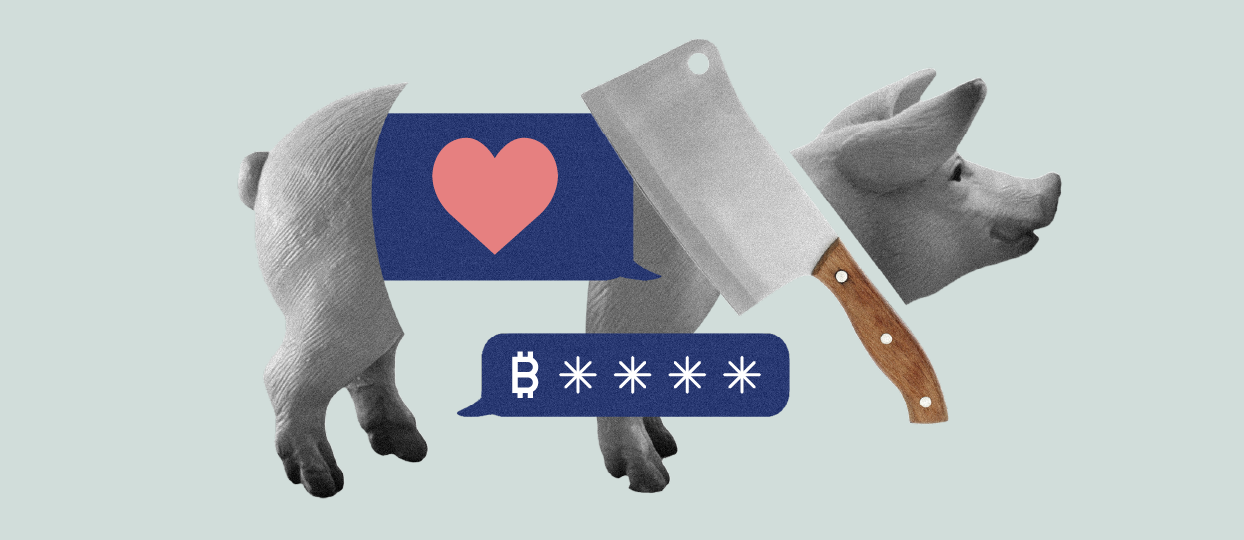

Episode 93 of the Public Key podcast is here! Investment schemes, pig butchering and romance scams are plaguing the crypto industry and we get a chance to speak to Nicola Staub (CEO and Co-Founder of CYBERA) who is bringing together victims, law enforcement and crypto exchanges to combat these cybercriminals once and for all.

You can listen or subscribe now on Spotify, Apple, or Audible. Keep reading for a full preview of episode 93.

Public Key Episode 93: The Future of Crypto Scam Prevention

Investment schemes, pig butchering and romance scams are plaguing the crypto industry in this episode Ian Andrews (CMO, Chainalysis) finds out from Nicola Staub (CEO and Co-Founder, CYBERA) how the crypto industry can fight back.

Nicola discusses CYBERA’s mission to combat crypto scams and fraud by providing a platform for victims to report incidents and for financial institutions, crypto exchanges and law enforcement to share information and data.

Nicola emphasizes the importance of speed in preventing and recovering assets lost to scams and highlights the role of financial institutions and messaging and dating app service providers in the fight against fraud.

He warns the industry about the growing use of AI by scammers and the need for a collaborative approach to combat the use of deepfakes in crypto scams.

Quote of the episode

“The faster we can react after the fraudulent transaction, be it crypto or wire [transfer] and the faster we can inform relevant parties, the higher the chance we get money back.” – Nicola Staub (CEO and Co-Founder of CYBERA)

Minute-by-minute episode breakdown

- (2:15) – Nicola’s background as a prosecutor and passion for fighting scams led to CYBERA

- (6:40) – Lack of resources and technology in law enforcement

- (8:25) – The scale of CYBERA’s impact and partnerships

- (12:27) – Shift in fraud methods, from wire transfers to business email compromise and investment scams

- (17:50) – CYBERA’s approach to information sharing and prevention

- (22:21) – Differentiating CYBERA from crypto recovery companies

- (31:50) – The impact of AI on scams and deepfakes

Related resources

Check out more resources provided by Chainalysis that perfectly complement this episode of the Public Key.

