This post is an excerpt from our 2023 Geography of Cryptocurrency Report. Download your copy now!

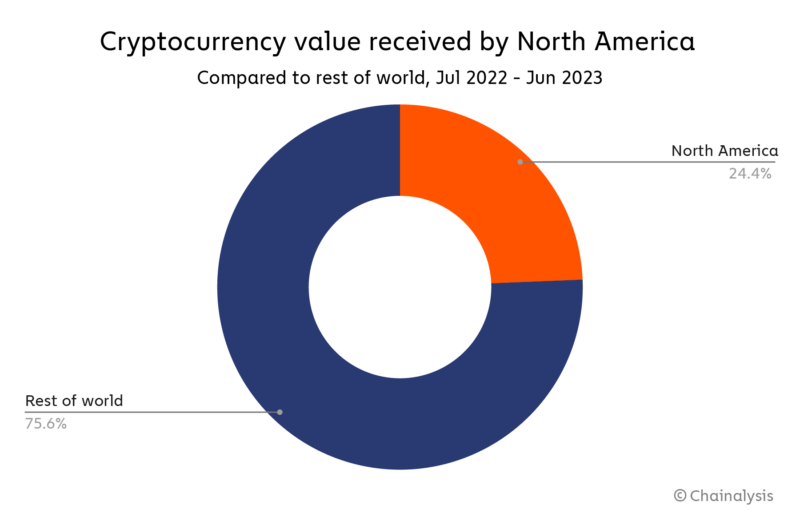

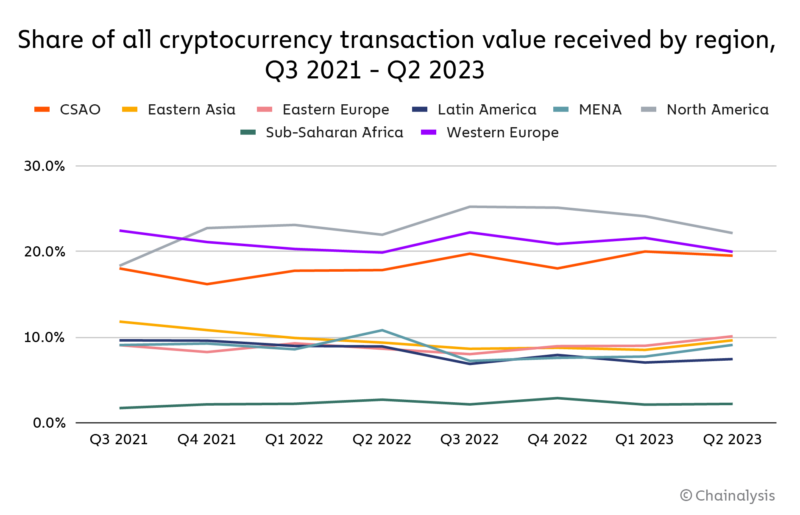

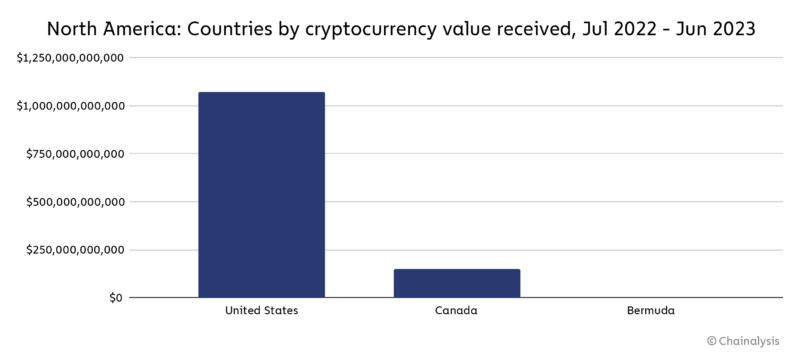

North America is the largest cryptocurrency market we study, with an estimated $1.2 trillion in value received on-chain between July 2022 and June 2023. That total represents 24.4% of global transaction activity during the time period studied.

Most of this activity is driven by the United States, which ranks first overall worldwide. Canada also contributes significant transaction volume, placing seventh globally.

