Customer impact

Even as threats grew more sophisticated, our intelligence advantage widened, enabling customer to take historic actions:

Unprecedented Recoveries and Seizures

Chainalysis customers took the fight to illicit actors

Law enforcement has long relied on Chainalysis, having seized $12.6B in illicit assets to date, but this year marked an inflection point. An additional $21.4B was seized or recovered, a 180% increase year-over-year.

Our latest analysis shows over $75B in seizable criminal balances are still within reach.

Learn more.

Global Fraud Disruption

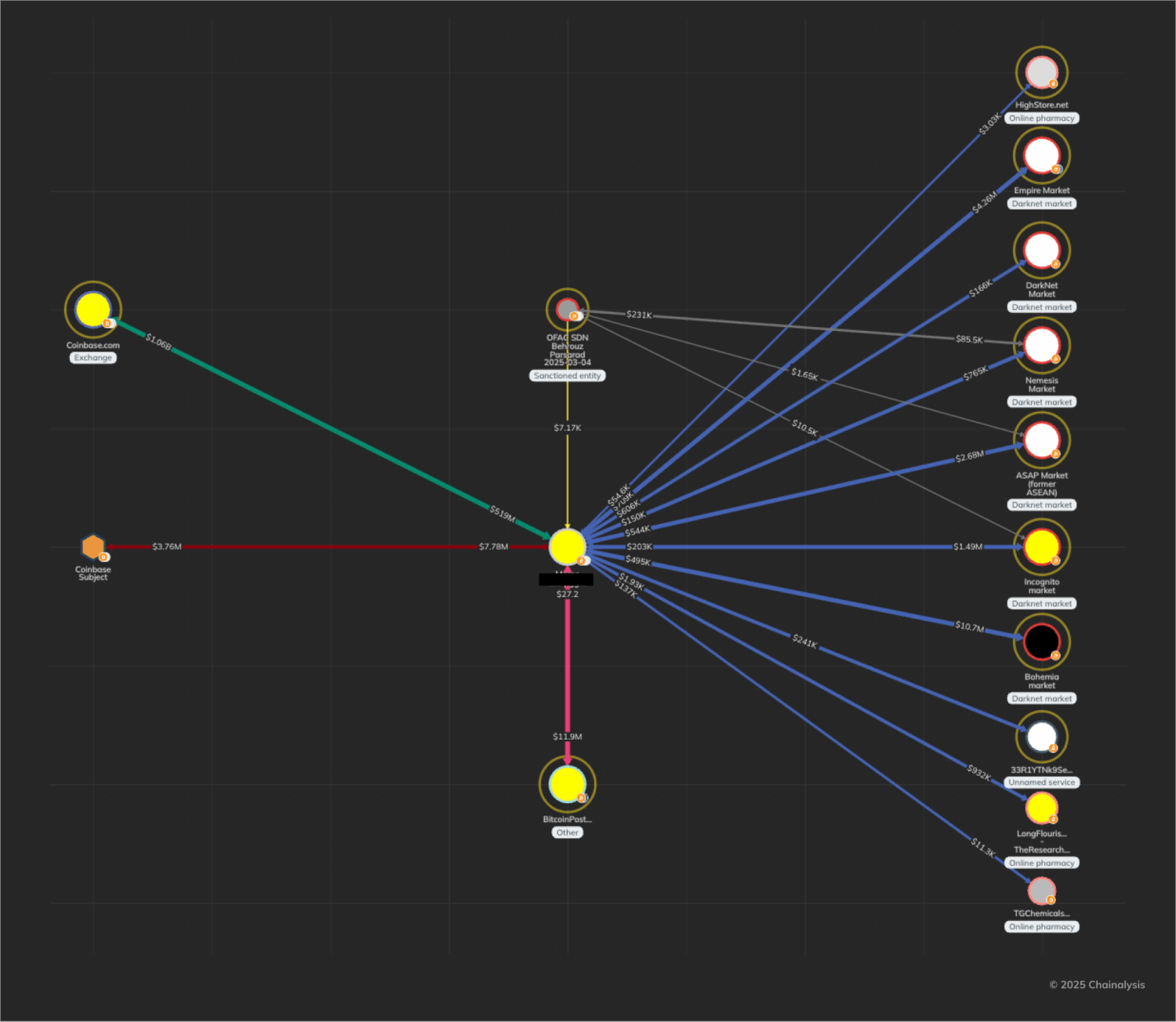

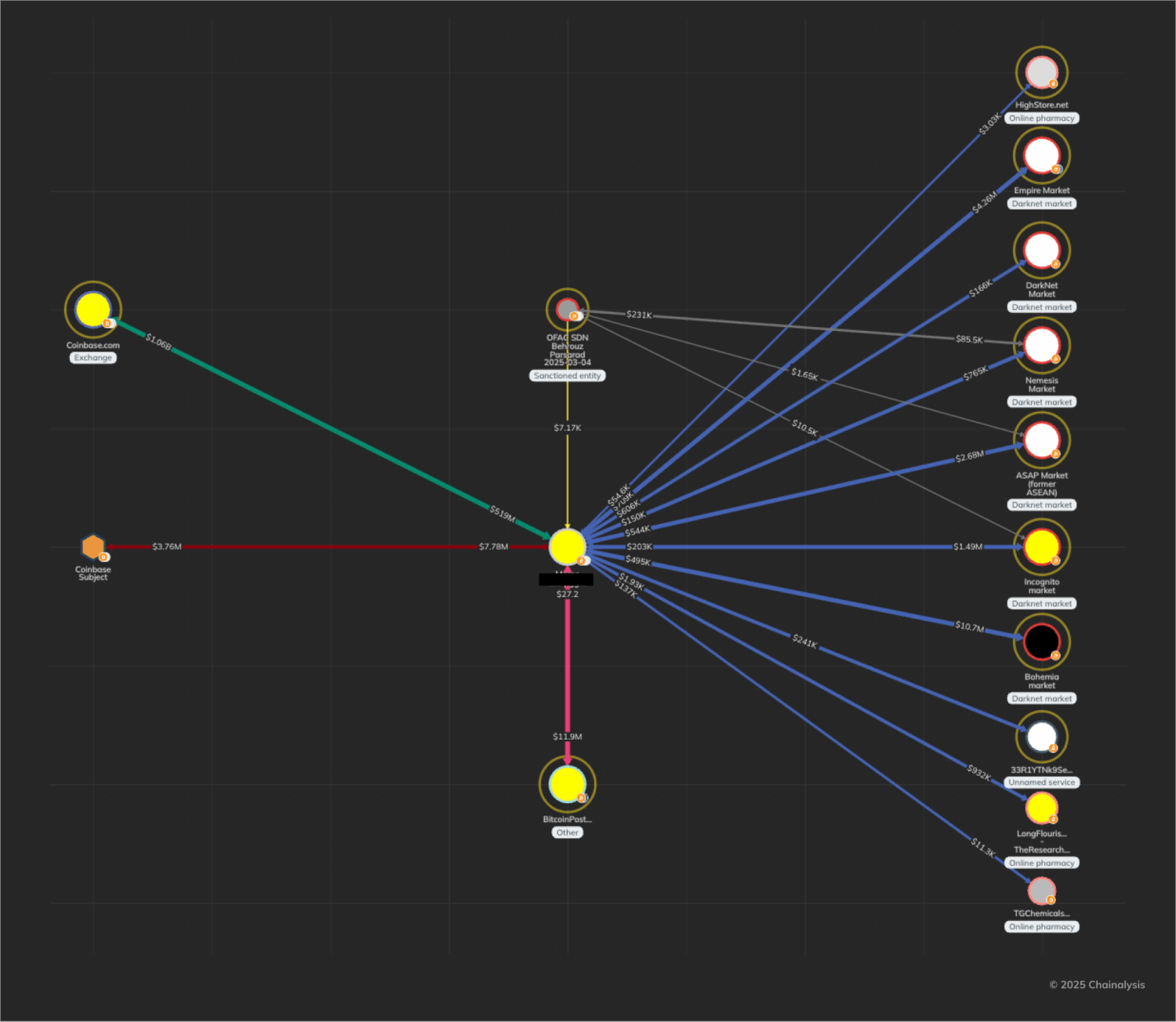

Historic $15B in Bitcoin DOJ action against a global scam empire

U.S. and U.K. authorities advanced a first-of-its-kind $15B forfeiture tied to a Southeast Asia scam network, proving that industrialized criminal infrastructure can be mapped and disrupted at scale.

$47M in USDT frozen, halting Southeast Asia pig-butchering scams

APAC law enforcement, OKX, Binance, Tether and Chainalysis traced pig-butchering scam flows into consolidation points, freezing criminal funds.

Raising the standard for blockchain intelligence

Data is at the heart of Chainalysis, helping our customers execute mission-critical needs. This year, we deepened that commitment by:

