TL;DR

- Iran’s crypto ecosystem reached over $7.78 billion in 2025, having grown at a faster pace for most of the year compared to the year prior.

- Iranian cryptocurrency activity is correlated to political events and conflict at home and abroad.

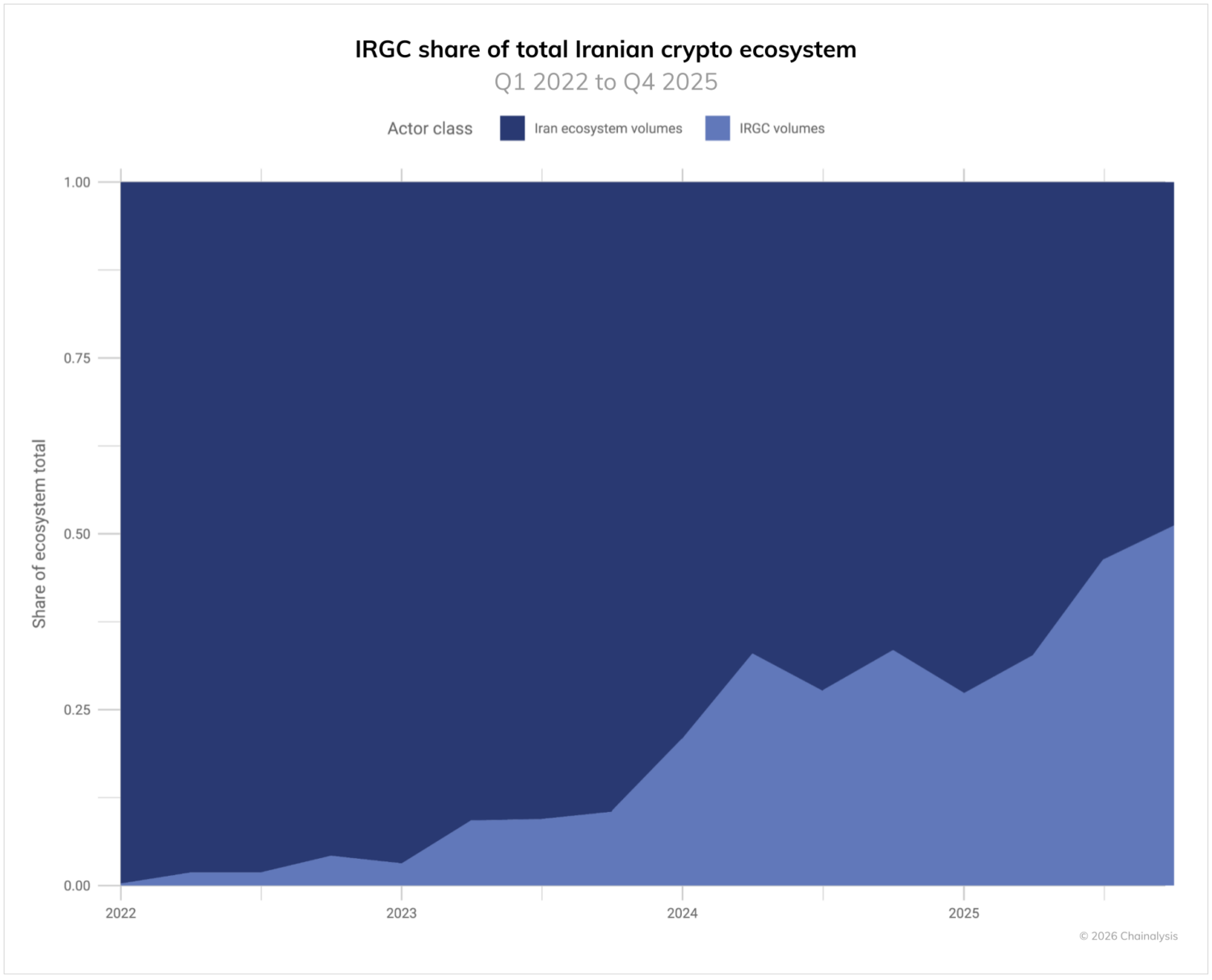

- The IRGC’s on-chain activity represents approximately 50% of Iran’s total crypto ecosystem in Q4 of 2025 and has steadily increased its share over time, mirroring its dominance in Iran’s economy more broadly.

