This post is an excerpt from our 2025 Geography of Cryptocurrency Report. Download the full report now!

Sub-Saharan Africa: Strong recovery with deepening retail activity

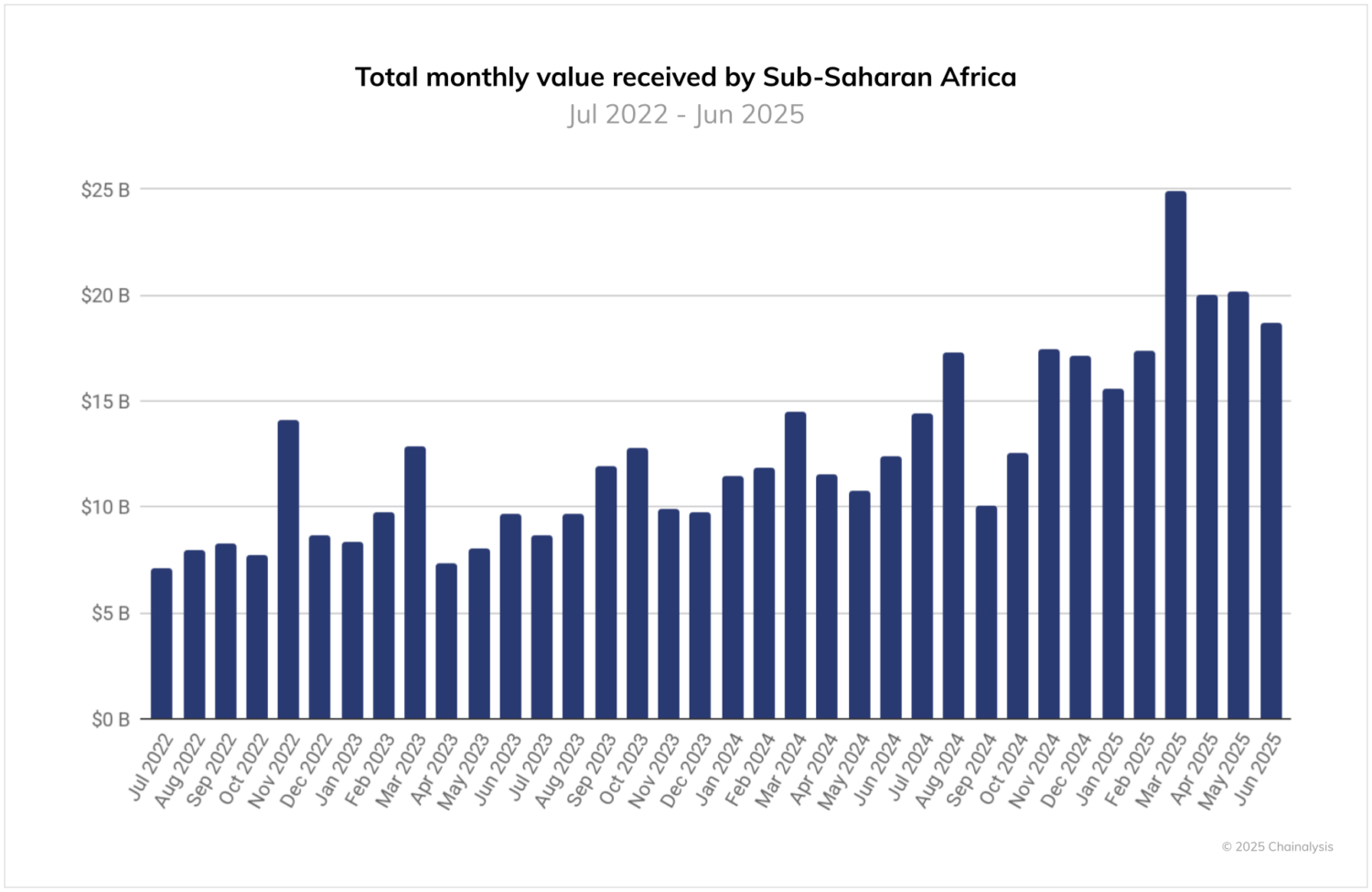

Sub-Saharan Africa (SSA) remains the smallest crypto economy in our regional analysis, yet its usage patterns reveal significant insights into grassroots adoption and the increasing role of crypto in everyday financial activity. Between July 2024 and June 2025, the region received over $205 billion in on-chain value, up roughly 52% from the previous year. This growth makes it the third fastest growing region in the world, just behind APAC and Latin America.