- Blog: Glossary of Scams

- Placeholder – Announcement of CYBERA Partnership

- YouTube: Chainalysis YouTube page

- Twitter: Chainalysis Twitter: Building trust in blockchain

- Tik Tok: Building trust in #blockchains among people, businesses, and governments.

- Telegram: Chainalysis on Telegram

Speakers on today’s episode

- Ian Andrews * Host * (Chief Marketing Officer, Chainalysis)

- Nicola Staub (CEO and Co-Founder, CYBERA)

This website may contain links to third-party sites that are not under the control of Chainalysis, Inc. or its affiliates (collectively “Chainalysis”). Access to such information does not imply association with, endorsement of, approval of, or recommendation by Chainalysis of the site or its operators, and Chainalysis is not responsible for the products, services, or other content hosted therein.

Our podcasts are for informational purposes only, and are not intended to provide legal, tax, financial, or investment advice. Listeners should consult their own advisors before making these types of decisions. Chainalysis has no responsibility or liability for any decision made or any other acts or omissions in connection with your use of this material.

Chainalysis does not guarantee or warrant the accuracy, completeness, timeliness, suitability or validity of the information in any particular podcast and will not be responsible for any claim attributable to errors, omissions, or other inaccuracies of any part of such material.

Unless stated otherwise, reference to any specific product or entity does not constitute an endorsement or recommendation by Chainalysis. The views expressed by guests are their own and their appearance on the program does not imply an endorsement of them or any entity they represent. Views and opinions expressed by Chainalysis employees are those of the employees and do not necessarily reflect the views of the company.

Transcript

Ian:

Hey everyone. Welcome to another episode of Public Key. This is your host, Ian Andrews. Today I’m joined by Nicola Stab, who’s the CEO and Co-founder of a company called CYBERA. Nicola, welcome to the podcast.

Nicola:

Hey Ian, thanks for having me. It’s a great pleasure to be here.

Ian:

I am super excited to talk about your company, because I think you’re working on one of the biggest problems of our day, which is stopping what seems to be an epidemic of financial scam activity. I hadn’t heard of your company until just the last few months when our respective companies started collaborating together. So maybe we can start with a bit of background on what does CYBERA do, how do you help people? What’s the mission of the company?

Nicola:

Yeah, sure. And I’m glad you’ve heard about the company now, and you know what we are doing because it is truly an important mission we run. And just to back up a little bit, because it’s important about talking about CYBERA is also very much linked to my personal background. And so before CYBERA, I worked as a public prosecutor in Switzerland and long story short, I dealt on a daily basis with scam and fraud victims internet crimes and I realized how big the problem is, how easy it is for criminals to carry out these attacks and how horrible on an individual basis this is for an individual or a person that falls victim to a scam and it sparked a big passion for me to do more against these kinds of crimes. And one of the result, let’s say, is CYBERA, a company that we started three years ago based on some insights that I had on the job as a prosecutor dealing with these crimes and seeing a way where we can improve some big pieces by building technology.

Ian:

That’s quite the pivot. I mean, we talked to a lot of founders on this podcast. I think you’re the first who’s gone from prosecutor to leading a technology company. How did you have the confidence to make that jump? I mean, that’s a very different career path I would imagine.

Nicola:

Yeah, yeah, you’re absolutely right. And yeah, I should put that out there, but I think it’s true. I don’t know any other prosecutor who went from prosecutor to CEO of a startup. Well, to tell you, I mean honestly, when I first started studying, I actually never thought that I would end up working for government in the first place and it’s in my family, my dad is quite logical, entrepreneurial, and I always liked to improve things. And I liked also technology, but I studied law, I loved criminal law. I did a traineeship at the office of the Attorney General in Switzerland. And I kind of, if you want, fell in love as much as you can say that with the work of law enforcement, with investigations, working with the police and they fighting crime and helping victims.

But so yeah, how did I make the jump right after four years, five, almost in law enforcement, I still loved the job, but I kind of merged with my entrepreneurial spirit and I saw some way how we can really make a bigger impact. And I have to say, of course, I have my co-founder, who is also my twin brother who had the business background, who knows the startup world a bit better, so that helped to give me some confidence to team up with him and kind of form that dream team joining these forces and building a company. But it’s been exciting.