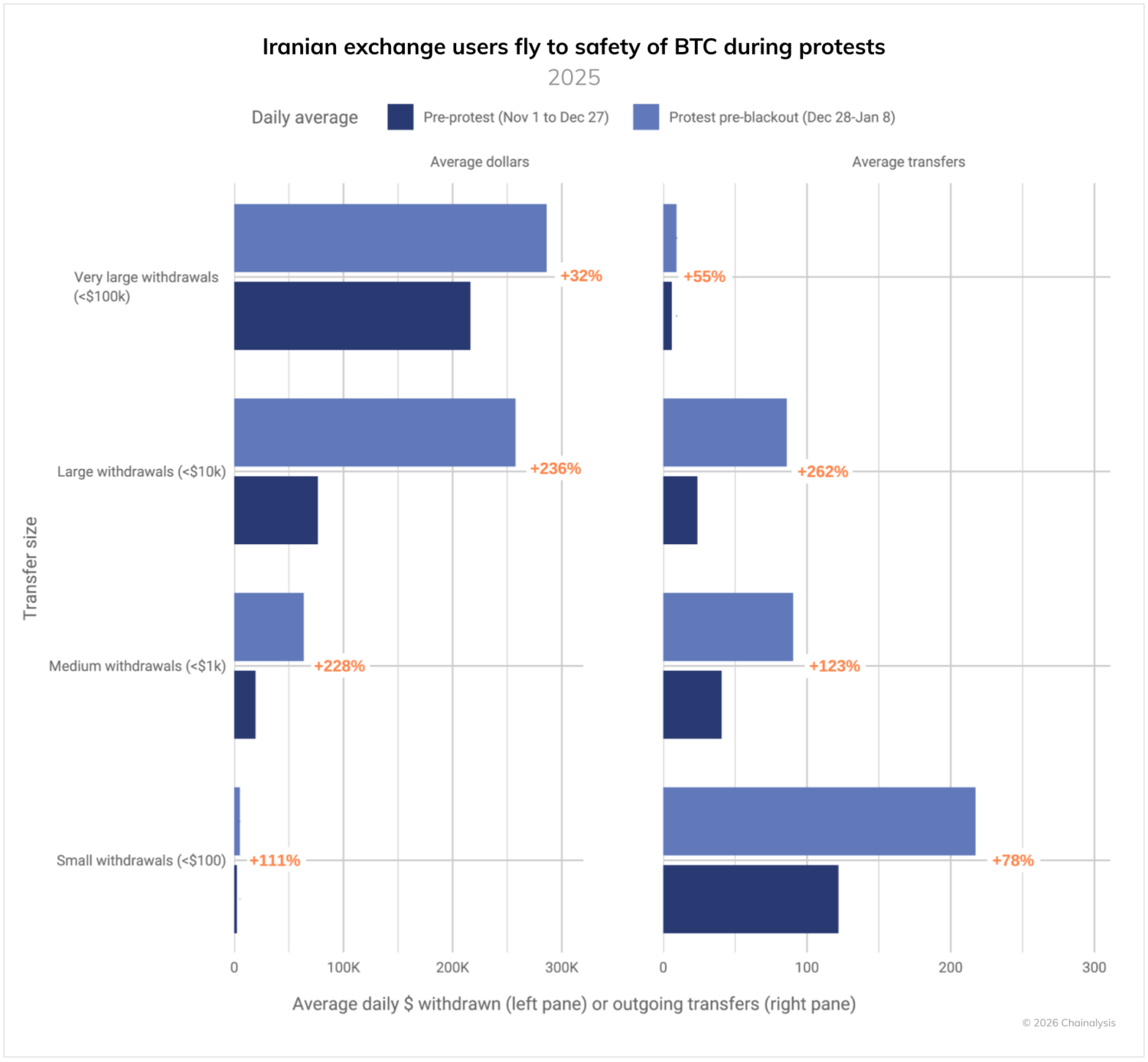

- During the recent mass protests, Iranians have significantly increased withdrawals of Bitcoin to personal wallets, possibly as a flight to safety amid currency collapse and political instability

Against the backdrop of Iran’s increasingly beleaguered regime, facing extraordinary pressure both internally and externally, cryptocurrency has emerged as a critical financial alternative for many Iranians. The ruling establishment, battling widespread protest movements domestically and the looming threat of external military intervention, has watched the Iranian rial plummet by approximately 90% since 2018, with depreciation accelerating amid escalating regional conflicts. For Iranian citizens living under a government struggling to maintain economic stability amid inflation rates of 40-50%, cryptocurrency represents not just a sanctions workaround but a way to opt out of a failing system controlled by an increasingly desperate regime. Notably, it is not just ordinary Iranians who have turned to crypto—the Islamic Revolutionary Guard Corps (IRGC) has extensively leveraged digital assets to finance its malign activities both domestically and through its network of proxy networks across the Middle East. This analysis examines three key trends: how Iranian crypto activity correlates with political events, the IRGC’s growing dominance in Iran’s cryptoeconomy, and how Iranians have turned to Bitcoin as a safe haven during recent protests.