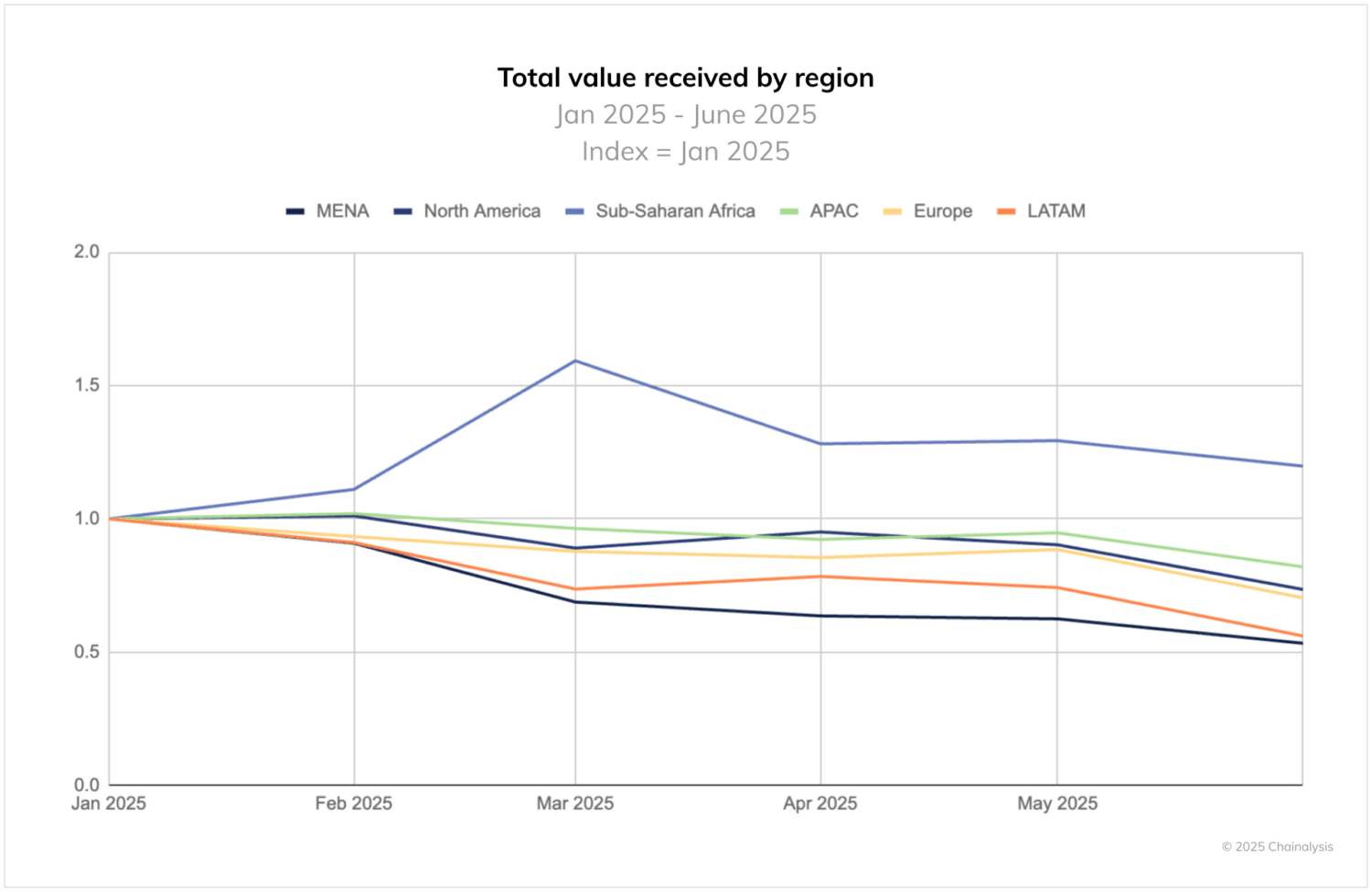

In March 2025, Sub-Saharan Africa saw a sharp surge in activity, with monthly on-chain volume reaching nearly $25 billion, a clear outlier during a month when most other regions experienced declines, as the indexed chart below shows. The surge was driven largely by centralized exchange activity in Nigeria, where a sudden currency devaluation prompted increased crypto adoption. Such devaluations typically drive volumes higher in two ways: more users move into crypto to hedge against inflation, and existing purchases appear larger in local currency terms as it takes more fiat to buy the same amount of crypto.