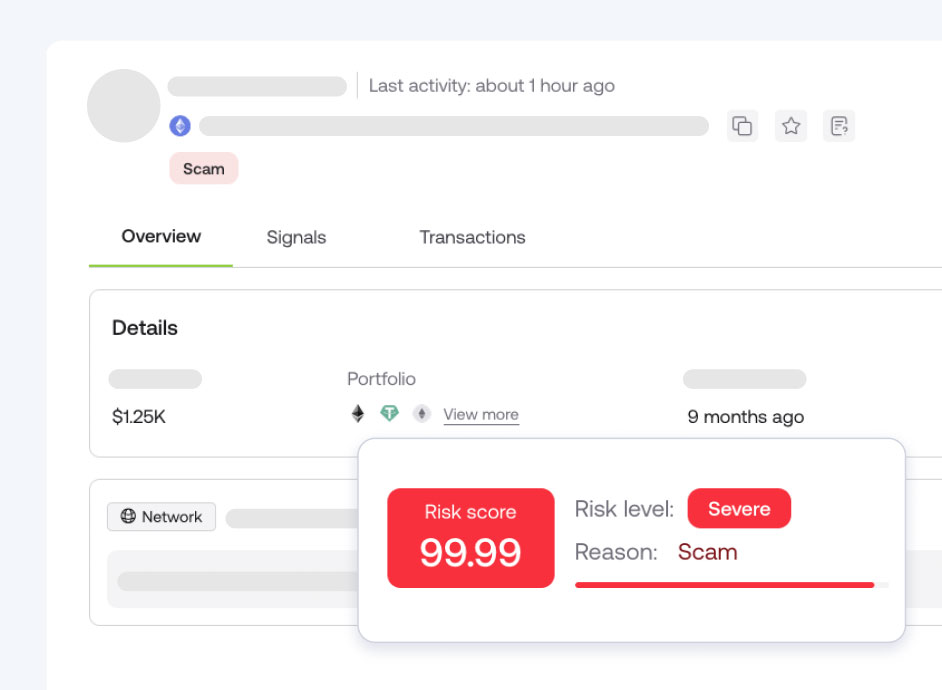

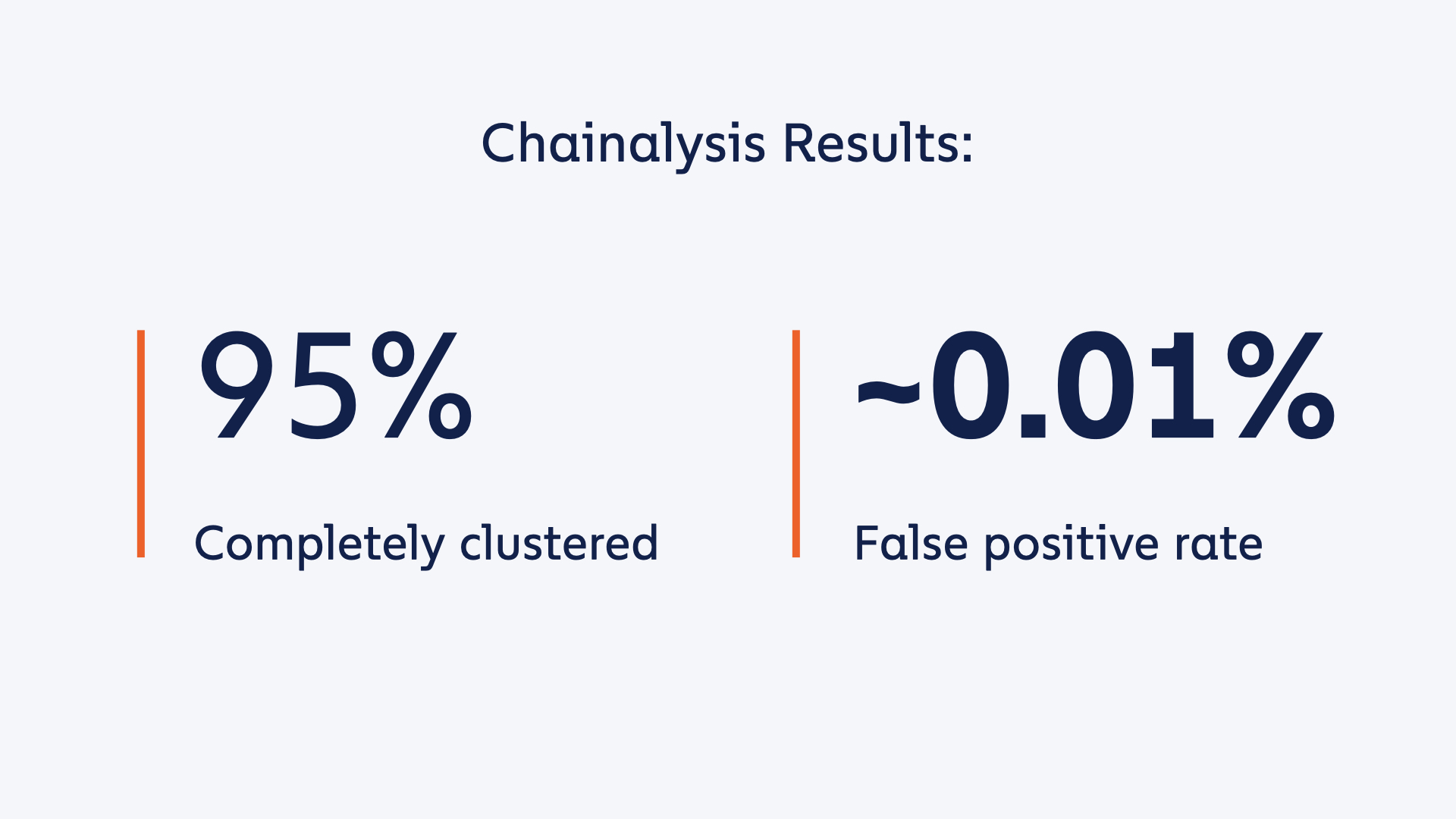

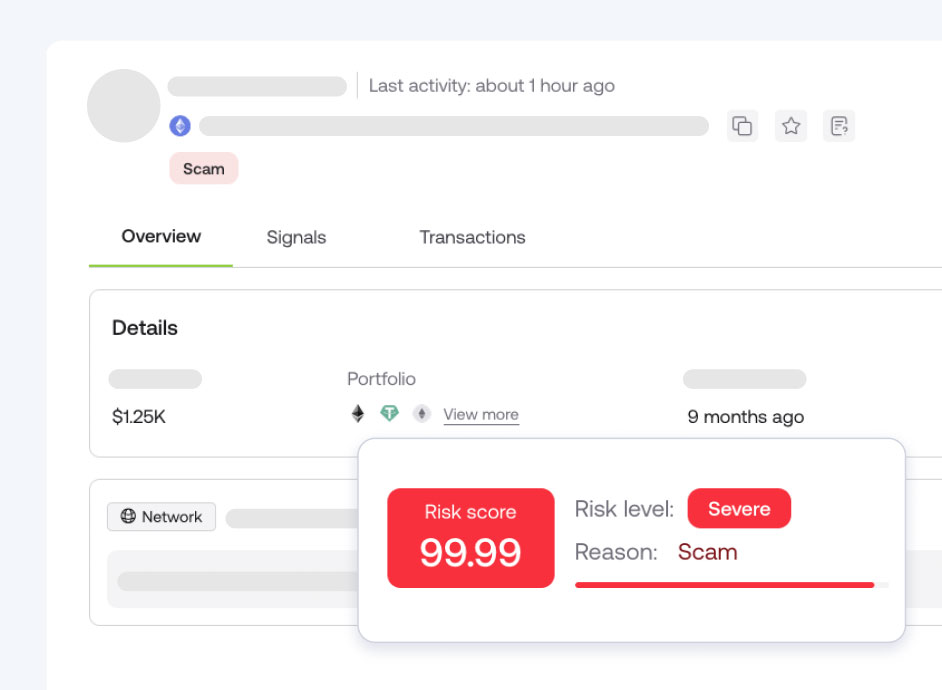

Proving our data quality

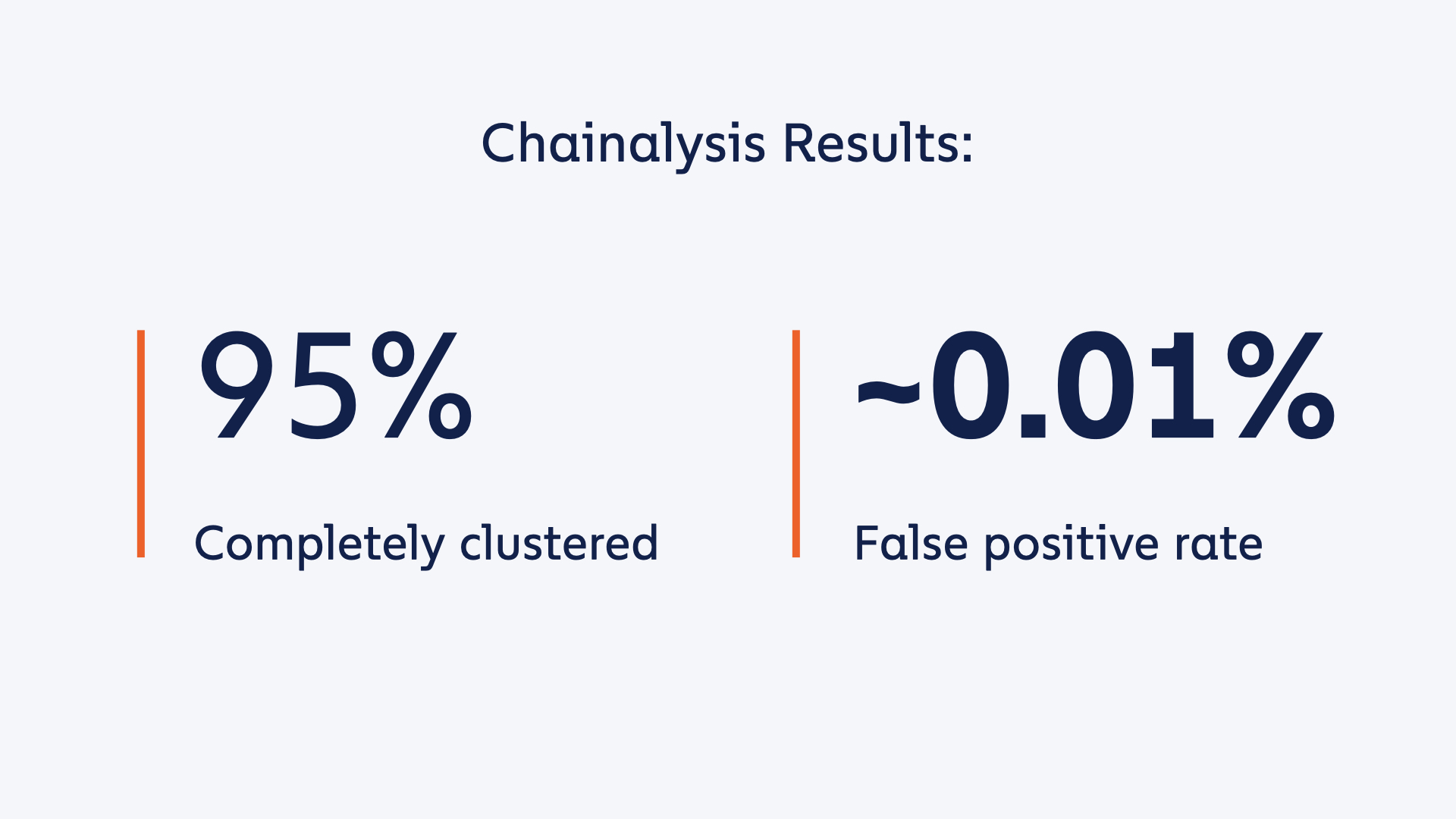

Independent academic researchers evaluated Chainalysis against a controlled dataset

Peer-reviewed research found Chainalysis to be most accurate with highest coverage, delivering up to ~95% coverage of tested illicit services with false positives below ~0.01%.

Setting new benchmarks in excellence

Coverage now spans 134K+ unique entities, twice as many as other vendors.

50% increase in cross-chain swaps and bridge coverage for deeper insights and better decision making.

Trace across 300+ bridges and 325M+ swaps with unmatched clarity.

Widening our support across ecosystems

Unichain, Ink, Soneium, TON, World Chain, X Layer, Kaia, Plasma, and XRPL tokens

Did you know? Chainalysis adds over 100k tokens per day!

Accelerating AI investments

AI compounds the data advantage

New growth financing from Hercules Capital accelerates our continued investment in AI technologies to expand our data advantage, enabling more automated workflows and new use cases for blockchain analytics.

Innovations that moved missions forward

From AI triage, to next‑generation graphing, and instant seed‑phrase analysis, our flagship capabilities took a generational step forward, enabling investigative teams to move with greater agility and impact.

Rapid launched

Instant triage. Actionable intelligence.

Rapid is the industry’s first AI-powered crypto triage solution, letting any investigator, regardless of crypto experience, to quickly see if there’s something actionable or nothing at all.