Blockchain as barometer: On-chain behavior amid instability

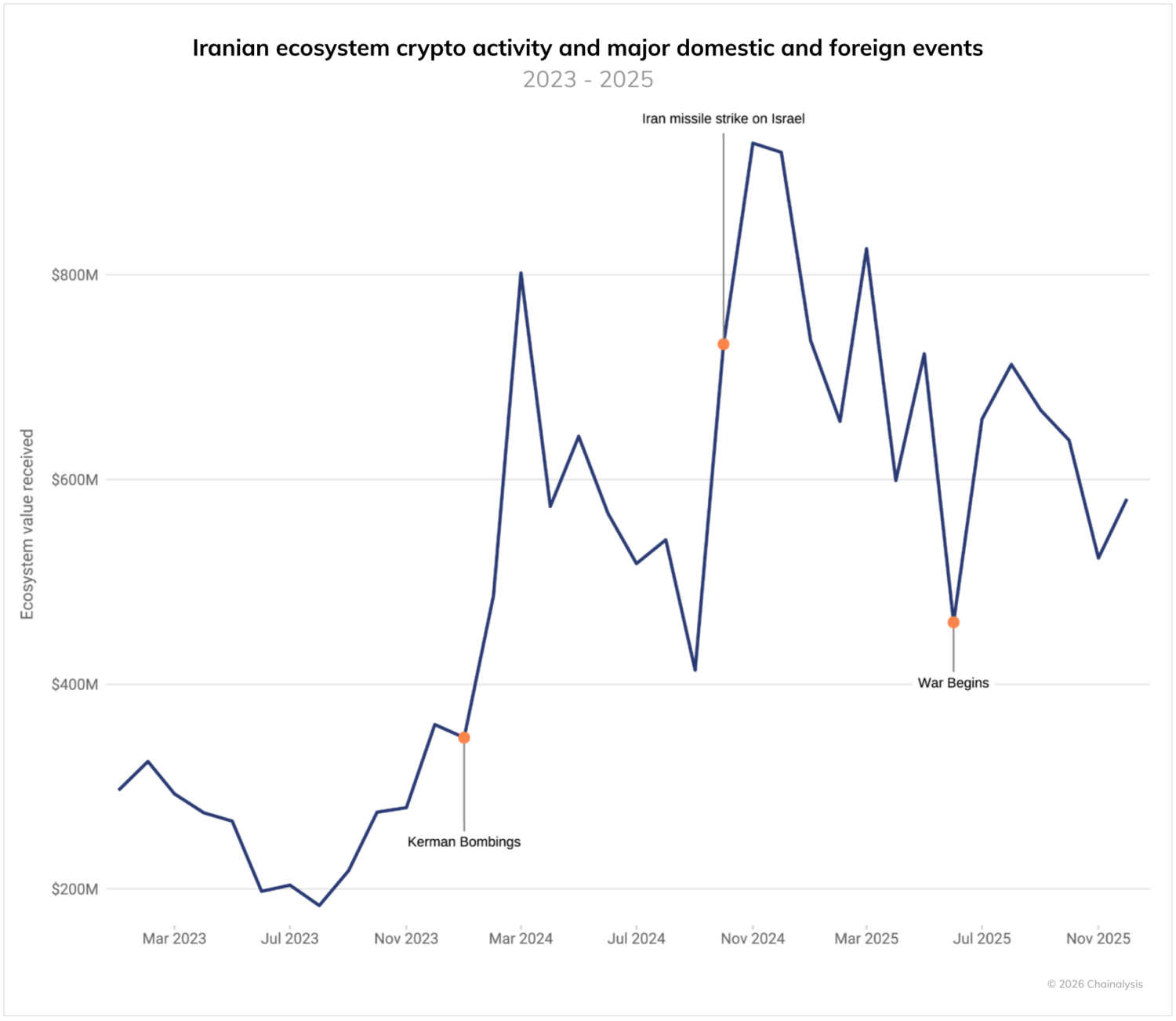

Iran’s crypto ecosystem reached over $7.78 billion in 2025, having grown at a notably faster pace compared to the year prior. As shown in the chart below, and following trends from last year’s Crypto Crime Report, Iran’s crypto activity shows significant spikes corresponding to major domestic and geopolitical events.

