Sentinel

Complete ecosystem view of who holds and moves tokens, illicit‑exposure insights by category/service, and real‑time alerts that can feed automated workflows via API.

Achieve the clarity needed to secure operations, detect threats early, and maintain full regulatory compliance for stablecoin and asset-backed token issuers, fintechs, financial institutions, and regulators.

Audit issuance, track real-time redemptions, and monitor secondary market liquidity across CEXs and DEXs in one unified view.

Protect your peg and prevent exploits & market manipulation with real-time smart contract auditing and automated alerts.

Leverage the same court-admissible intelligence used by 50+ global regulators to automate AML/KYT workflows and meet FATF requirements.

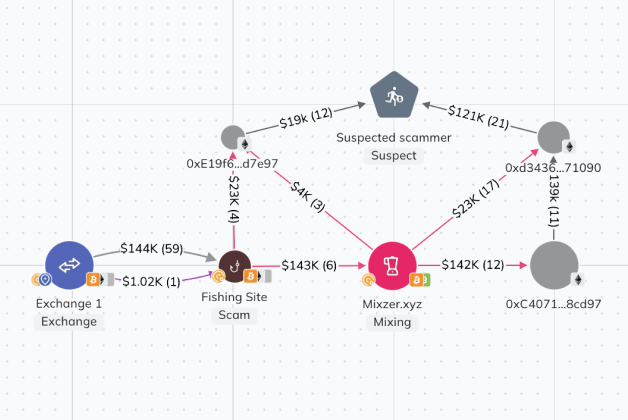

Rapidly conduct enhanced due diligence and trace illicit flows across chains, mixers, and smart contracts. Move from detection to action with visual evidence.

Ecosystem visibility and real-time security tools to proactively safeguard the token’s integrity and manage regulatory expectations.

Partner with issuers or launch proprietary tokens while enforcing robust compliance programs, continuously vetting cryptocurrency counterparties, and maintaining issuer-grade security and ecosystem monitoring.

Provide ecosystem-wide intelligence to monitor stablecoins, flag risk hotspots, and visually trace funds with court-trusted attribution to speed investigations and support digital asset freezes and seizures.

Continuous, real-time security monitoring that guards against technical exploits and detects economic anomalies targeting protocol solvency and the stability of stablecoins.

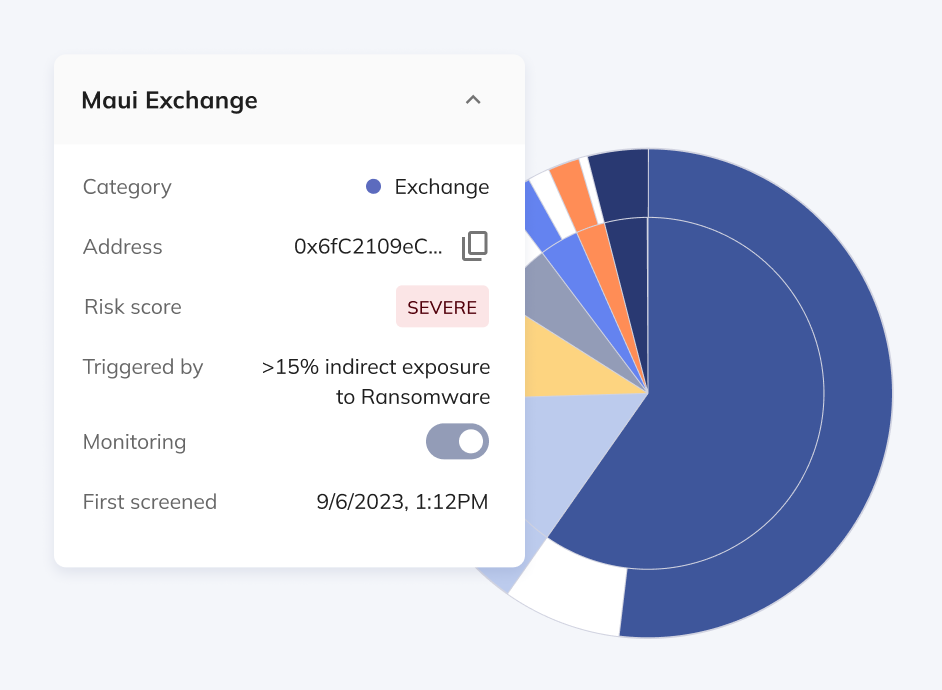

Move beyond simple transaction monitoring with unparalleled intelligence that scans a stablecoin’s entire ecosystem. Instantly map token distribution, track fund flows across the secondary market, and pinpoint illicit exposure with surgical precision.