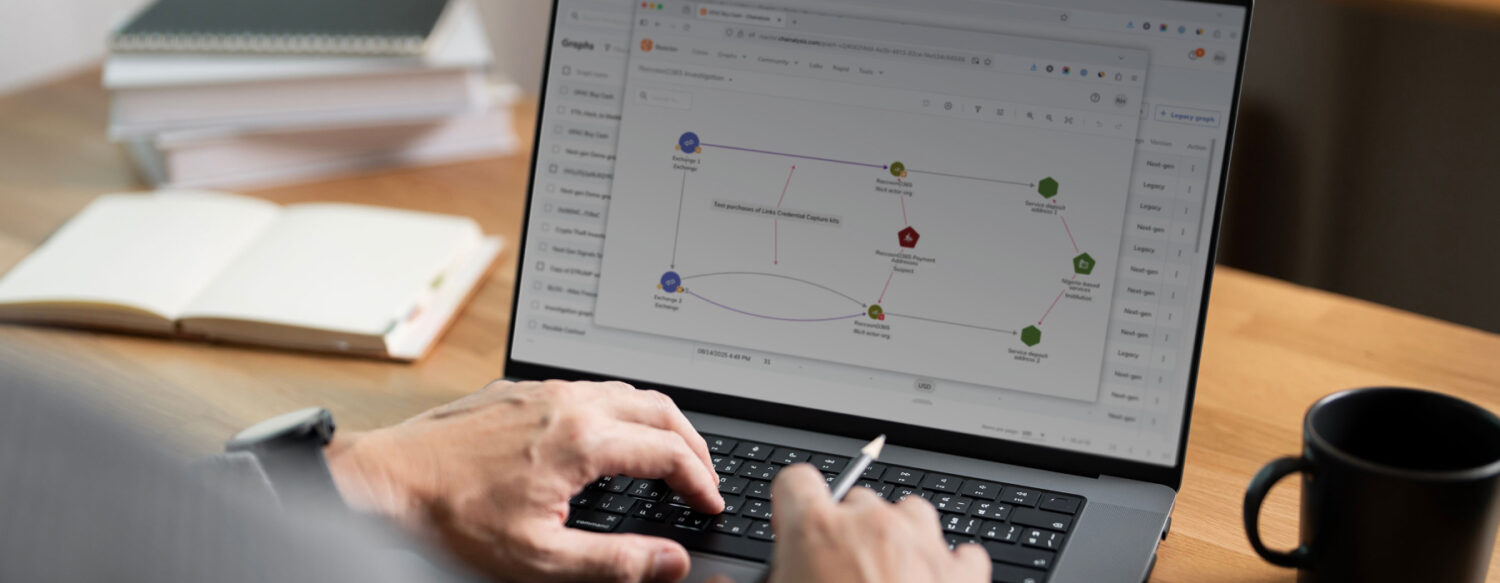

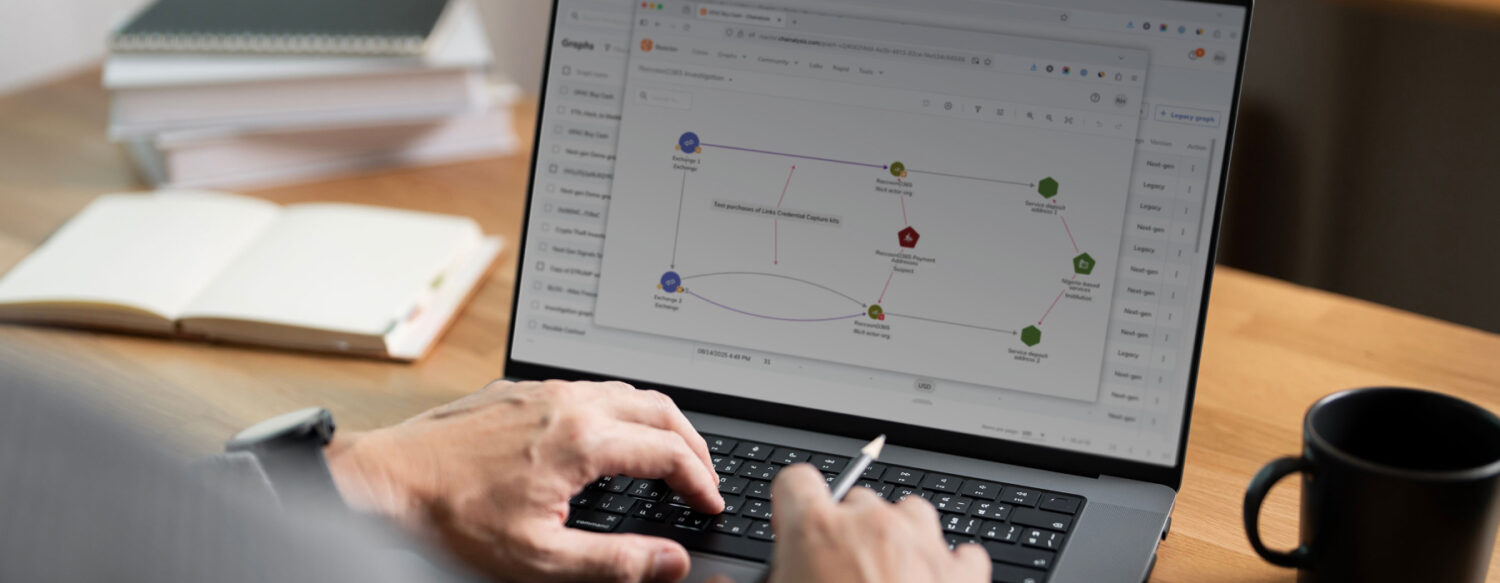

Next-generation graphing with Reactor

Reactor rebuilt for investigative clarity and speed

Reactor was rebuilt for investigative clarity, speed, and cross-chain scale. From transaction interpretations, to automatic graph layouts, to blazing performance that loads massive graphs instantly, Reactor helps analysts robustly trace and present complex fund flows.

Try out Reactor Next Gen with interactive examples.

Solve real-world cases using the latest Reactor features and learn tips and tricks along the way.

Investigative impact

Reactor Powers Microsoft’s First Civil Action

Blockchain evidence, traced with Chainalysis Reactor, played a key role in supporting Microsoft’s first civil enforcement action regarding RaccoonO365.

Wallet Scan launched

Find seizable crypto linked to any recovery seed

Wallet Scan launched to support crypto asset seizure. Convert seed phrases into public keys offline, automatically identifying all associated wallets and balances across multiple blockchains.

“Through Wallet Scan, we identified and recovered $11.4 million in funds that were missed during the initial wallet reconstruction in 2019 due to derivation paths that were unknown at the time.”

– US Government agency

Investigative Partnerships

Cryptocurrency Insights for National Security and Law Enforcement Agencies

i2 Group and Chainalysis teamed up to integrate Chainalysis data directly into Analyst’s Notebook, providing investigators a holistic view of on- and off-chain criminal intelligence.