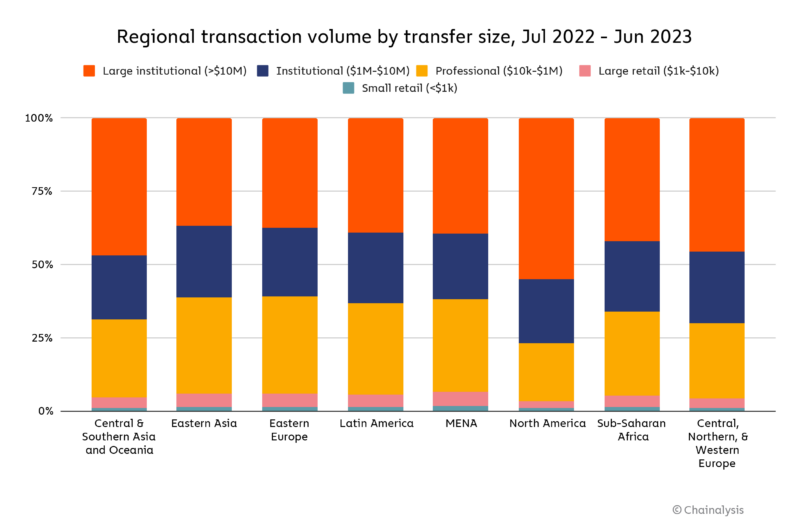

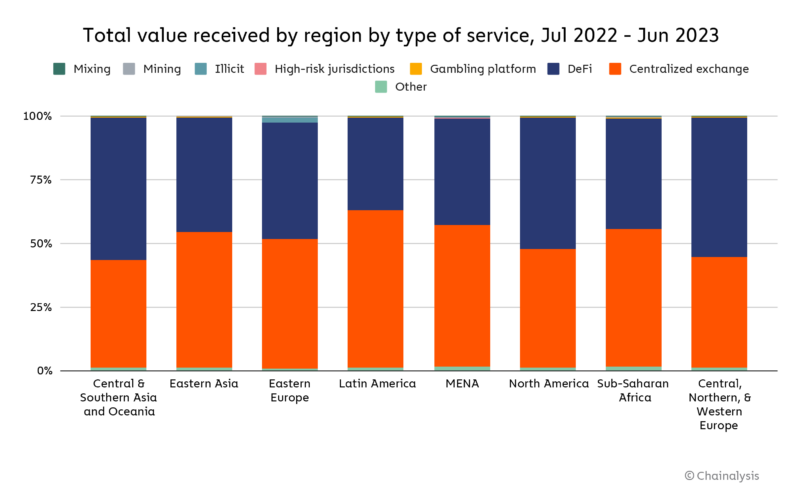

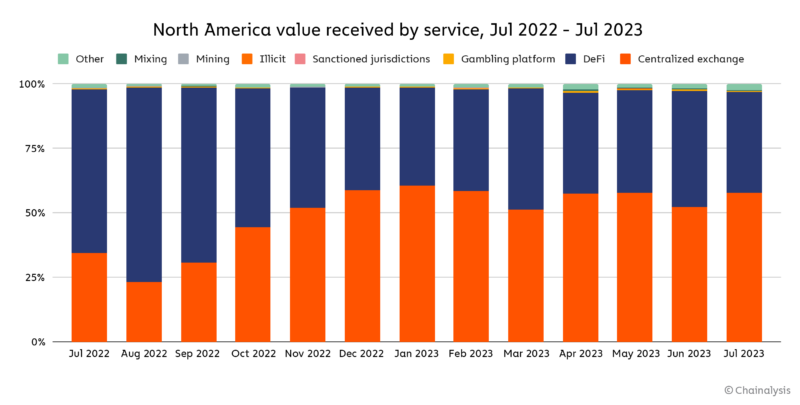

North America’s crypto market is more driven by institutional activity than any other region’s with a whopping 76.9% of transaction volume driven by transfers of $1 million or more. The region’s on-chain activity is split relatively evenly between DeFi and centralized exchanges.

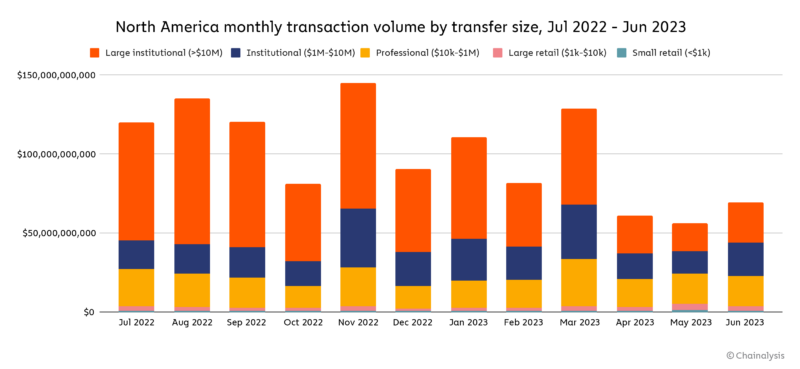

As we’ve seen in other regions, on-chain data suggests that North American crypto activity has fallen over the last year, following negative developments such as the blowup of FTX in November of 2022. Interestingly, crypto activity contracted more in the months immediately following the March banking crisis that saw Silicon Valley Bank and crypto-friendly banks Signature and Silvergate close down, and the ensuing temporary drop in USDC’s value in secondary markets. However, on-chain activity starts to tick back up beginning in June. As we see on the chart below, transaction size data suggests that pullback from institutional investors was the primary driver in the overall decline in activity, as retail users and sub-institutional pro traders’ estimated activity remained consistent.