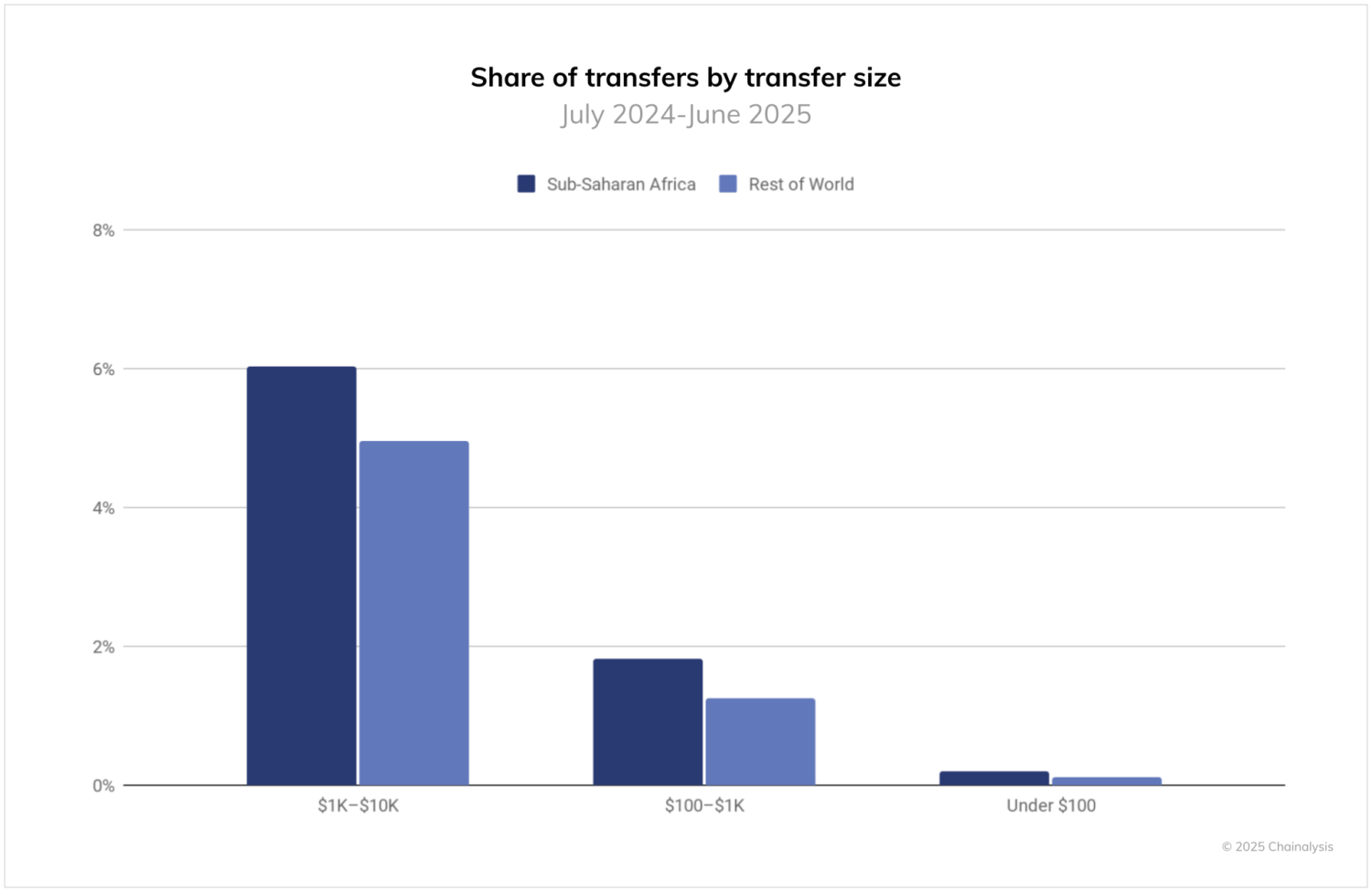

In the past year, Sub-Saharan Africa also emerged as a key retail market. Currently, analyzing transfer sizes shows that the share of all transfer sizes in the region that are less than $10,000 is larger than that seen in the rest of the world. In Sub-Saharan Africa, over 8% of all value transferred between July 2024 and June 2025 was less than $10,000 versus 6% for the rest of the world. This highlights that crypto adoption trends in Sub-Saharan Africa are more intertwined with the region’s ongoing financial inclusion challenges. Despite significant