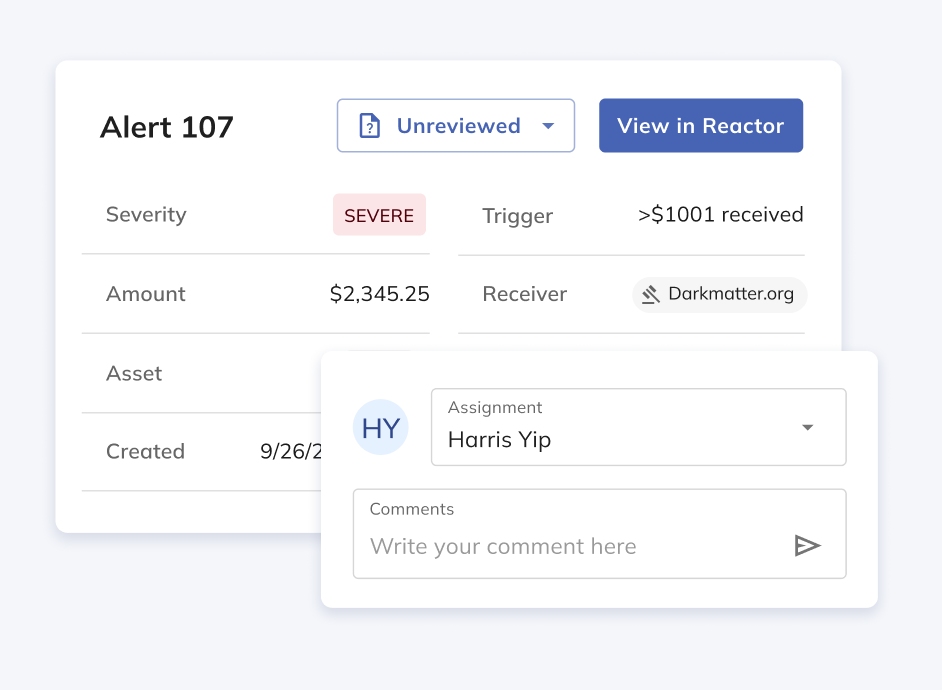

Achieve full command of stablecoin issuance and redemption with continuous compliance: instantly flag high‑risk on‑chain behavior using flexible, policy-aligned risk rules, and translate alerts into rapid reviews and actions.

Detect suspicious activity the moment it occurs. Our real-time alerts feed directly into your internal controls to safeguard your protocol and maintain market integrity.

Onboard partners with confidence. Our instant counterparty risk assessments evaluate the on-chain exposure of virtual asset service providers to ensure your entire network meets your risk appetite.

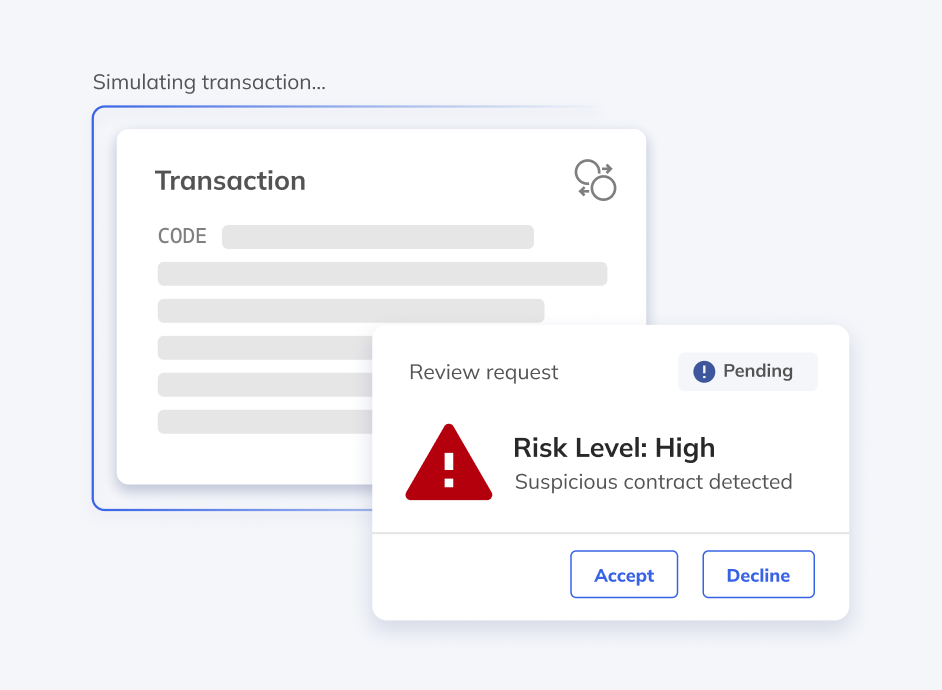

Enable real-time detection and prevention of exploits, market manipulation, and depeg events via smart contract monitoring and threat intelligence. Smart contract monitoring and threat intelligence trigger automated guardrails to defend your treasury and user funds.

Conduct enhanced due diligence and investigations by visually tracing funds across all major blockchains, mixers, bridges, and smart contracts. Build regulator-ready evidence and use integrated workflows to freeze, seize, or burn tainted assets in collaboration with authorities.

Powered by the industry’s most trusted intelligence, breakthrough technology, and unmatched expertise.

Automatic support for new blockchains and tokens ensures you’re always investigating with the most comprehensive view of crypto activity.

Chainalysis uses hundreds of clustering heuristics, ingests data intelligence at scale, and verifies data accuracy with the lowest tolerance for error in the industry.

Regulators around the world use Chainalysis and collaborate with private sector companies.

Stablecoin issuers, financial institutions acting as reserve holders or custodians, exchanges, PSPs, and other participants seeking lifecycle compliance, security, and ecosystem risk visibility.

Regulators worldwide rely on Chainalysis intelligence and tooling, helping harmonize expectations and streamline supervision, reviews, and casework.

We provide end-to-end coverage across the entire stablecoin lifecycle to ensure regulatory alignment, build trust, and allow organizations to operate confidently across compliance, security, and risk.

Chainalysis enables stablecoin issuers and their banking partners to meet FATF‑aligned AML/CFT expectations with real‑time blockchain analytics, sanctions and illicit‑exposure screening, and regulator‑ready monitoring across issuance, redemption, and secondary‑market flows.

Chainalysis gives stablecoin issuers and reserve banks a unified view of counterparty and ecosystem risk by using blockchain intelligence, real‑time monitoring, and ecosystem‑wide alerts to profile partners, track issuer and holder activity, and trigger freezes when exposure exceeds policy.

Yes. Built on the same blockchain intelligence that has already screened $30T+ in value, Chainalysis is designed to scale from first‑time stablecoin launches to multi‑billion‑dollar programs, delivering ecosystem‑wide monitoring, automated alerts, and regulator‑ready reporting as adoption accelerates.