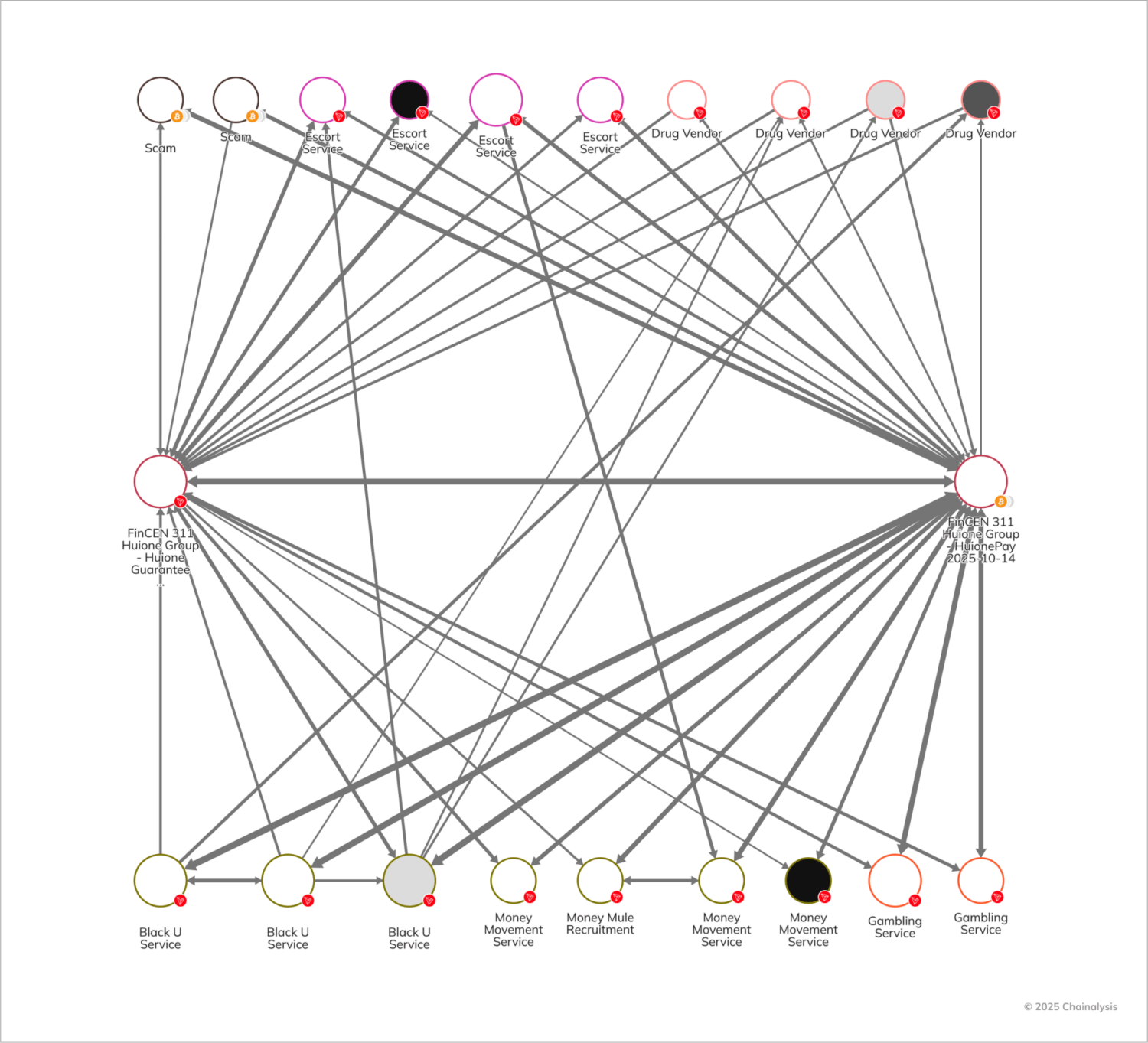

Compliance

Institutions gained a clearer view of risk and new ways to enforce rules, stop bad actors, and protect market trust.

Sentinel launched

Real-time stablecoin and token ecosystem monitoring

Sentinel gives token issuers continuous intelligence on illicit activity so they can freeze suspicious funds, enforce blocklists, and maintain regulatory confidence as their tokens scale.