progress in recent years, particularly around mobile money adoption, a significant amount of adults in Sub-Saharan Africa remains unbanked which creates further fertile ground for alternative financial technologies like cryptocurrencies.

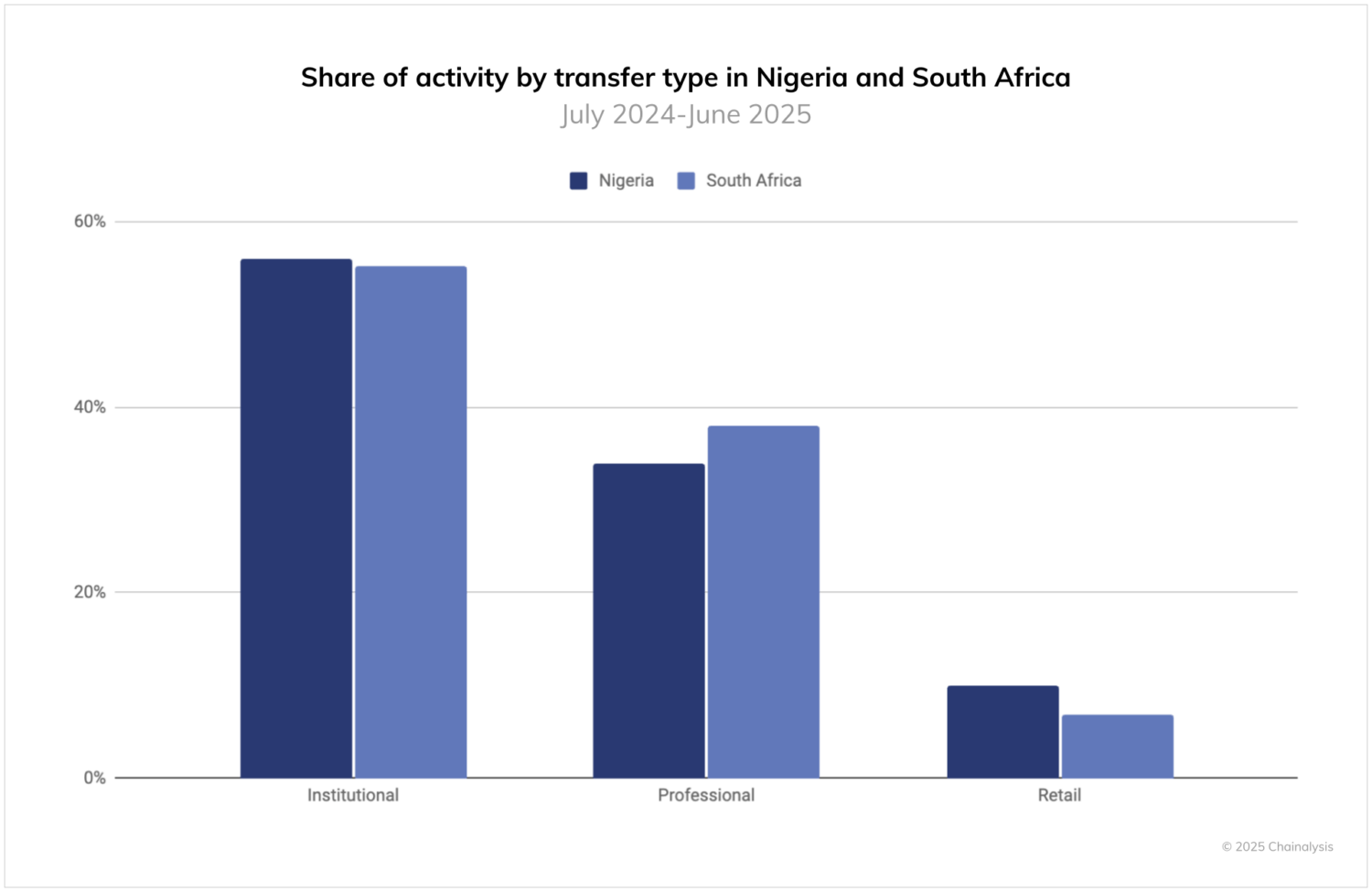

Institutional Momentum: How Nigeria and South Africa are driving crypto maturity

Nigeria and South Africa, the two largest markets in the region, show substantial institutional activity, as we can see in the chart below. Much of this is likely driven by a growing B2B sector facilitating cross-border payments.