Ian:

Incredibly fortunate to have a built-in co-founder.

Nicola:

Exactly.

Ian:

Your twin brother as well, that’s amazing. So you mentioned as you were a prosecutor, you spent lots of time trying to help victims and fight these scammers, and you uncovered a couple insights that led you to realizing there might be a more impact that you could have than just prosecuting the bad guys. Talk us through what some of those insights were.

Nicola:

Yeah, sure. So in general, I was just amazed by the amount of these scams and the money lost. It really happens on a daily basis. And how they happen in the detail of course, is different case by case, but overall, they have very similar elements. And it’s always that in one way or the other, criminal scammers trick somebody or a company, it’s usually a person and they trick the person into making a financial transaction.

Now, eight years ago, it used to be mostly wire transfers, and then increasingly of course it’s crypto. And so this happens in all of these fraud and scam cases. And I saw very key thing in how we can improve this is by working with the financial sector because they’re very much involved in these crimes unwillingly they don’t want to be and that of course, well is Chainalysis. And where I saw a gap, to put it very simply, is one in crime reporting and two in information sharing. I can give some examples if you like.

Ian:

Yeah, please do.

Nicola:

Okay, yeah. So let’s take a romance scam often starts on a dating app. I know that would never happen to you Ian, but just imagine, right? You’re on a dating app and somebody kind of start conversation with you and they end up scamming you. And the result is that you, let’s say make a wire transfer, you’re sending 80,000 from the US to a bank account, let’s say in Germany, and then they trick you into making also a crypto transaction by Bitcoin transaction. Now, once you realize you’re a scam victim, you usually go to your police or you seek kelp, you want help with recovering your essence mostly. But frankly, what do you think if you go to your local police, I guess you have some experience, what happens?

Ian:

I’d love to say that they open up Chainalysis’ reactor and they do an investigation, they contact an exchange and they freeze the funds and they return to the victim, but that’s the rare occurrence. The more likely case is first, the victim’s embarrassed because they realize they’ve been scammed, so they’re going to be hesitant and they may let it go for weeks or months before they report it and then when they do show up at the police station, that frontline officer often has no experience with financial crime. And so they hear, “Oh, the funds are likely in crypto. Well then they’ve probably been transferred overseas. There’s nothing that can be done and you don’t even open a case.” So it doesn’t get recorded usually is the experience, right? It’s under reported.

Nicola:

Yeah. So I mean from my experience, and I mean this is not the bashing of law enforcement of course, because my heart beats very much for law enforcement and I would say 99% are doing an amazing job. But what I realized, there’s just lack of resources. There is so many cases, an incredible amount of cases. Even when I used to be a prosecutor, I had hundreds of cases and I could deal with one after the time. And then often as you said, they don’t have the technology resources.

And I would go one step further, law enforcement and the police’s job is primarily to investigate catch to criminals, but it’s not primarily to help you recover assets. And it’s a tough way to find a solution, but that’s exactly where CYBERA innovates today, basically and to recover assets and the response side of things, and for prevention, speed is key.

The faster we can report, the faster we can alert the bank in Germany, let’s say, where that money went to, the faster we can help tracing and alerting, like you said, the crypto exchange. And the faster we can share the crime data that is reported across the ecosystem, the better everybody can use it for prevention. And so that’s exactly that gap that we are every day trying to fill with more and more success.

Ian:

It’s amazing in valiant that you’re trying to solve this problem because it’s what I encounter every day. You’ve been at it for a number of years now. Give us a sense of who are you working with and what’s the scale of the business in any dimension you’re happy to share?

Nicola:

Yeah, sure. So I mean, I started around three years ago, pretty much alone with my brother. So we came a long way from there. We’re now kind of a global company. We built technology, a platform that helps exactly with what I said before. We have built a platform where a scam or fraud victim can report, they get resources, they get help, we then alert banks or help with tracing and alert crypto exchanges immediately and very fast in the case. And we share these alerts through our partners, which includes now chain analysis, which is quite amazing of course.

In that sense, yeah, we came from, I would say zero to today, helping every single day scam and fraud victims give you a little number. We’ve helped close to 10,000 total victims now that reported through the platform, and I would say between 10 and 30 every day and for this year, we have additional partnerships that will go live very soon where this number will increase a lot. And it has to because as you know, that’s still the tip of the iceberg and that is still the tip of the iceberg. And our platform’s goal is really to help pretty much every legitimate scam fraud which demo out there.

