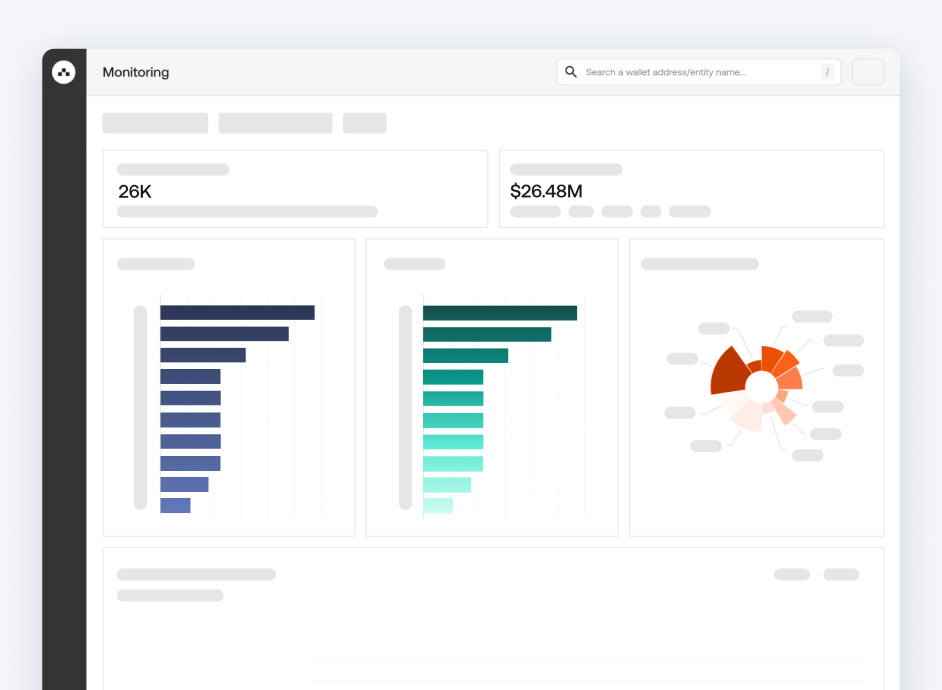

Track fraudulent activity across your platform

Understand the scope of your platform’s exposure to malicious actors through comprehensive transaction tracking.

Purpose-built capabilities for high volume payment services

Entity risk score

Get a single score that informs the fraudulent risk score for an address.

Dashboards

Understand your platform’s exposure to malicious actors and track suspicious activity.