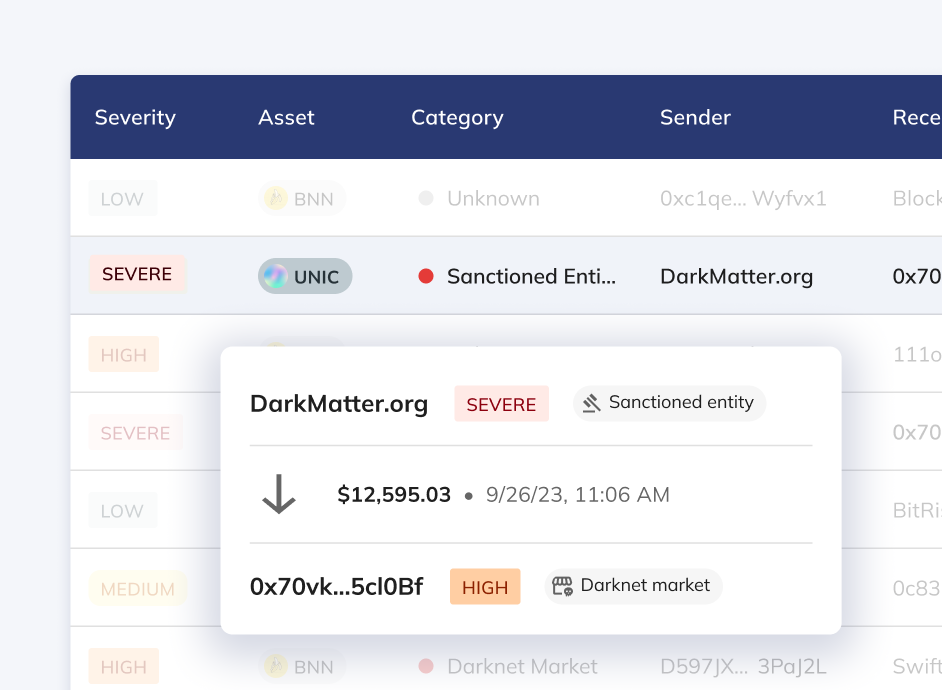

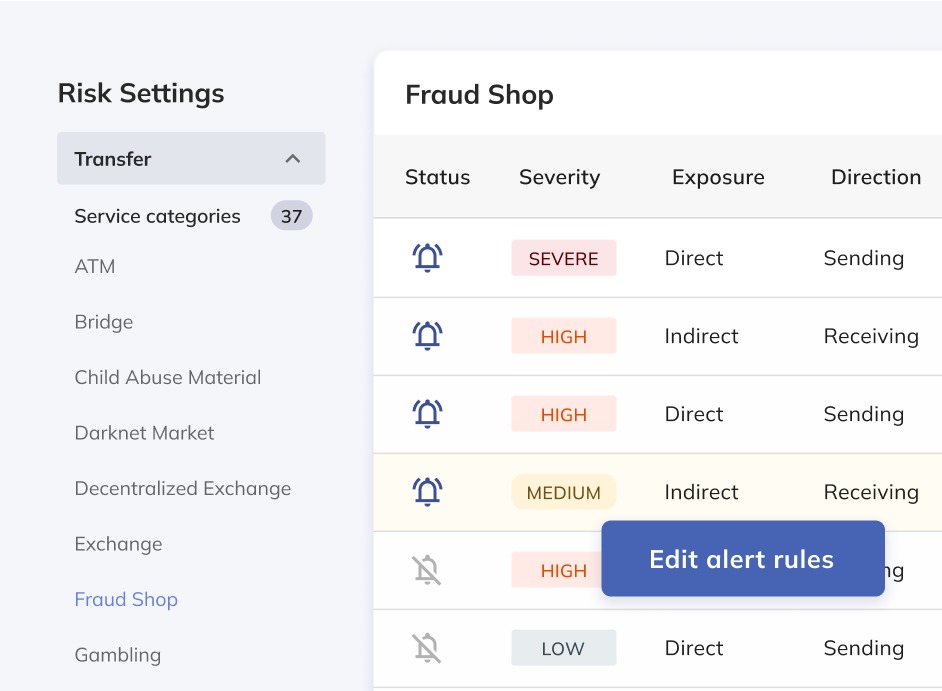

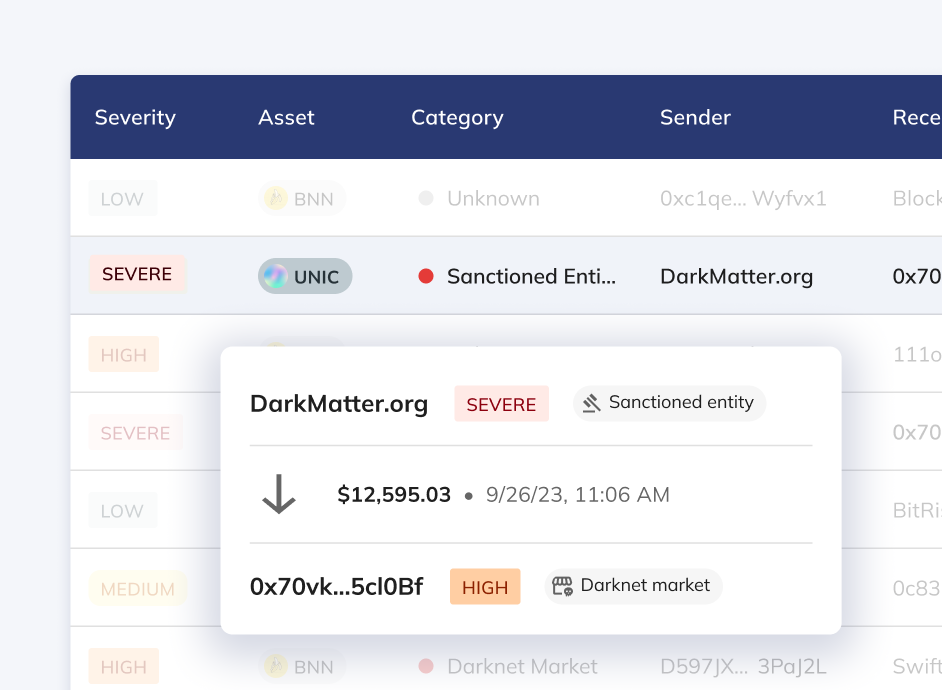

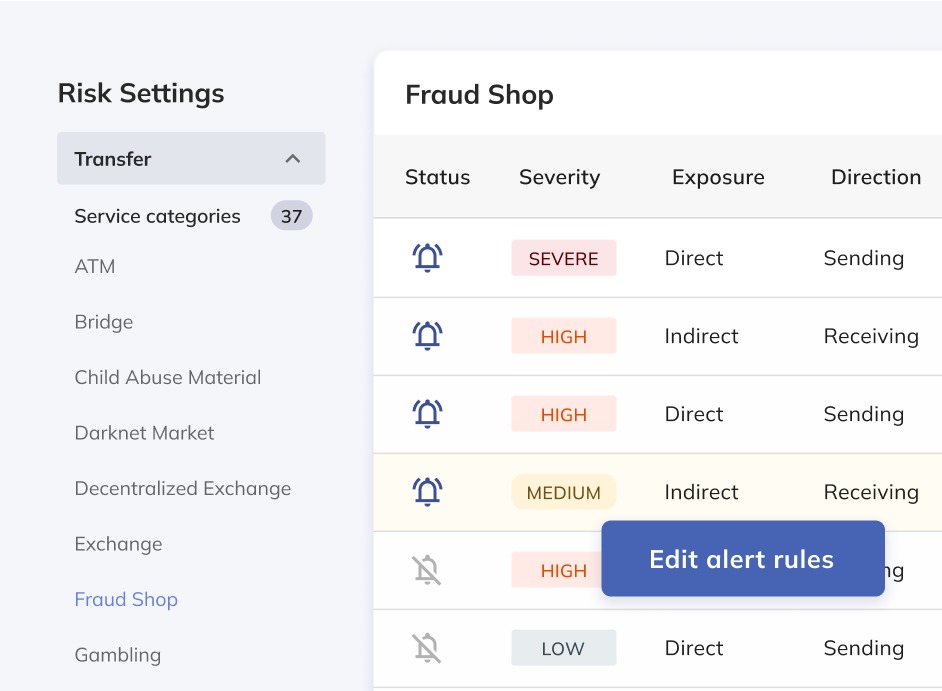

Smarter, Faster Transaction Monitoring

More precise monitoring and controls

Teams gained tighter control over alerts and enabled streamlined workflows. New KYT features, including dynamic lookback windows, enhanced rule thresholds, automatic assignments, and user-property based optimizations, help compliance teams reduce false positives and accelerate alert review.

Compliance Partnerships

Advanced cross-chain compliance with Chainlink partnership

Our new strategic partnership with Chainlink brings Chainalysis risk intelligence into Chainlink’s interoperability layer, enabling automated, cross‑chain compliance controls as institutions expand across fragmented ecosystems.

Chainalysis integrates with Hadron by Tether

Chainalysis integrating compliance tools directly into Hadron by Tether, establishing the security standard for real-world asset tokenization.

From solving crime to preventing it

2025 marked the shift in application of blockhain intelligence, enabling customers to proactively stop illicit activity.

Fraud

Using AI tools to fight AI-powered fraud

Alterya joins the portfolio

Alterya provides real-time, proactive fraud prevention by using AI to identify scam accounts at inception, allowing customers to block funds before a victim reports the loss

This year, Alterya has prevented $300M+ in transfers to scams.

Alterya in action