That’s not possible alone. So we are very much about building a community ecosystem and we work with financial institutions, so banks, also crypto exchanges, they work with us to help scammed users or customers. They also use our data for prevention, but we also work with law enforcement and with victim nonprofits. For example, in Switzerland where I’m from, the police officially works with us. And whenever there is a fraud victim, they now hand out the leaflet saying, “Hey, report also with CYBERA.” It just boosts the resilience of the ecosystem. And in the best case, it can help you get your money back even.

Ian:

Amazing. So I imagine that there’s a bit of a tension between the prevention side and the recovery side. Ideally, we would be able to stop all the scammers before they steal anyone’s money and we don’t have to worry about recovery at all. Looking at your website, it looks like you’ve actually got multiple different products that are one set oriented towards a bank or a crypto business or other financial institution and then you’ve also got services that you offer to individual victims as well. Am I following that correctly?

Nicola:

Yeah, yeah, that’s pretty much correct. And you’re right, if we can prevent every scam, then we can kill the recovery side of things, which I’d be more than happy to do, but it’s not very realistic. Unfortunately, so we just have to become much, much better and do what we do, which is information sharing at scale to fight back, basically.

So in terms of the solutions right now that we offer, you’re right, it’s what we call it the CYBERA Watch List, which is basically a very high quality block list of suspect of crime data reported to us. And so that is useful for banks who for example, include accounts that we flag for crypto of course, but also for individual people or companies.

So if you trade a lot in crypto, you can actually can access also as an individual, our watch list and check if a name or a social media account or even a bank account provides a hit. And that really boosts prevention. And you said right, if prevention fails, it’s important We have something almost like an insurance that we try our best as CYBERA, but as everybody involved to help try to get that money back before it ends up in the hands of the scammers and that’s where our response solution comes into play.

Ian:

Can you talk a little bit about the relative scale? I know you said when you first started as a prosecutor, almost all fraud in the financial context came back to wire transfers as kind of the means of getting money from victims. And that I sense that mix has shifted quite a bit. So on this podcast, we’re generally talking crypto, we talk a lot about pig butchering. If you can, give us a sense of the relative dollar value behind different methods in which people are being taken advantage of.

Nicola:

Yeah, sure. I mean, one of the key statistics or I would say at least today, who has the most reports in crimes? It’s not yet CYBERA by the way, but soon, it’s the FBI, right in the US with IC3 where people report also on victim behalf quite a lot. And when you look at that, the statistics, the FBI provides, then the two clear number one types of fraud and scams is today, one, it’s business email compromise, CEO fraud, which often companies are a victim of, and that’s most of the time wire transfer.

The other one that you’ve mentioned it several times is investment scams, which now mostly goes by the name of pig butchering, which is most of the time crypto. So from what I personally have seen when I started in law enforcement around 8 years ago, there was a lot already of romance scams with wire transfers and I did see that there has been a trend to mix that and start with a romance scam and then get the people, the victim basically to invest in most of the times to invest in a fake platform. And that’s pretty much what you call pig butchering today. That being said, and you know that the president and me, we see at least, yes, there’s crypto, but we also have several victims who were the scammers first they make a bank transfer, then they switch to crypto. So we really see both, right?

Ian:

Yeah. And we’re talking order of magnitude here, billions of dollars a year, right?

Nicola:

Absolutely. So again, one of these numbers that is quite tough to measure, but the FBI says something like I think 10 billion, there’s a big under-reporting now, one of the nonprofits have estimated that it’s already in the trillions. So there is several measurements, but for me it’s clearly the number one crime out there when you talk about victim losses. And one thing I always like to point out, almost everybody has somebody in their family or a friend who has been scammed and sometimes it’s smaller amounts, but if you add all of that up, right, we’re talking billions and that is money that goes from individuals from legitimate kind of people, really more or less directly to full organized crime. And so it’s money, but it’s also organized crime that’s growing and of course there is a lot of emotional consequences for victims themselves beyond losing money, which can go as far as to leading to suicide and really, really bad results. So for us, that’s pure motivation to do more and to fight back.

