Each week, we share a data-driven snapshot of the most compelling trends in digital assets through our “Chart of the Week” series on social media. Drawing from first-in-class Chainalysis data, these visualizations capture key moments and movements that are shaping the crypto ecosystem. Below are the charts we featured in July 2025.

If you want to see these charts as they go live each week, follow us on LinkedIn, X, and Telegram.

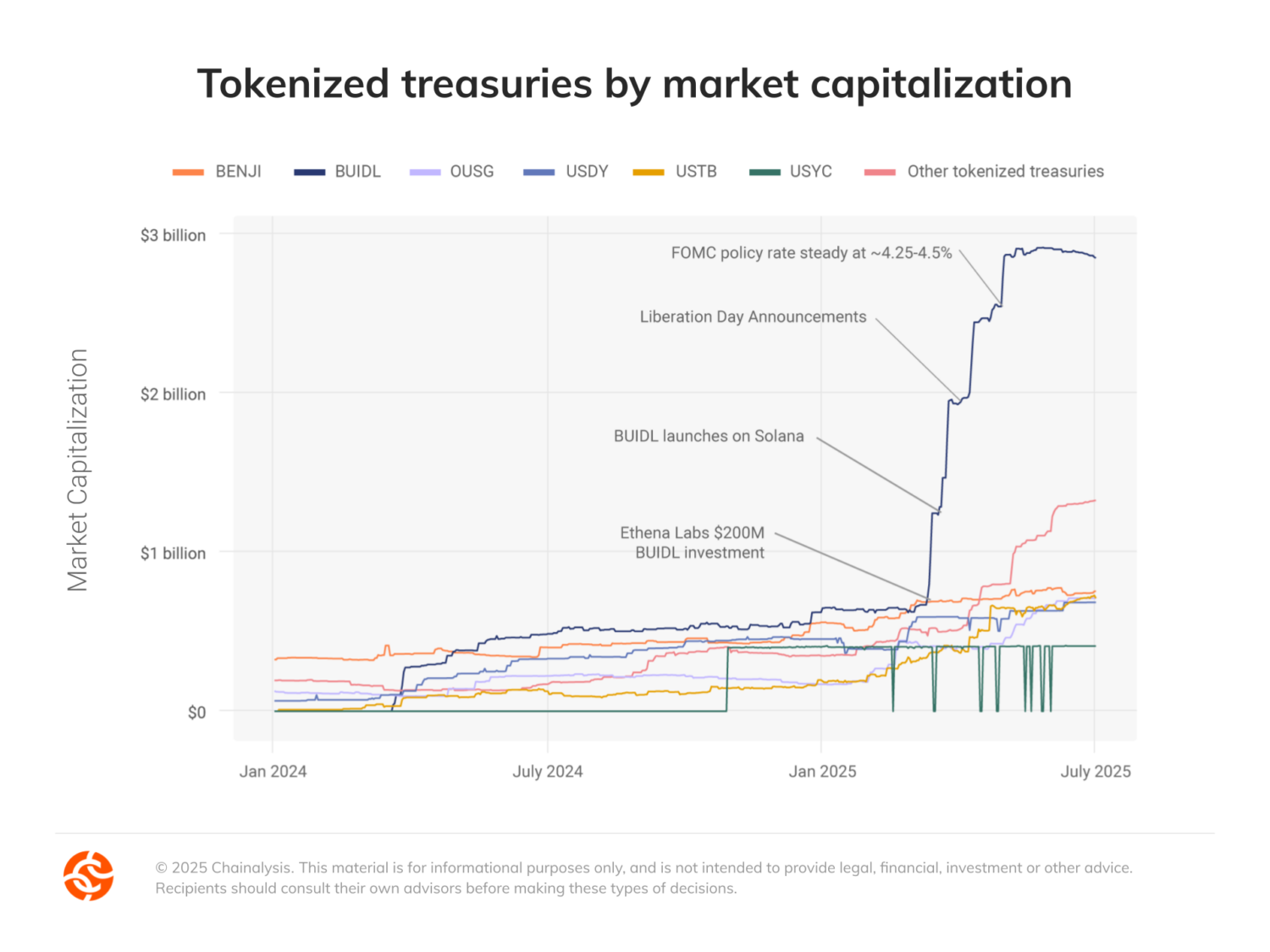

BlackRock’s BUIDL fund sees 300% growth in 2024

BlackRock’s BUIDL Institutional Digital Liquidity Fund has demonstrated remarkable growth in 2024, with its market capitalization surging from approximately $650 million to nearly $3 