Scam data powering both private and public sector

Alterya’s fraud data is leveraged from financial institutions, to exchanges, to the public sector to take down scams at a community-wide scale. From just 5,000 reported scam webpages, a regulatory agency leveraged Alterya to map 25 seizable accounts and identify over $300 million in scam loss funds.

Security

Real-time defense against Web3 exploits

Hexagate joins the portfolio

Hexagate delivers adaptive, real-time, on-chain security to detect everything from key compromises to phishing and governance attacks.

Web3 security innovations

Wallet Compromise Detection Kit

Instantly detect and stop cryptocurrency wallet drain attempts with machine learning models that adapt to hackers techniques and activity on your platform.

GateSigner

$1.5B ByBit hack highlighted the urgency of operational vulnerabilities. Hexagate GateSigner provides crucial protection against blind signing and real-time transaction threats. It runs pre-signing simulations to analyze, flag, and auto-deny risky transactions before a signature occurs.

Hexagate in action

Hexagate and a Community Stopped a Hack

Protocol monitoring and community action secured $13M, turning a major Venus hack into a swift recovery victory.

“This incident reminds us how important it is to have the appropriate security measures in place to guard against bad actors. We couldn’t have done it alone. Threat detection and response measures like what Hexagate offers are vital to prevent catastrophes.”