Ian:

We’ve talked quite a bit about the industrialization of the scammer operations and particularly in Southeast Asia where you have these factories where many of the people that are working there have actually been trafficked into that and forced labor. There was big news out of China just a few months ago where they arrested, I think the number they reported was over 30,000 individuals who were supposedly involved in this. If that were real, I would imagine that we would see a meaningful decline in the new scam activity. I’m curious if you’ve seen any data in your systems to indicate that that was real or has had any effect.

Nicola:

We haven’t seen it, and it’s a bit tough to talk about individual countries rule of law. I mean, I am not an expert on China and China law enforcement, but at least there is some, I think questions marks. I mean, it’s obviously known that I think the judiciary of law enforcement is at least not fully independent how we the investing world like to do it. So I’d hope to see the US or European country publish the same news that would give me some hope. And there is some hope, right?

I really think when I compare 8, almost 10 years ago when I started and the last two, three years, it’s really nice to see that the topic is much more out there. Also thanks to people like prosecutor Aaron West, who’s very publicly about it and about the news, who are rating much more about these stories. So to put that out there I think is really good and that has changed. But for the individual victim, honestly, I don’t think the situation has that much improved because it takes time, law enforcement still has a lack of resources and the scammers increasingly also thanks to AI technology, they are becoming even better and better by the day. And so this will remain an ongoing battle for sure, even if there is more success in prosecution,

Ian:

One of the things I’ve always wondered about is while I might use a crypto exchange or a bank to ultimately send money to a scammer, that’s not usually the point of inception. Like you mentioned earlier that many of these start inside of a dating app. If I scroll back through my text messages over the last year, I’ve got tons of these seemingly random, innocent, wrong number type messages. Occasionally, I’ll interact with them and it’s fairly clear it’s a scam just because I’m used to it, I’m kind of expecting it. I see it as a scam. But I think about the entry points or actually tech companies, the telephone company like my cell phone service provider, that allows these kind of random spam text messages to get through. Are you doing any work on that side of the ecosystem to try and limit the access to potential victims?

Nicola:

Yeah, that’s a very good point, right? You’re right, of course, when the money flows, I would say it’s almost already step three, and it’s often the banks today that are in the crossfire, but I think rightly so, the banks, especially in the UK, are fighting back quite a lot saying, “Hey, this has to be a whole ecosystem approach. We have to stop the scams or put some more pressure, if you like, with the online platforms where they often originate.” And it’s true, even also in our platform we see a lot is originating on WhatsApp, on Telegram, also on online, on dating platforms.

So I mentioned right when you go and report to the police for example, that’s one thing that certainly is not happening or in most cases not right, but actually, and that’s when you report to CYBERA, that’s the vision, we’re actually very close to it is when you report, we don’t just share information with the banks or with the crypto ecosystem to prevent, but we’re also providing that to, for example, a dating app provider.

We are moving towards that and I think that’s the effectiveness we want to achieve also with our platform that when you report, the quality is checked, it’s high this is a scam case, and then at this high quality, this is distributed available to everybody, to all the companies that are involved and they can immediately shut this down or investigate it. So that trend is happening and very important and I fully agree with you.

Ian:

Yeah, I mean it seems like the information sharing the rate at which you can disseminate, “Hey, we have a scam, or this group of individuals are involved in perpetrating a scam,” and get that information shared as widely as possible so that every financial institution, crypto business bank, all have that data. Ideally, we also get that upstream into the messaging apps, the dating apps, so that they can close the accounts that these folks are using. If you can do that after we’ve detected one victim, it just limits the blast radius in such a way that’d be really powerful. Why isn’t everyone using CYBERA? What’s the objection when you go talk to one of these folks.

Nicola:

I hope after this podcast they’ll all be using us, spread the word. Well, I mean, to be frank, we are still also an early stage company. So we are building, we not out there in the market for that long, but let’s say a bit over a year since our platform is really working in that very effectively and it is growing more and more, “Are you using us?”

Two things I would say are very, very important and it’s kind of up to us to deliver that. One is the trust, but trust comes really from security, of course, we have to be secure and the quality. So right, imagine everybody’s plugged into CYBERA. We want people to trust our intel, to trust our data. If we have bad data, that’s not good.