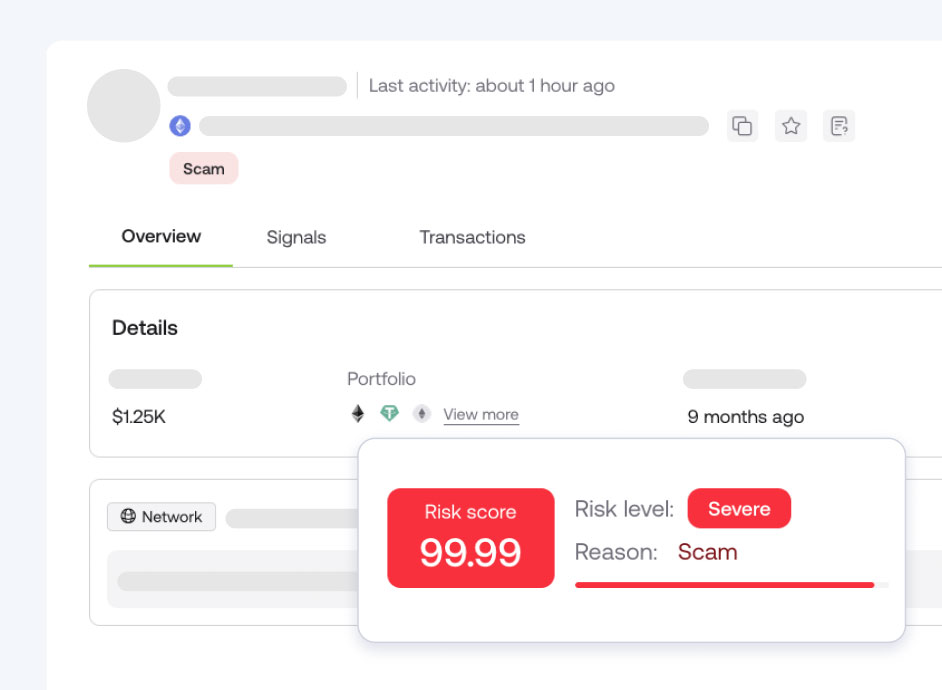

Evidence

Automatically see evidence of fraudulent activity in manual review.

Notifications

Automatic alerts of risk changes through Webhooks.

Explorer

Conduct in-depth risk investigation and analysis for accounts and wallet addresses.

Watchlists

Quickly assess information for specific financial identifiers.

How Alterya helps you

Cryptocurrency Exchanges

Secure transactions and user accounts. Detect and block scam-related transfers. Find and off-board money mule and fraudulent user accounts.

Real-time payment platforms (RTPs)

Detect and block fraudulent activity to scam-linked crypto wallets, high-risk counterparties, and suspicious on/off-ramp activity.

Payment processors

Enable businesses to improve risk management and operate more confidently in blocking fraudulent activity in high-volume environments.

Banks to reduce scam risk

Prevent fraud in cryptocurrency transfers, digital wallet (RTP) transfers, and traditional fiat transfers. Identify and offboard fraudulent accounts.

Why customers choose Chainalysis for Web3 security

Multi-chain, multi-protocol coverage

Chainalysis prevents on-chain exploits across L1s, L2s, DeFi protocols, and exchanges, offering full cross-chain coverage.

Industry leading threat and fraud detection systems

Chainalysis security solution detects almost all hacks with near-zero false positives.

Easy integration

Deploy without disrupting your existing workflows–no smart contract modifications, no custom coding required.

Trusted by 1,400+ law enforcement agencies and organizations worldwide

With over a decade building trust in blockchains, Chainalysis is the trusted partner for governments, enterprises and web3 companies.

Blog

What is Authorized Push Payment (APP) Fraud? Understanding Crypto-Related Scams & Prevention

FAQ

What is Alterya?

Alterya is an AI-powered fraud prevention platform from Chainalysis that connects fraud signals across crypto, digital wallets, and traditional bank accounts. It detects scams at inception through AI-driven monitoring of web, social, and chat channels, enabling real-time blocking of authorized push-payment (APP) scams before funds leave a customer’s account.

Who uses Alterya?

Alterya is used by cryptocurrency exchanges, real-time payment (RTP) platforms, payment processors, and banks. These organizations rely on Alterya to secure withdrawals, prevent crypto-related and fiat APP scams, identify mule or synthetic accounts, and reduce fraud losses while maintaining smooth customer experiences.

What types of fraud can Alterya detect and prevent?

Alterya detects a wide range of fraud types, including authorized push-payment (APP) scams, crypto transfer scams, money-mule and synthetic accounts, pig-butchering and romance scams, and social-engineering-driven withdrawals. Its AI models connect these fraud vectors across crypto and fiat ecosystems.

How does Alterya use AI to detect scams?

Alterya’s AI models continuously learn from patterns across web data, chat messages, and blockchain activity. This allows it to identify emerging scams such as romance fraud, investment scams, or mule recruitment before they spread, enabling proactive detection and automated blocking in real time.

What makes Alterya different from other similar security tools?

Many alternatives are reactive and rely heavily on end‑user reports or purely behavioral/transaction anomalies, making them slower on authorized (APP) fraud; Alterya’s upstream, cross‑channel collection identifies the scam infrastructure and recipients before victims send funds. Traditional compliance tooling focuses on sender behavior (unauthorized fraud); Alterya brings recipient‑side risk and cross‑rail identifiers into the same view, which is critical for APP fraud and money‑mule workflows.

Safeguard your platform with AI-driven fraud prevention

Get a personalized demo and learn how Alterya prevents financial fraud before it happens.