– Venus Labs Core Member

Threat intelligence and automation

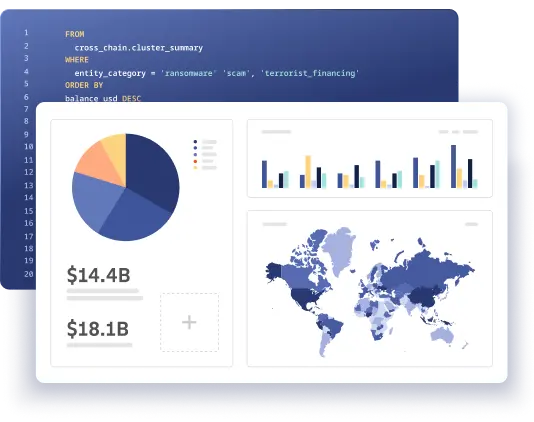

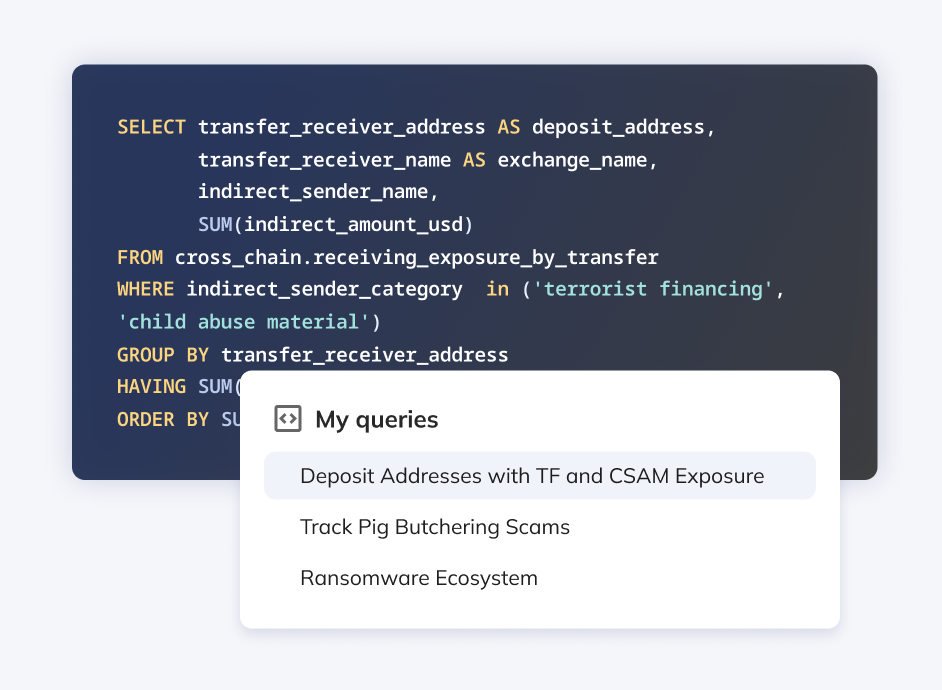

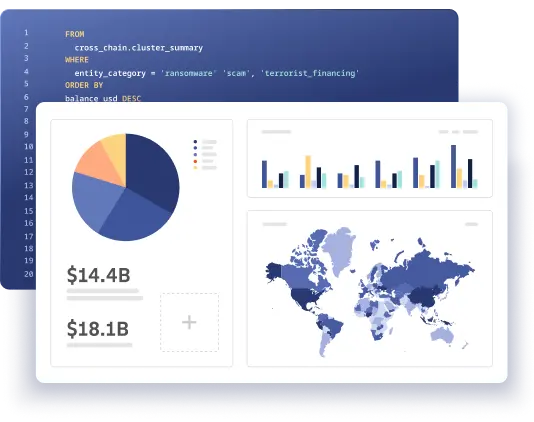

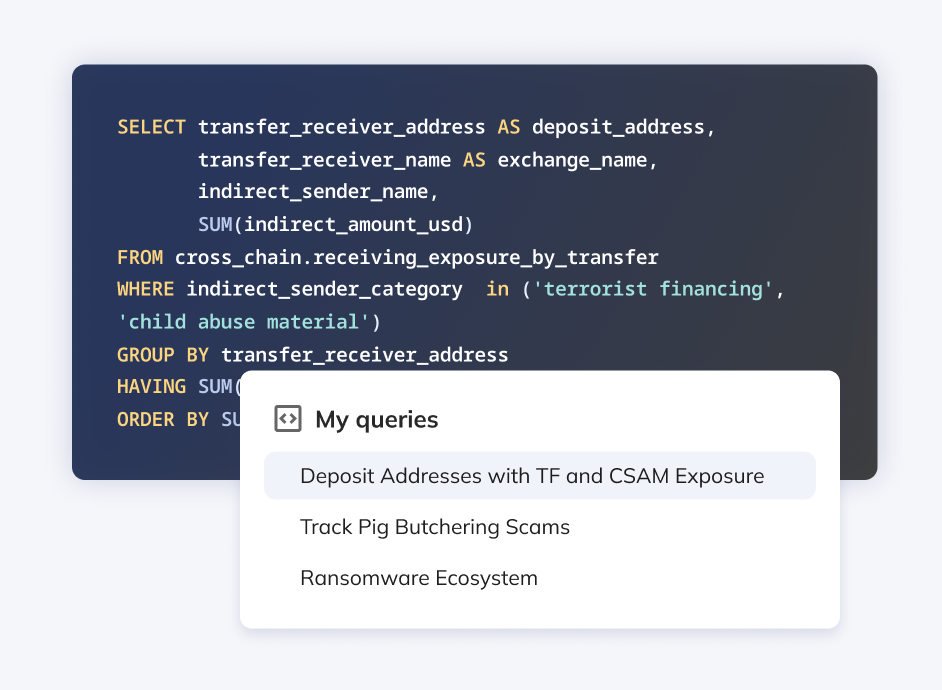

Chainalysis DS was introduced and provides the most customizable threat intelligence and automation in blockchain intelligence.

Chainalysis DS launches

Threat monitoring and automation at scale

Chainalysis DS enables you to visualize threat landscapes and automate with customizable monitoring and alerting.

Try out Chainalysis DS and follow video guides.

Chainalysis DS new features

Customizable alerting platform

Define and continuously track any emerging activity and automate analysis to prioritize and generate leads for immediate, actionable alerts.

New intelligence insights

Boosting compliance and risk assessment capabilities, Chainalysis DS now features Asset Issuer Enforcement Events for streamlined access to multi-chain freezes and blacklists, along with Geo-Signals for critical geographical intelligence on entity activity.

Customer DS in action

DS helps disrupt fentanyl networks

Coinbase targeted the crypto nexus of fentanyl trafficking as part of their proactive risk management strategy. They tracked and mapped 17,000+ crypto transactions and resulted in 41 intelligence packages distributed across 12 countries.

Services

Through industry-leading training and services, we support customers to build the internal knowledge and capacity to disrupt illicit networks and execute on missions.

Training certifications

Knowledge is power

Chainalysis Academy issued over 16k certifications across 11 languages for customers in investigations, compliance and foundational knowledge.

Evolving with industry needs