I would say one of the challenge that why what we do is actually quite complex, usually it sounds very easy. It’s say, “Hey, why is that not existing? It should actually exist already since 15 of 20 years. Why isn’t Interpol doing it? Why isn’t anybody else doing it?” Because it’s actually quite complex. But yeah, we’ve built a system that now is already very good and gets more accurate to do that, and we need partners. And one of the big ones is Chainalysis that we’re very excited because you guys have reach much, much wider reach, of course, than CYBERA does. And so that’s also why I’m very excited to partner with companies like you said, yours, and that we can expand that reach and really together make this whole ecosystem much more safer from these horrible scams.

Ian:

All right, so we got to get the word out there is what it sounds like.

Nicola:

That’s one piece of the puzzle for sure.

Ian:

Now, are there people who don’t feel good about the information sharing? I know on the victim side, obviously there can be embarrassment getting scammed where they may not want to report. But I’m curious more on the financial institution side. Is there a reason why they wouldn’t want to participate in an information sharing network? It sounds like this is all upside for them.

Nicola:

Yeah, yeah, very relevant of course. So I would say the biggest hurdle is actually the law. Let’s put it legal provisions to some degree and then the risk if you want. So one way of course to share information is bank to bank or crypto to crypto, or law enforcement to bank. But one of the biggest hurdles are legal provisions.

So for example, law enforcement is actually in most cases not really allowed to share. In some countries this is now softening up, but that’s very, very slow progress and it’s risky. And the same is kind of with banks, especially then when it goes global and cyber crime scams are completely global. So even if they’re allowed to share, sometimes it’s within its own country, but it’s not global. So there’s all these hurdles and that’s actually where when we started three years ago, and that’s more true now than ever.

That’s one part where the innovation with the tool solutions it promotes makes sense because with us, any bank or crypto exchange can recommend this additional support for their users who are scammed, but it’s actually in most cases, the victim or the user that comes and reports with us. So we get a lot of the data that makes sense to share for the whole ecosystem, but we get it ourself on our platform legally checked so we can then actually provide it. So it’s kind of a win-win win, actually and you don’t have to wait for all the laws to change, which they never will. I’m a lawyer, so I know this, it takes a lot of time.

Ian:

So in this case, the user reports the scam or the fraud to CYBERA. CYBERA then combines all of the reports you’re getting all around the world and then any one of your customers now has a very accurate, relevant list of known scam activity that they can use as a means to prevent their other customers from falling victim to it. So blocking withdrawals to a particular person or a wallet address in the case of crypto like that, that makes all the sense in the world. That’s great.

Nicola:

Yeah, yeah, yeah, exactly right. And maybe one thing to mention is what sometimes we forget is that I always say every scam incident, every scam or fraud is also money laundering and not to get too legal here, but this sometimes operates in two different spheres, but every fraud and scam results pretty much in a financial transaction and for the bank, and same for crypto.

This is a money laundering transaction, a money laundering risk. And so it’s actually not just important voluntarily to be better and detect that stuff, but it’s also from a regulatory point of view, very important that as a exchange or as a bank, you do the best possible thing you can do to detect this stuff. And if you don’t, we’ve seen it, you know that better than me. Binance is the latest example, but many are fined because of not taking enough measures when it comes to money laundering. So I think it’s important to always point out this is not scam fraud, but it’s really, there’s also trillions we’re talking of money laundering that we need to prevent.

Ian:

That’s a great point. I’m curious about the other side of the business. So after a victim is contacted you and recovery, I saw on LinkedIn you posted a look back at 2023 and I think it said that you had helped victims recover almost 5 million US dollars. How does that work? And I am particularly curious because there’s been some reports of recovery firms that are maybe not really operating in the best interest of their customers. They promise the world and deliver nothing, and the result is the victim is kind of victimized twice. So I’d love to hear your approach to recovery, how you’ve been successful, and then maybe if we can contrast to some of the other things that are happening out there just so people can tell the difference. That would be great.

Nicola:

Yeah, that’s a very important point and it’s one of them why we are so public about it. Why I do post? I love to speak to you here on the podcast because there it’s called recovery scam, right? There is a lot of recovery scam companies out there, and I would say then there is also other investigators mostly or individual firms who are actually legitimate. More, some of it less. Then looking at that is actually one of the reasons why CYBERA is so valuable and we strive to make it clear. I mean, we’re a VC backed tech company. We use technology as much as we can and we make the process as transparent and clear so it benefits the victim and so we can make sure that reaction happens in the best possible way to improve this chance of recovery. Now, more specifically, what does that mean?