Further analysis of on-chain flows reveal that stablecoins are frequently used in high-value transactions tied to trade flows between Africa, the Middle East, and Asia. In particular, we observe regular multi-million dollar stablecoin transfers that support sectors such as energy and merchant payments, highlighting crypto’s utility as a settlement rail in regions where traditional financial infrastructure may be limited or slow.

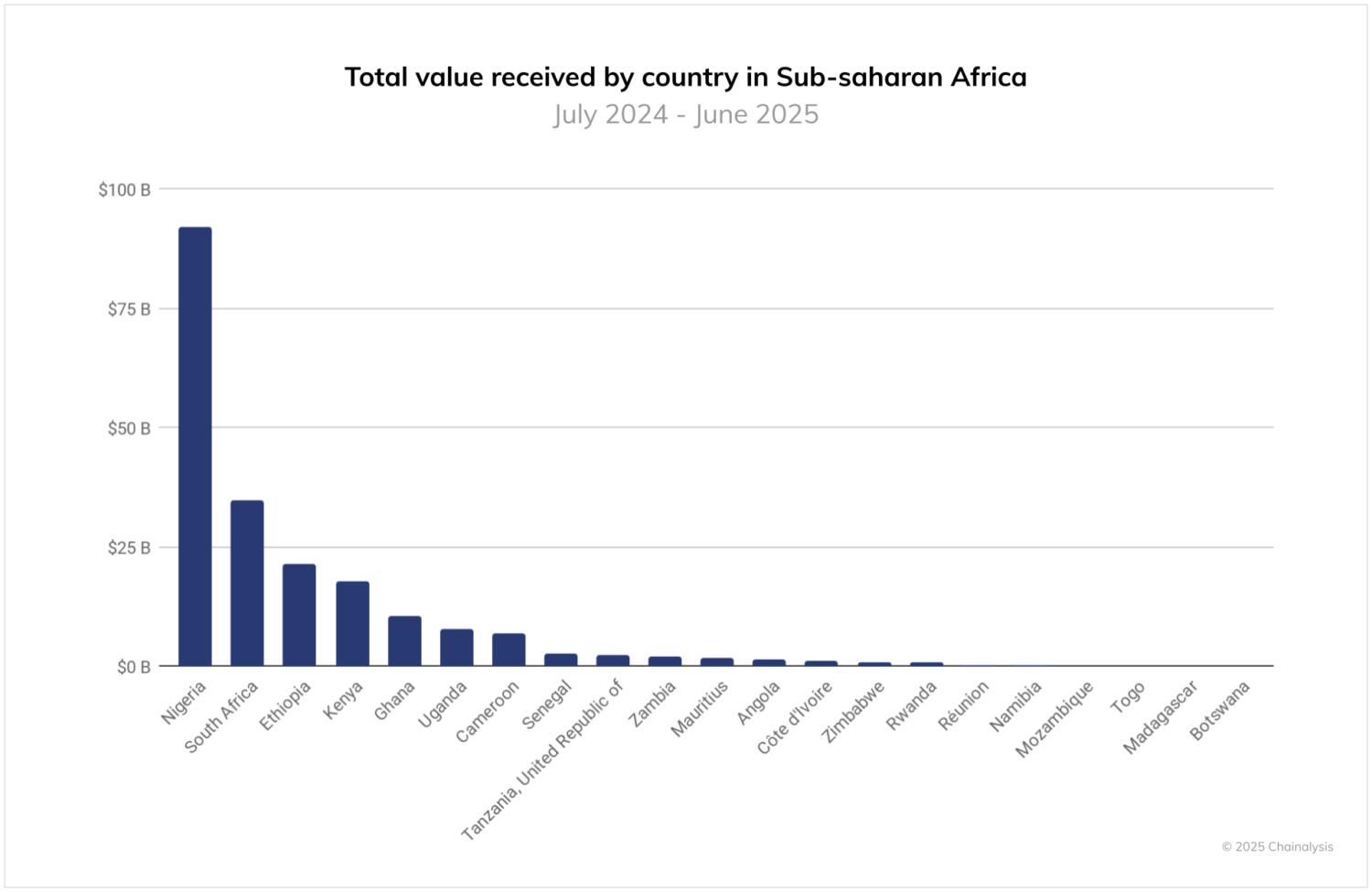

At the country level, Nigeria continues to lead the region by a wide margin, receiving over $92.1 billion in value during the 12-month period — nearly triple that of the next country, South Africa. Ethiopia, Kenya, and Ghana round out the top five. Nigeria’s scale is tied not only to its population and tech-savvy youth, but also to persistent inflation and foreign currency access issues that have made stablecoins an attractive alternative.

South Africa stands out in Sub-Saharan Africa for its advanced regulatory framework, which has fostered a more institutionalized crypto market. With hundreds of registered virtual asset service providers already licensed, the country has provided the regulatory certainty that institutional players need to engage meaningfully. As a result, the market sees a high share of large-ticket volumes, often driven by sophisticated trading strategies like arbitrage. Financial institutions are actively exploring crypto-related offerings, from custody to stablecoin issuance, signaling a shift from exploratory interest to active product development. For instance, institutions like Absa Bank in South Africa are in advanced stages of product development for institutional clients. This institutional momentum sets South Africa apart as a regional leader in crypto infrastructure and compliance maturity.