billion, marking a more than 300% increase. This exceptional performance can be attributed to several key factors: accelerating institutional adoption, successful integration with the Solana ecosystem, persistent macroeconomic uncertainty, and stable Federal Reserve monetary policy.

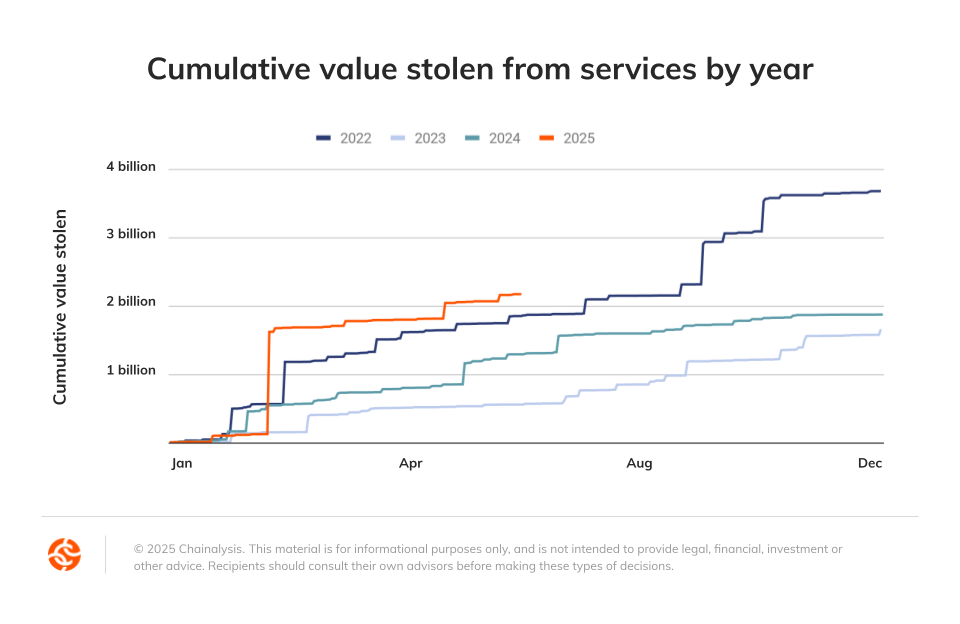

Mid-year crime update: Service thefts hit $2.17 billion

Value stolen from services cracked $2.17 billion in the first half of 2025 and is trending toward the worst year on record. But service compromises tell only part of the story. Our mid-year crime update details the growing trend of personal wallet compromises, which make up a larger and larger share of all value stolen each year.