It’s all about speed, I’m going to put out there. If it’s one thing to remember, we see that in our data, we know it from law enforcement, the faster we can react after the fraudulent transaction, be it crypto or wire, and the faster we can inform relevant parties, the higher the chance we get money back. And just briefly, I have to separate between wire transfer and crypto because we also have a lot of success cases with wire transfers, but it’s actually not that different.

With a wire transfer, coming back to the example with you, let’s say you sent money from the US to German bank account. When you report with us, we immediately create a criminal report or complaint and send or dispatch that to that beneficiary bank where we have a contact that happens within the platform and to the relevant police in Germany, we translate that report with all the information into German even, which also is sometimes important.

And so within minutes, police and the beneficiary bank have at a high quality all the information about this case, the victim, the transaction, and that can help them, or that usually triggers them to take action to investigate the account and to freeze money if it’s still there. So that’s on the wire side. Now, on crypto cases, as you of course know better than me, there is always the element of the crypto like tracing.

So we have to follow the flow of funds, identifying which potential crypto exchanges we can inform similarly to informing a beneficiary bank and here in the best case scenario, I always say, you can go to your police, the offices are there, they help you in one or two days, they do the tracing, they do all of that for you. But as we discussed, that doesn’t happen often. Resources are still limited and it’s also not the main job, even legally speaking of the police to help you with that.

So as transparently as possible, we try to bridge that gap and we’ve been doing it more and more successfully. That means we help by doing that tracing with our own team, using of course tracing tools. And we don’t just trace, but we also like with the bank example, then immediately send the report and the tracing to the identified crypto exchanges. Doing it at a high quality and high speed has allowed us to then have these exchanges or banks trigger funds, which is a key first step to then recover it, which obviously takes law enforcement and so on.

Ian:

Yeah, I mean that is really the critical thing. I couldn’t agree with you more is the speed of recovery or the speed of notification in order to help with recovery, I should say. Because at least in the crypto world, at some point there’s a funds go through compliant exchanges, almost always. And if you can reach that exchange in time, they can freeze those funds in an account. And there’s a high likelihood you can have those recovered.

But once they’ve passed through the exchange, it becomes difficult to trace. They often will then go to non-compliant exchanges and jurisdictions where they don’t really respond to legal process and the likelihood of recovery goes significantly down from there. I’m curious, if I were a victim and I was trying to decide which recovery firm to talk to, what would be some of the things that you would say would be a good indication that the firm is maybe not one that I should be doing business with? How should someone tell the good guys from the not so good guys in this recovery world?

Nicola:

Yeah. Well, for me, that goes even for scams in general, when you look at the website this organization has, even though it gets much easier and easier now with AI to do professional websites, if they don’t communicate too much, I think about the company organization, who’s behind it. If you click on their LinkedIn and they don’t have one or it looks dodgy or has 10 followers, for me these are some red flags.

Now again, it can be that you have an amazing person that just started out and it’s just the beginning, right? These are some signs, and I know they can be hard to spot. The other thing is, in general, I would say turn to the places you can trust, which is law enforcement, but might also be your sending bank or the exchange or whatever wallet provider you used.

And if they have a recommendation of who to work with, then that’s also another sign you can take and it’s one of the approaches we do. We put it out there as much as possible that we have the best interest at heart of victims. And that’s why we already successfully work together with police, with exchanges, with banks, and with a lot of nonprofits that support victims and they’re convinced with what we do and that we can make a difference and so they’re happy to work with us. But yeah, that’s as much as clear answer I can give you because as you know, the scammers are creative and they might try to impersonate CYBERA, and it’s not always easy, but just take your time, I would say as a victim, do as much research as you can, but then once you’ve done that, it’s important to act fast.

Ian:

That’s right. Yeah. We’ve even had impersonators for chain Chainalysis.

Nicola:

Yeah, that doesn’t surprise me.

Ian:

Multiple different speeds.

Nicola:

You’re the real deal, right? I’m speaking to the real Ian.

