Address Screening

Detect and block risky wallets instantly

Safeguard your operations and build a better customer experience with a deeper understanding of the risk profiles of wallet addresses or liquidity pools.

Secure your platform

Block risky or illicit actors from engaging in your platform.

Engage liquidity pools confidently

Get advanced risk assessment, monitoring, and comprehensive understanding.

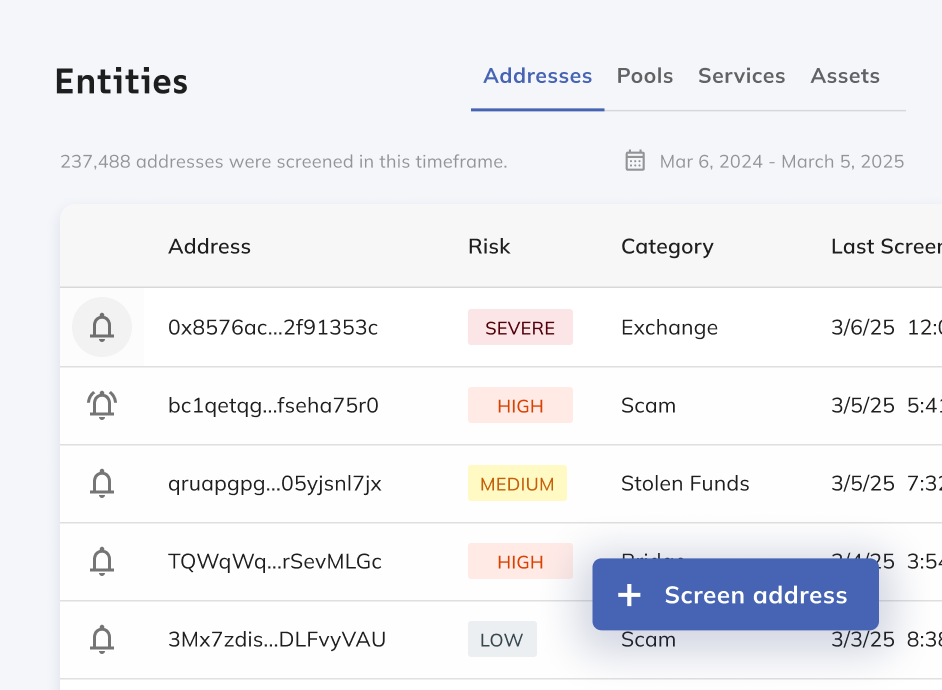

Real-time, scalable monitoring

Programmatically or manually screen addresses for instant risk assessment.

Maintain compliance

Guard against illicit activity from sanctioned, scam, darknet markets, and more.

Detect compliance risks early with comprehensive analysis

Block risky and illicit wallets, not your customers

Identify risky wallets with precision and comprehensively screen addresses to understand risk, exposure and counterparties. Automate user workflows to support legitimate users on your platform while blocking risky or illicit actors.

Gauge risk in liquidity pools

Conduct thorough assessments and uncover insights into thousands of liquidity pools – evaluating fund movements, exposure patterns, and risks.

Continuously monitor addresses

Stay informed with automated alerts whenever an entity’s risk score changes, eliminating the need for manual rescreening while maintaining a historical log of screenings.

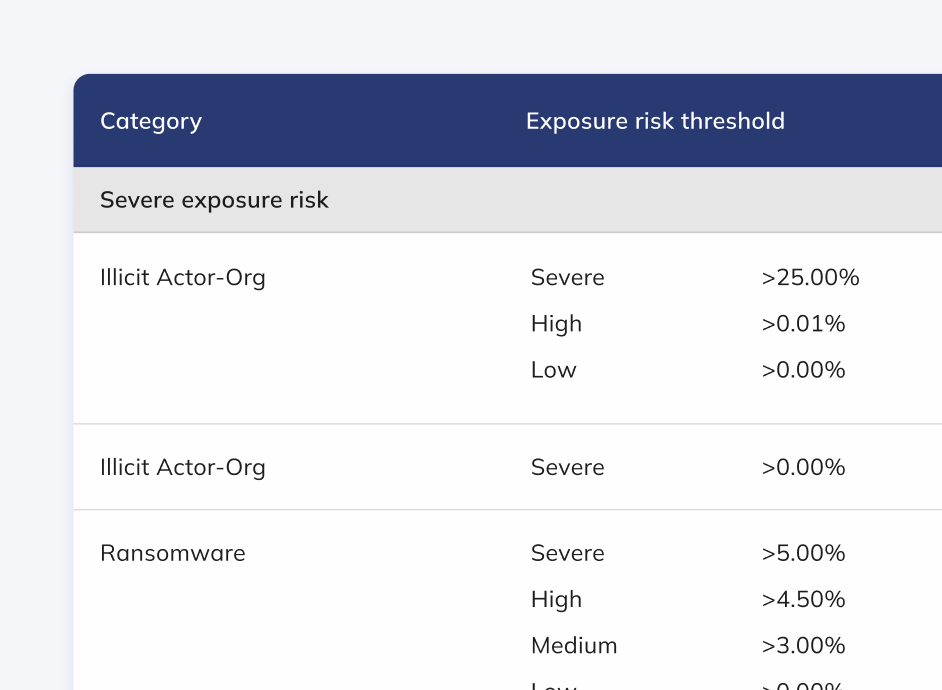

Customize risk settings to your compliance policies

Effortlessly tailor and integrate risk insights into your compliance workflows, ensuring operations remain streamlined to your organization’s needs.