These include the following events:

- The Kerman bombings in January 2024, which killed nearly 100 people at a memorial ceremony for former Islamic Revolutionary Guard Corps-Qods Force (IRGC-QF) Commander Qasem Soleimani

- Iran’s missile strikes against Israel in October 2024 following the assassinations of Hamas leader Isma’il Haniyeh in Tehran and Hezbollah Secretary General Hasan Nasrallah in Beirut.

- A smaller but notable spike occurred during the 12-day war in June 2025, which saw Iran’s shadow war with Israel reach a boiling point. Not only did this conflict result in joint U.S.-Israeli strikes against Iran’s nuclear weapons and ballistic missiles programs, but the conflict also saw cyberattacks against Nobitex, Iran’s largest crypto exchange, and Bank Sepah, Iran’s oldest bank which is used heavily by the IRGC. Hackers also breached Iranian state TV, airing footage of women’s protests and urging Iranians to take to the streets.

The IRGC’s growing crypto footprint

Particularly noteworthy is the IRGC’s growing dominance within Iran’s cryptocurrency landscape. Addresses associated with the IRGC’s sprawling transnational facilitation networks have fluctuated over recent years, but as seen below, have risen steadily over time as a share of the overall Iranian crypto economy and accounted for over 50% of total values received in Q4 of 2025. This trend has not occurred in a vacuum, mirroring the IRGC’s expanding control over Iran’s broader economy and political institutions. In 2024, the volume of funds received by IRGC-associated addresses on-chain reached over $2 billion, spiking to more than $3 billion in 2025. Importantly, even these extraordinary figures are a lower-bound estimate that includes only a limited number of addresses from sanctions designations of IRGC wallets by the U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) and Israel’s National Bureau for Counter Terror Financing (NBCTF). However, this does not account for potential shell companies, financiers, or other wallets not yet identified to be IRGC-controlled. We expect this figure will increase as more IRGC-affiliated wallets are publicly disclosed, and larger parts of their laundering network is exposed. These addresses include not only IRGC operatives working in Iran, but also facilitators in numerous countries and networks that move commodities and illicit oil, launder money, transfer funds and arms to Iran’s web of regional militia proxies, and help Iran evade sanctions.

Bitcoin as protest: Withdrawal patterns during civil unrest

Our most recent data reveals a significant shift in on-chain behavior during the current mass protest movement. Comparing the pre-protest window (November 1 to December 27, 2025) with the period from December 28, 2025, to January 8, 2026 (when Iran’s blanket internet blackout began), we observed substantial increases in both the average daily dollar amount transacted and the number of daily transfers to personal wallets. Most telling is the surge in withdrawals from Iranian exchanges to unattributed personal Bitcoin (BTC) wallets. This surge suggests Iranians are taking possession of Bitcoin at a markedly higher rate during protests than they were beforehand. This behavior represents a rational response to the collapse of the Iranian rial, which has lost nearly all of its value, rendering it effectively worthless against major currencies like the euro.

BTC’s role during this crisis extends beyond mere capital preservation. For many Iranians, cryptocurrency has become an element of resistance, providing liquidity and optionality in an increasingly restricted economic environment. Unlike traditional assets that are illiquid and often subject to government control, BTC’s censorship-resistant and self-custodial nature offers financial flexibility — particularly valuable in a situation where individuals may need to flee or operate outside government-controlled financial channels. This pattern of increased BTC withdrawals during times of heightened instability reflects a global trend we’ve observed in other regions experiencing war, economic turmoil, or government crackdowns.

As sanctions pressure and international opprobrium intensify, and Iran’s economic volatility persists, cryptocurrency will likely remain a crucial tool for Iranians seeking financial sovereignty. The correlation between major political events and spikes in crypto activity underscores how blockchain analytics can provide unique insights in real-time into the economic impacts of geopolitical developments, while highlighting cryptocurrency’s evolving role as both a financial lifeline and potential vehicle for resistance in authoritarian economies.

This website contains links to third-party sites that are not under the control of Chainalysis, Inc. or its affiliates (collectively “Chainalysis”). Access to such information does not imply association with, endorsement of, approval of, or recommendation by Chainalysis of the site or its operators, and Chainalysis is not responsible for the products, services, or other content hosted therein.

This material is for informational purposes only, and is not intended to provide legal, tax, financial, or investment advice. Recipients should consult their own advisors before making these types of decisions. Chainalysis has no responsibility or liability for any decision made or any other acts or omissions in connection with Recipient’s use of this material.

Chainalysis does not guarantee or warrant the accuracy, completeness, timeliness, suitability or validity of the information in this report and will not be responsible for any claim attributable to errors, omissions, or other inaccuracies of any part of such material.