Ian:

That’s right. This is not a fake podcast. This is a real podcast today. And actually, that brings me to my next question, which is actually about deepfakes. So I’ve spent a lot of time over the last year kind of diving into the world of artificial intelligence and the things that you can do, whether it’s building a website or translating audio and video from English to German or another language, it’s incredible. And it can be done with such high quality, low cost, and done quickly that I have to imagine that this is going to change the way that scammers operate. I mean, I would expect it to be more scams, maybe shorter lived scams, because the cost of setting one of these up kind of goes down. You can just quickly build a new website or quickly invent another online persona. I’m curious if you’re starting to see this show up in the data yet, or is it still too early? Are we still in the beta testing phase of artificial intelligence?

Nicola:

Yeah, no, I think we’re way past the beta testing. Well, I’m personally still in a testing phase and I already see the potential. But again, criminals are often unfortunately even a step ahead. So they’re usually some of the first ones who adopt these technologies. And I mean, frankly speaking, in our days at CYBERA, it’s not the majority. We don’t have every day a case where AI is involved. But on the other hand, the victim who reports might most cases not know that, right?

So from stuff I’ve been reading, the people I’ve been talking to, it’s quite obvious that AI is already widely adopted and in use by organized crime. And I mean, we see it, for example, in how these attacks or the social engineering is carried out. You mentioned it, the emails, the phishing mails, that initial message or the text they send with AI, so much easier to make them sound good.

I mean, if you use sometimes AI for your emails, or especially me as a non-native English speaker, obviously. So it’s really amazing how it can help you, but it also unfortunately, amazingly helps the scammer and the criminals, right?

Ian:

That’s right.

Nicola:

And it goes beyond that. So I’m sure you’ve read some of the reports. There has been AI applied in voice kind of cloning. So this will happen much, much more often. I mentioned CEO fraud, but it can be used for a romance scam, pig butchering anything. If you have a recording of a voice of let’s say me or you, you can use that voice and you can call your CEO and say, “Hey, Michael, please make the transfer 50K or something,” right? He wouldn’t fall for that, but that’s already happening and then video the same thing. So the tools the criminals have are becoming much more effective, unfortunately and so it’s even more important we fight back.

Ian:

Well, and I think a lot about that audio case, because obviously I’ve got a few hundred hours of high quality audio for anybody to train on. It’s available in any podcast.

Nicola:

Hope’s you’ve got good security.

Ian:

I just have to tell all my loved ones to ignore a phone call from me asking for money ever. I wish there was a better solution, but that’s all I’ve come up with so far. But we’ve also seen, I think humans, it seems in this day and age, tend to trust video more than they do text and audio. We’re all maybe on the lookout for fake emails.

Even my non-technical friends, they tend to have a skeptical eye towards anything that comes into their Gmail inbox. But when you see a video, I don’t know if it’s a human brain thing, it is hard to imagine that it’s not real, assuming that it’s of reasonably good quality. And with AI, we’ve gotten to this moment where you can create videos of well-known people saying and doing things that they never did.

There was one scam, I think with Mr. Beast recently where it was something like an iPhone giveaway that you could register for, and totally unaffiliated to Mr. Beast. But given his draw and popularity, it drew in, I think millions of people who fell for this. So be safe out there, I think when it comes to AI.

Nicola:

Yeah, no, a hundred percent. Yeah.

Ian:

Be safe. Be skeptical. I guess as we come to the end of the conversation, Nicola, I’m really curious, what’s next for the company? What do you see on the roadmap for the coming year here in 2024 that you’re excited about?

Nicola:

Yeah, a lot of course we’re excited about, as you’ve heard a bit throughout this conversation, we’ve come really a long way basically showing that this information sharing concept in the way that we build it is working. I mean, our collaboration is a big milestone towards that way and so we are excited to build upon that, right? And we have a lot of partnerships that are going to happen in this year, in 2024. And in the end, our business is about scale, so the more victims we can reach, the better. The better for the recovery side of things, but also the better for the prevention side of things. So yeah, we’re very, very excited of course, to just continue and build on that success that we had and now double and triple and 10X that. So as you said, pretty much hopefully everybody soon knows about CYBERA and that we can, together with our partners, really make a big difference against this crazy scam epidemic.

Ian:

Awesome. I am so excited for the partnership and the opportunity to make a dent in these scammers activities and to help as many victims as we can. So thanks so much for the time today, Nicola. I really enjoyed getting to know you.

Nicola:

Likewise Ian, it’s been a great pleasure talking to you.