eToro aces global compliance and investigations

- Alerted in real-time about potential illicit activity and block illicit activity

- Enhances investigations into suspicious activity and more quickly address any potential problems

- Satisfies different requirements from different regulators

- Positioned to cover a broader range of coins

Chainalysis innovations allow us to respond quickly to our clients and to any potential problems with transactions.”

About eToro

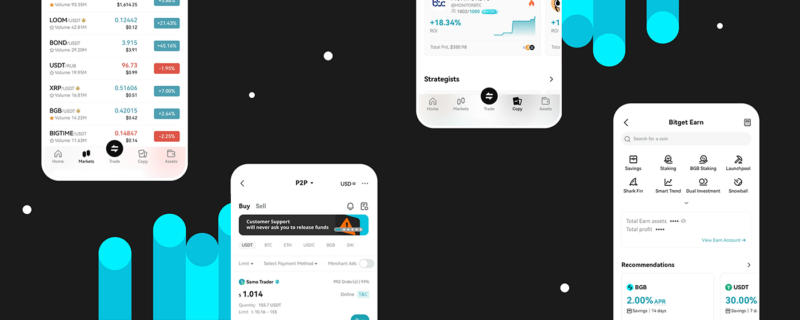

eToro is a social investment network that empowers people to grow their knowledge and wealth as part of a global community of successful investors. eToro was founded in 2007 with the vision of opening up global markets so everyone can trade and invest in a simple and transparent way. Today, eToro is a global network of more than 25 million registered users who share their investment strategies – enabling anyone to follow the approaches of those who have been the most successful. Due to its simplicity, eToro makes it possible for users to easily buy, hold and sell assets; monitor their portfolio in real-time; and transact whenever they want.

Challenge

An early entrant in the crypto asset market, eToro sought a forensic blockchain technology partner that could support the company’s stringent approach to compliance.

Solution

eToro has long used the Chainalysis KYT and Chainalysis Reactor solutions to address both its business and regulatory requirements. The ability to identify and mitigate risk gives eToro the confidence to continue expanding globally.

Chainalysis helps us comply with regulatory requirements and mitigate risk where we operate and offer crypto.”

What is the importance of having Chainalysis in the technology pillar of your cybersecurity strategy?

eToro’s cybersecurity strategy rests on the three established pillars of people, process, and technology. We partnered with Chainalysis for their forensic blockchain technology so we can monitor crypto asset transactions and suspicious activity in real-time.

The Chainalysis partnership helps us make better decisions around the transactions coming in and going out of our platforms. It helps us monitor and defend our products and our clients from any illicit activity. It also provides visibility that we’re meeting regulatory requirements around money laundering and terrorist financing.

How do you see Chainalysis fitting into eToro’s future plans?

We hope to continue growing together. We always want to do our best for our clients. We see Chainalysis as part of our daily routine, and we hope that it will continue that way and that our relationship and capabilities will grow.