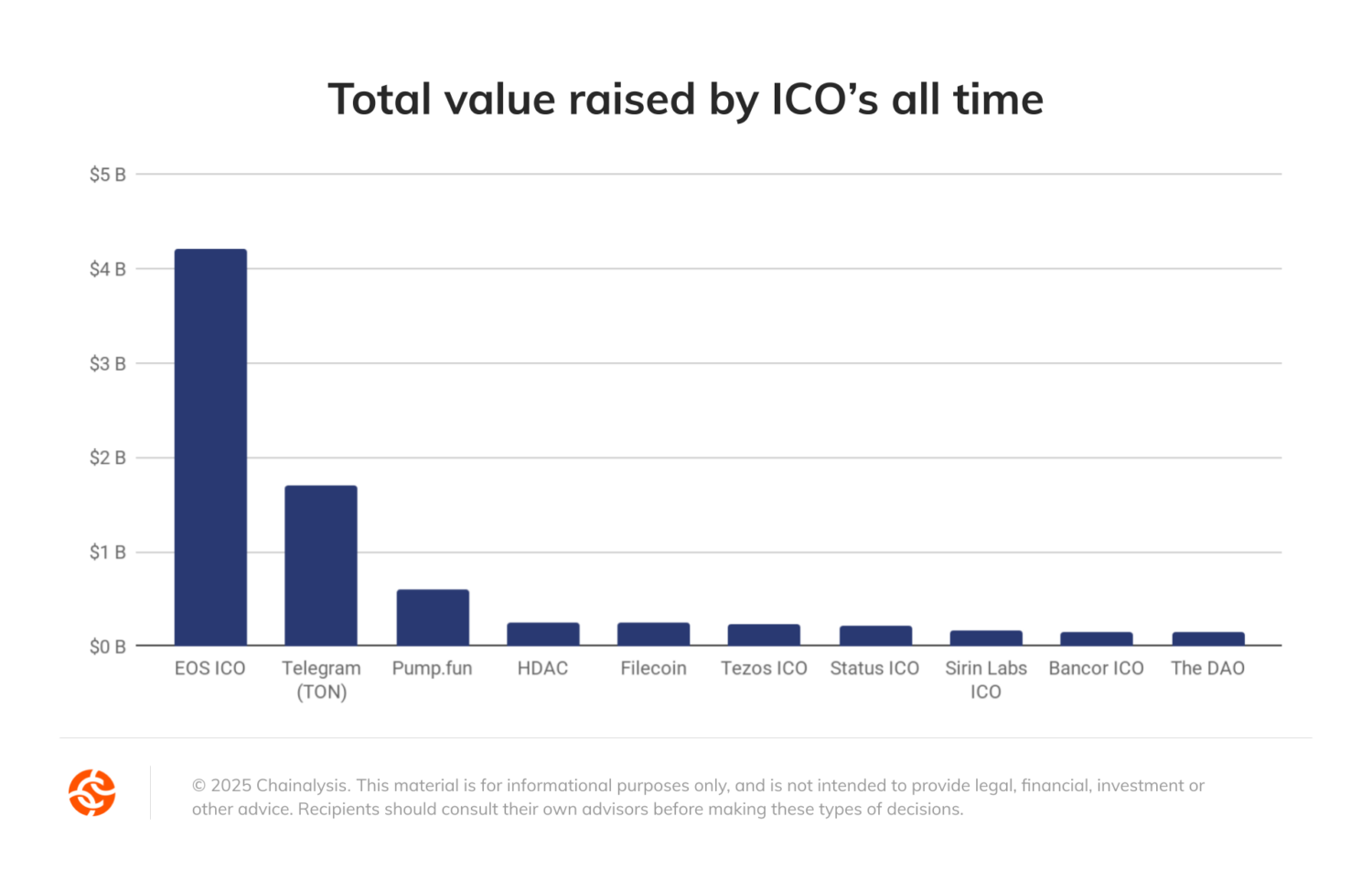

Pump.fun’s record-breaking ICO signals market maturity

The recent Pump.fun ICO has made history by raising an impressive $600 million in less than 15 minutes, making it the third-largest ICO ever and matching Circle’s initial IPO target. Ranking as the 8th largest public offering of any kind this year, this milestone demonstrates the growing convergence between traditional financial markets and crypto. Beyond the numbers, it signals an important shift in market maturity—showing that major capital formation isn’t limited to blockchain infrastructure, but now extends to cultural narratives and broader crypto use cases.

