TL;DR

- OFAC designated two UK-registered crypto exchanges, Zedcex and Zedxion, for operating in Iran’s financial sector and processing cryptocurrency transactions for the Islamic Revolutionary Guard Corps (IRGC).

- The action includes seven Tron (TRX) addresses associated with Zedcex, a service that has reportedly processed over $94 billion in transactions since its registration in August 2022.

- This marks OFAC’s first designation of digital asset exchanges specifically for operating in Iran’s financial sector.

- The exchanges are linked to Iranian businessman Babak Morteza Zanjani, who was previously sentenced to death for embezzling billions from Iran’s National Oil Company

- These designations are part of a broader action targeting Iranian officials responsible for human rights abuses and violent repression of protesters.

On January 30, 2026, the U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) designated two UK-registered cryptocurrency exchanges, Zedcex Exchange Ltd. and Zedxion Exchange Ltd., for operating in Iran’s financial sector and processing cryptocurrency transactions for the Islamic Revolutionary Guard Corps (IRGC). This action marks the first time OFAC has specifically designated digital asset exchanges for operating in the financial sector of the Iranian economy.

Digital asset exchanges supporting the IRGC

According to OFAC as well as our on-chain data, the designated exchanges have processed significant volumes of funds associated with IRGC-linked counterparties. Zedcex Exchange Ltd., registered in August 2022, has reportedly processed over $94 billion in transactions since its establishment.

Zedxion Exchange Ltd., registered in May 2021, initially listed Iranian businessman Babak Morteza Zanjani as its director. Both exchanges appear to be part of a network facilitating sanctions evasion and money laundering for Iranian state interests, particularly the IRGC.

Secretary of the Treasury Scott Bessent highlighted the Iranian regime’s exploitation of digital assets, stating, “This includes the regime’s attempts to exploit digital assets to evade sanctions and finance cybercriminal operations. Like rats on a sinking ship, the regime is frantically wiring funds stolen from Iranian families to banks and financial institutions around the world.”

Babak Morteza Zanjani: From death row to sanctions list

The exchanges’ connection to Babak Morteza Zanjani adds a notable dimension to today’s action. In 2013, he was originally designated by OFAC for acting as a financial facilitator for the IRGC, and he was delisted in 2016 under Joint Comprehensive Plan of Action (JCPOA)-related designation removals. That same year, he was sentenced to death in Iran for embezzling billions of dollars from Iran’s National Oil Company. However, his sentence was commuted in 2024, and by April 2025, he had reemerged as a financial backer of one of Iran’s largest railway investments.

OFAC describes Zanjani as an “Iranian businessman and sanctions evader” active in multiple sectors including hospitality, transportation, technology, financial services, and oil exports. His connection to the designated cryptocurrency exchanges suggests a sophisticated operation attempting to leverage digital assets for sanctions evasion.

On-chain activity of the designated addresses

OFAC included seven Tron (TRX) addresses in the designation of Zedcex Exchange Ltd. Notably, some of these wallets overlap with wallets identified by Israel’s NBCTF in September 2025 as controlled by the IRGC:

- TCA9vmjsYw9MtPKEwRBtGhKFRfr4CLxJAv

- TGsNFrgWfbGN2gX25Wcf8oTejtxtQkvmEx

- TASWbk6X1wiTku5TMmMQYqYFvshVEtfJy8

- TTS9o5KkpGgH8cK9LofLmMAPYb5zfQvSNa

- TCzq6m2zxnQkrZrf8cqYcK6bbXQYAfWYKC

- TLvuvpfBKdxddxSsJefeiGCe9eVY8HUroE

- TNuA5CQ6LB4jTHoNrjEeQZJmcmhQuHMbQ7

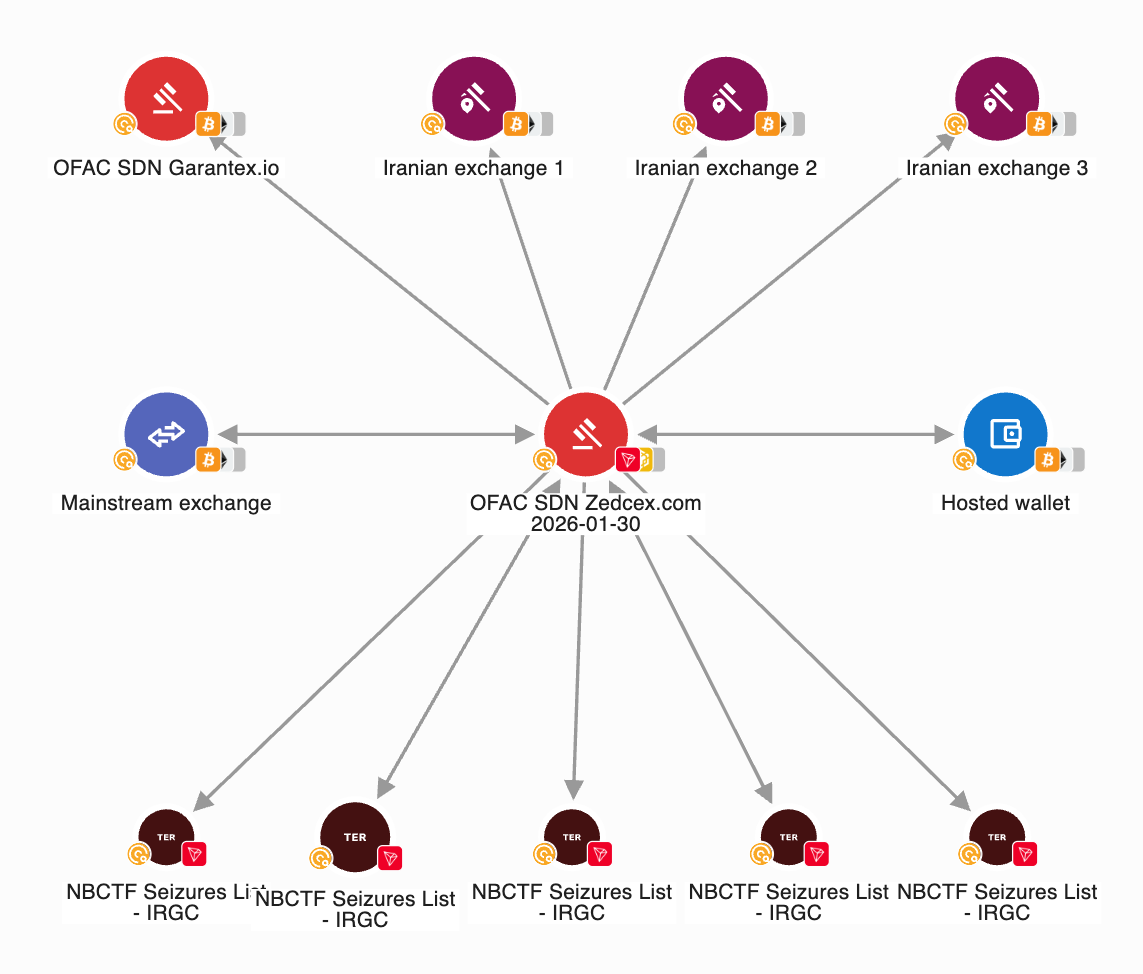

The Chainalysis Reactor graph below shows a sample of Zedcex’s interaction with IRGC counterparties, as well as Iranian exchanges, other sanctioned entities, and compliant services.

Pattern of Iranian exploitation using digital assets

Today’s action is part of a growing pattern of Iranian actors and their proxies turning to cryptocurrencies to evade sanctions and facilitate illicit activities. In recent years, OFAC has designated numerous Iran-linked individuals and entities involved in cryptocurrency-related sanctions evasion, though this marks the first designation specifically targeting digital asset exchanges for operating in Iran’s financial sector.

The use of cryptocurrencies by the Iranian regime and its proxies has been documented in several recent designations:

- In September 2025, OFAC designated Iranian nationals Alireza Derakhshan and Arash Estaki Alivand, who coordinated the purchase of over $100 million worth of cryptocurrency related to Iranian oil sales between 2023 and 2025.

- Also in September 2025, Israel’s NBCTF listed dozens of IRGC wallets with transaction volumes totaling over $2 billion.

- In April 2025, OFAC designated eight wallets with transaction volumes nearing $1 billion used to support the Iran-based Houthis’ weapons, commodities procurement, and sanctions evasion efforts.

- In December 2024, OFAC updated its designation of IRGC-connected Houthi Financier Sa’id al-Jamal to include crypto wallets used by him to facilitate money laundering and illicit shipping of Iranian oil on behalf of Houthi rebels.

Broader action against Iranian officials

The designation of the cryptocurrency exchanges is part of a broader action targeting Iranian officials responsible for human rights abuses. OFAC also designated six Iranian officials associated with the IRGC and Law Enforcement Forces (LEF) for their roles in the violent repression of protesters.

These individuals include Eskandar Momeni Kalagari, Iran’s Minister of the Interior who oversees the Law Enforcement Forces of the Islamic Republic of Iran (LEF), and multiple IRGC commanders responsible for provinces where security forces have killed protesters, including children.

Impact on cryptocurrency compliance

Today’s action introduces new compliance considerations for cryptocurrency businesses globally. The designation of UK-registered entities with ties to Iran underscores the importance of robust know-your-customer (KYC) procedures and enhanced transaction monitoring, particularly when dealing with exchanges that have significant exposure to illicit wallets.

We have labeled the designated Tron addresses in our product suite and have updated our screening solutions to include all designated individuals and entities from today’s action. If you’d like to learn more about Chainalysis products, click here to request a demo.

This website contains links to third-party sites that are not under the control of Chainalysis, Inc. or its affiliates (collectively “Chainalysis”). Access to such information does not imply association with, endorsement of, approval of, or recommendation by Chainalysis of the site or its operators, and Chainalysis is not responsible for the products, services, or other content hosted therein.

This material is for informational purposes only, and is not intended to provide legal, tax, financial, or investment advice. Recipients should consult their own advisors before making these types of decisions. Chainalysis has no responsibility or liability for any decision made or any other acts or omissions in connection with Recipient’s use of this material.

Chainalysis does not guarantee or warrant the accuracy, completeness, timeliness, suitability or validity of the information in this report and will not be responsible for any claim attributable to errors, omissions, or other inaccuracies of any part of such material.