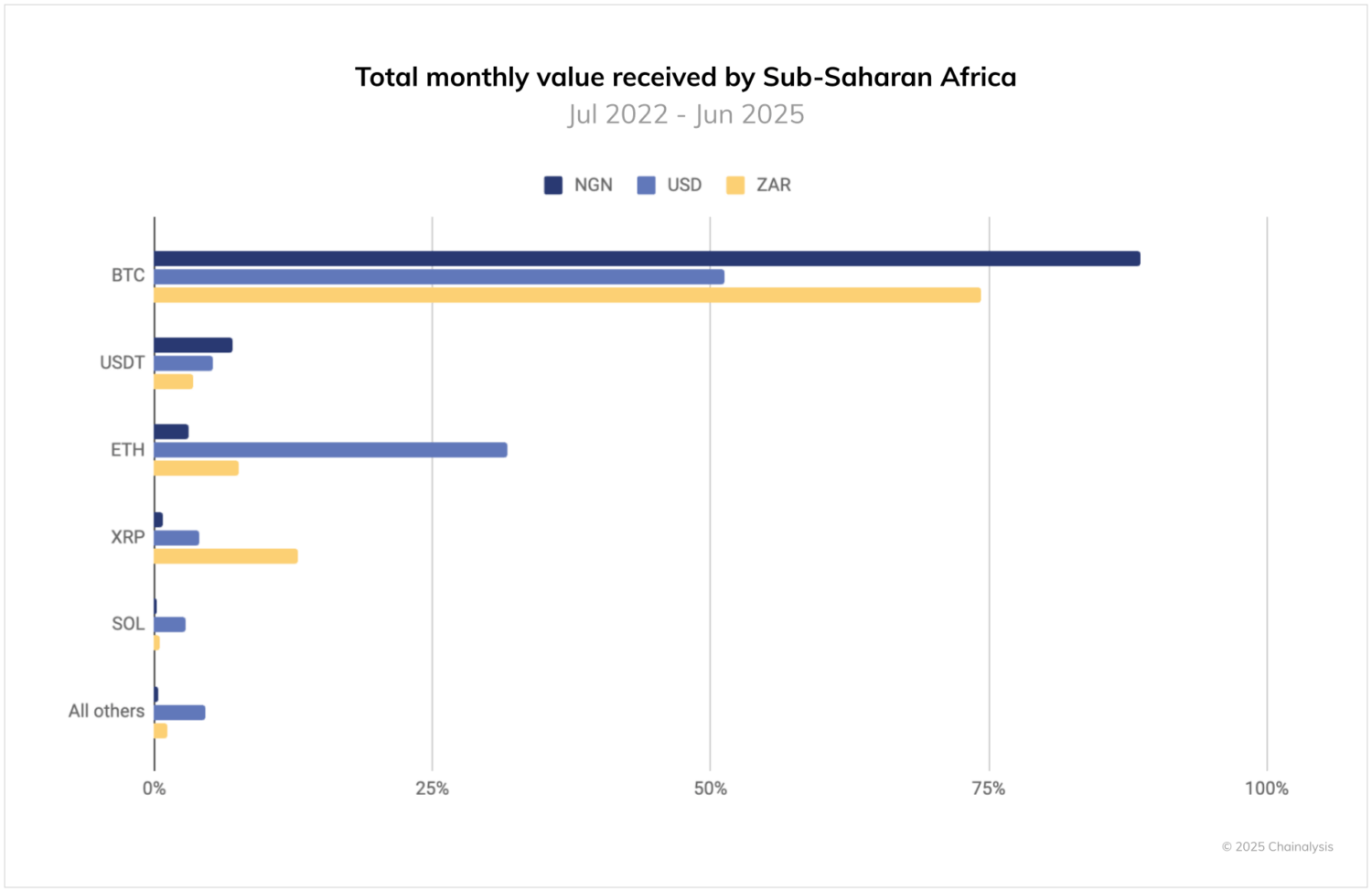

Bitcoin holds dominance

Among fiat purchases of crypto in Sub-Saharan Africa, a striking pattern emerges: bitcoin dominates in both Nigeria and South Africa, making up 89% and 74% of crypto purchases, respectively, far higher than the 51% share seen in USD purchases. This suggests that, in SSA markets, BTC is viewed not only as a store of value, but also as a default entry point for crypto exposure, particularly in environments where fiat currency faces volatility or access to other investment vehicles is limited. In Nigeria, where access to USD is tightly controlled and inflation remains high, bitcoin has become a widely recognized financial hedge and alternative savings tool.

Conversely, USDT adoption is also more pronounced in Nigeria than in USD markets, accounting for 7% of purchases versus just 5% in the USD cohort. This reflects the growing role of stablecoins as a dollar substitute in economies where the official exchange rate diverges from the black market rate, and citizens increasingly rely on crypto rails for informal FX access, payments, and savings. In South Africa, the higher share of XRP and ETH may point to a more speculative, investment-focused user base with access to centralized exchanges and diversified portfolios.

It should be noted that this is only reflective of activity on centralized exchanges and therefore is not inclusive of informal market transactions, B2B transactions, and other types of transfers that occur elsewhere or through OTCs.

Sub-Saharan Africa’s ongoing crypto revolution

Our analysis reveals Sub-Saharan Africa as a critical proving ground for crypto’s real-world utility. Beyond traditional narratives of investment and speculation, the region demonstrates how digital assets serve as adaptive financial technologies in challenging economic environments.