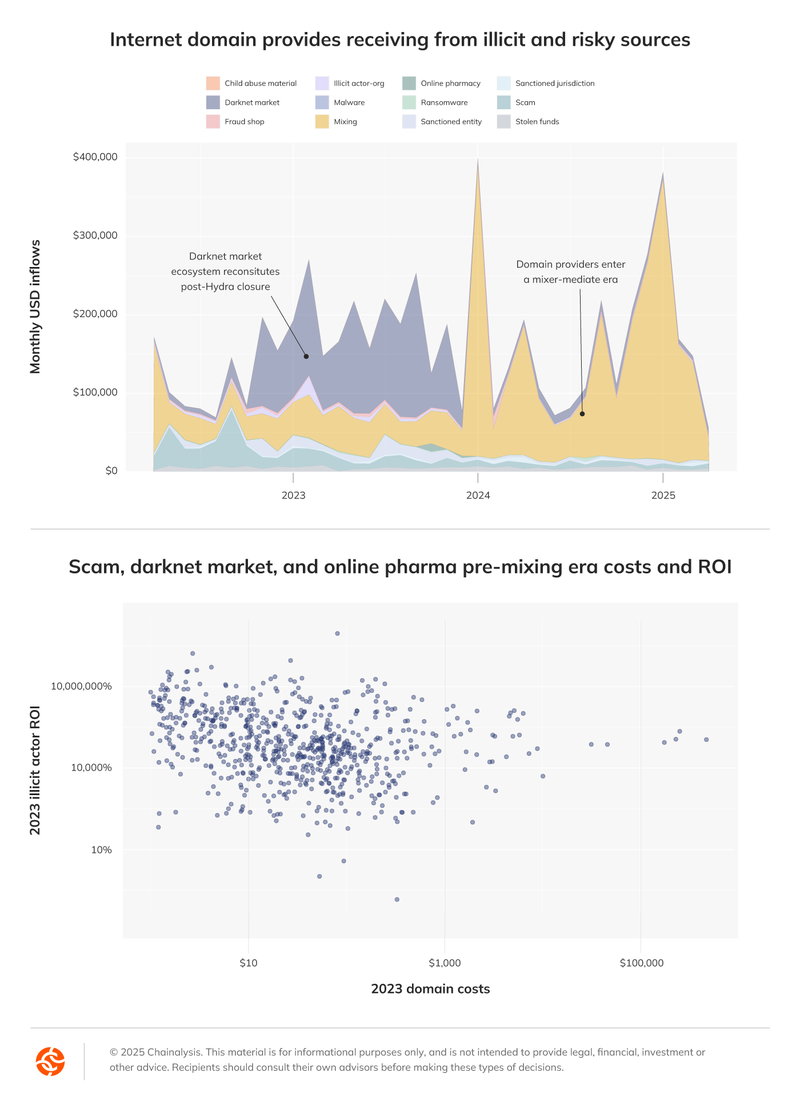

Criminal ROI: The growing abuse of domain services

Our analysis reveals alarming trends in how illicit actors are exploiting legitimate domain services, with cryptocurrency mixers increasingly serving as intermediaries for criminal transactions. The ROI analysis is striking: darknet markets achieve a median 700,000% return, while scam operations generate over 82,000% returns, both requiring minimal domain infrastructure investment. In the post-Hydra landscape, these trends highlight the growing challenge of protecting legitimate web services from criminal exploitation.