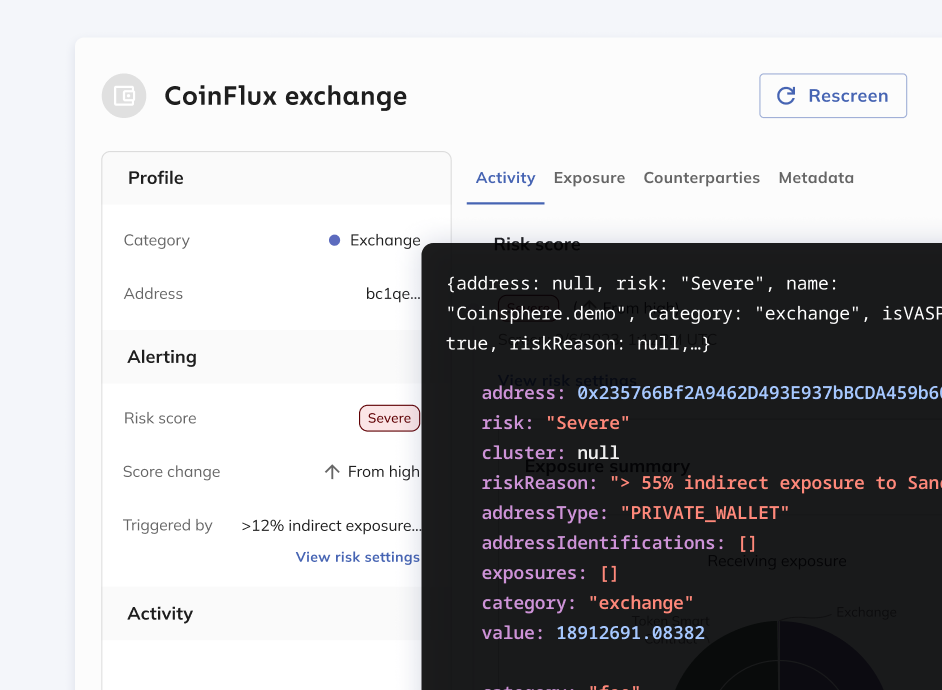

High reliability and low latency

Integrate advanced risk intelligence directly into your systems with easy-to-use APIs. Enable automated workflows, real-time monitoring, and streamlined compliance processes tailored to your organization’s needs.

Purpose-built capabilities for flexible and effective compliance programs

Risk score

Severity risk scores based on customizable settings including category and thresholds.

Time-based analysis

Fine tune your analysis with risk scores over specific periods.

Exposure

Direct and indirect exposures for wallets and liquidity pools, providing a clear overview of risk at a glance.

Counterparty analysis

Evaluate top counterparties and exposure trends over time.

Chainalysis makes wallet screening easier

Superior data

Chainalysis uses hundreds of clustering heuristics, ingests data intelligence at scale, and verifies data accuracy with the lowest tolerance for error in the industry. Better data translates to a better customer experience.

Continuous monitoring

Blockchain evolves quickly, avoiding repetitive and costly manually rescreening. Chainalysis provides continuous monitoring for changes in risk score.

Greater control over risk settings

Chainalysis provides greater tools for customizing risk settings and managing alerts in bulk, enabling you to tailor your risk posture and prioritize focus more effectively.

Aligned with regulators

Regulators around the world use Chainalysis and collaborate with private sector companies.

Transforming tradition: Towerbank’s journey into crypto excellence

FAQ

Can I choose to use the UI or API integration for using Entity Risking?

Yes. Address Screening can be used via an easy‑to‑use UI and integrated via high‑reliability, low‑latency APIs for real‑time screening.

Do I need to manually rescreen?

If you are using the UI, you will be automatically alerted for changes to a risk score via continuous monitoring. If you are integrating via API, you will need to make another call to the API (note: this does NOT incur additional costs / we do not charge for rescreens).

Can I change the risk settings I am alerting against?

Yes. You can configure risk settings such as category severities and exposure thresholds to align with your own policies, and these settings directly drive alerting and scores.

Is both direct and indirect exposure being assessed as part of the screen?

Yes. Both direct and indirect exposure are assessed for wallets and liquidity pools to capture proximate and mediated risk pathways.

Can I isolate specific time periods for the risk analysis?

Yes. Time‑based analysis lets you focus risk scoring and review on specific periods.

What can I do to dive deeper or investigate an address?

You may escalate to Chainalysis Reactor to trace funds, analyze counterparties, and map relationships for enhanced due diligence within the platform workflow.

Do I need to specify a network to assess exposure?

No. The exposure is network agnostic. This is the differentiating feature of Address Screening’s exposure compared to that of Reactor for investigations, where exposure is network and asset specific.

Uncover risks. Strengthen compliance. Safeguard your ecosystem.

Address Screening empowers you with the insights needed to evaluate blockchain entities comprehensively, detect threats early, and ensure compliance with confidence.