The 52% year-over-year growth is more than a statistical milestone—it’s evidence of a fundamental shift. From Nigeria’s response to currency devaluation to South Africa’s sophisticated regulatory approach, the region shows how crypto can be a strategic economic tool rather than merely an alternative investment.

Stablecoins and bitcoin are emerging as practical solutions to persistent challenges: hedging against inflation, facilitating cross-border trade, and providing financial access where traditional banking falls short. The March 2025 volume spike is a testament to this adaptive capacity, showing how quickly digital assets can be deployed during economic stress.

As institutional engagement deepens and regulatory frameworks mature, Sub-Saharan Africa is not just participating in the global crypto ecosystem—it’s actively reimagining and reconstructing financial infrastructure from the ground up.

This website contains links to third-party sites that are not under the control of Chainalysis, Inc. or its affiliates (collectively “Chainalysis”). Access to such information does not imply association with, endorsement of, approval of, or recommendation by Chainalysis of the site or its operators, and Chainalysis is not responsible for the products, services, or other content hosted therein.

This material is for informational purposes only, and is not intended to provide legal, tax, financial, or investment advice. Recipients should consult their own advisors before making these types of decisions. Chainalysis has no responsibility or liability for any decision made or any other acts or omissions in connection with Recipient’s use of this material.

Chainalysis does not guarantee or warrant the accuracy, completeness, timeliness, suitability or validity of the information in this report and will not be responsible for any claim attributable to errors, omissions, or other inaccuracies of any part of such material.