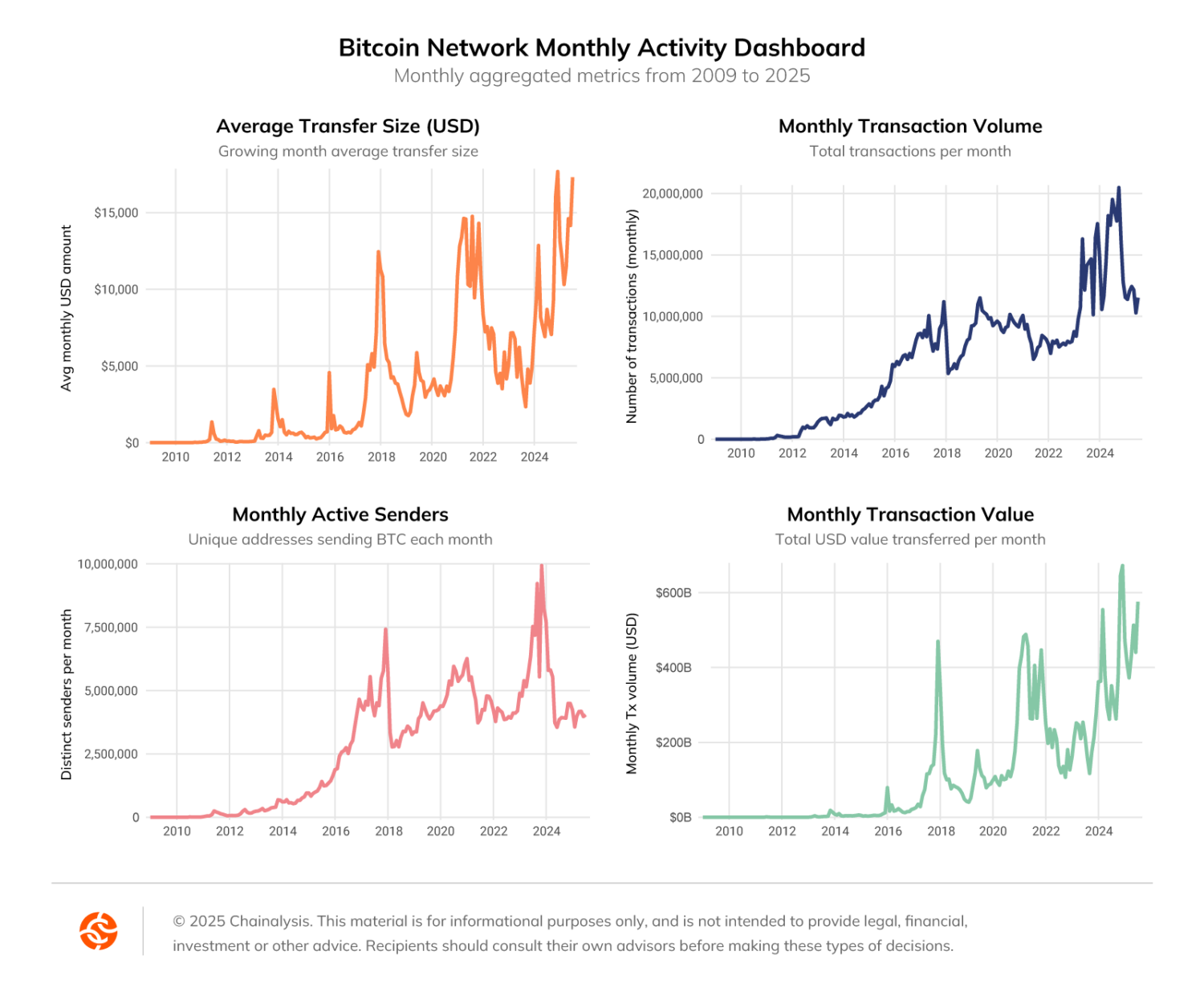

Bitcoin’s 16-year evolution shows remarkable growth metrics

Following the release of the White House’s Digital Assets Report, an analysis of bitcoin’s 16-year history reveals its dramatic transformation from a niche technology to a global financial force. The data highlights bitcoin’s substantial growth across key metrics, now processing over $600 billion in monthly transaction volume and facilitating more than 20 million monthly transactions. The network serves approximately 4 million active monthly users, and the average USD transfer size has increased 137% since the start of 2024.

To learn more about our data capabilities, request a demo here.

This website contains links to third-party sites that are not under the control of Chainalysis, Inc. or its affiliates (collectively “Chainalysis”). Access to such information does not imply association with, endorsement of, approval of, or recommendation by Chainalysis of the site or its operators, and Chainalysis is not responsible for the products, services, or other content hosted therein.

This material is for informational purposes only, and is not intended to provide legal, tax, financial, or investment advice. Recipients should consult their own advisors before making these types of decisions. Chainalysis has no responsibility or liability for any decision made or any other acts or omissions in connection with Recipient’s use of this material.

Chainalysis does not guarantee or warrant the accuracy, completeness, timeliness, suitability or validity of the information in this report and will not be responsible for any claim attributable to errors, omissions, or other inaccuracies of any part of such material.