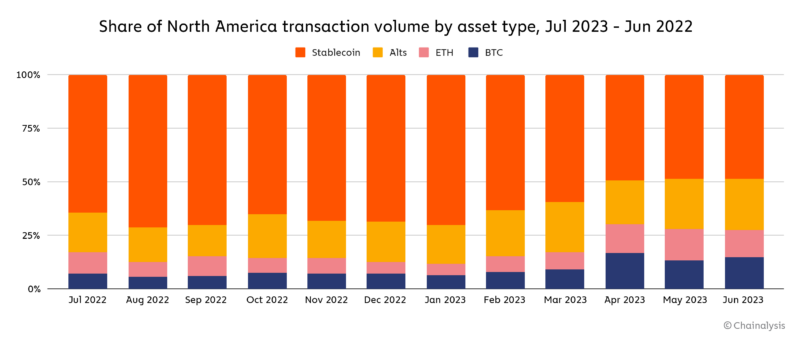

In line with a general trend seen around the world, we’ve also observed a relative decline in North America’s stablecoin usage, compared to other digital assets, beginning around February 2023. Between then and June 2023, stablecoins fell from 70.3% to 48.8% of North America’s on-chain transaction volume.

While the shift away from stablecoins was already underway before the banking failures in March, it’s possible that investor concerns over stablecoins following that incident have played a role in its continuation. Relatedly, stablecoin market capitalization sank to its lowest point in over two years this past summer.

U.S. may be losing regulatory oversight of stablecoin market

Despite the declines described above, stablecoins are the most widely-used type of crypto asset — Chainalysis data shows that more than half of all on-chain transaction volume to or from centralized services between June 2023 and July 2022 took place in stablecoins — and more than 90% of stablecoin activity takes place in stablecoins pegged to the U.S. dollar. U.S. regulators have a strong interest in exercising some regulatory authority over stablecoins, given the central role of USD-denominated reserves to these assets. For one, crypto assets have been used for crime, including uniquely pernicious forms of crime that impact national security, such as theft by North Korea-linked hackers that ultimately funds North Korea’s nuclear program. If U.S. regulators can work to limit stablecoins’ role in such activity, that would have huge, positive impacts on cryptocurrency-related crime given the huge share of overall crypto activity stablecoins represent. Stablecoin regulation also gives regulators a chance to help ensure that the U.S. is home to the cryptocurrency businesses that will play a big role in expanding how the U.S. dollar is used globally as the digital economy continues to grow. However, data suggests that more and more stablecoin activity is occurring through entities that aren’t licensed in the United States.

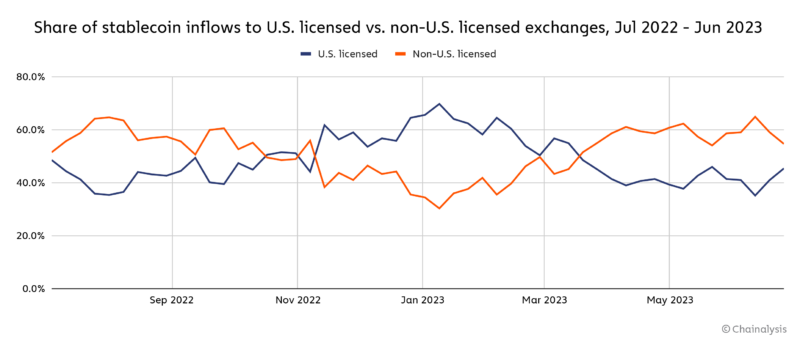

One way we see this is in looking at the services to which stablecoins are transferred. Since spring of 2023, the majority of stablecoin inflows to the 50 biggest crypto services have shifted from U.S. licensed-services to non-U.S. licensed services, undoing a shift in the opposite direction that occurred over the course of late 2022 and early 2023. As of June, a 54.6% share of stablecoin inflows to top 50 services were going to non-U.S. licensed exchanges.

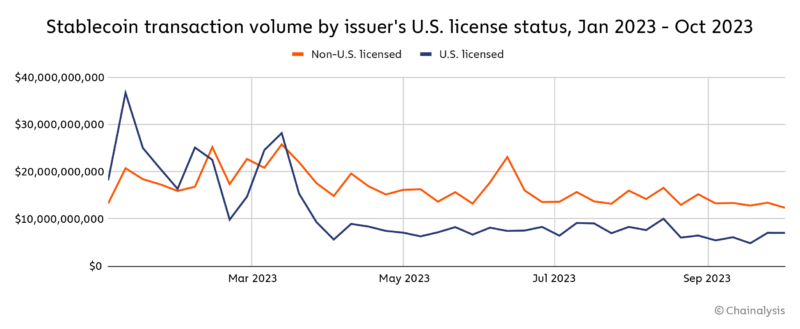

We can see similar trends in looking at stablecoin on-chain transaction volume by whether or not the issuer is a U.S.-licensed entity.

Though U.S. entities originally helped legitimize and seed the stablecoin market, more crypto users are pursuing stablecoin-related activity with trading platforms and issuers headquartered abroad. Unfortunately, this means the U.S. government is increasingly losing its ability to conduct stablecoin oversight and U.S. consumers are missing opportunities to engage with stablecoins with the safeguards provided by the US regulatory regime.

While Congress has shown interest in stablecoin legislation recently, it has yet to pass comprehensive regulation. Here’s a rundown of the proposed stablecoin bills currently in play:

- Clarity for Payment Stablecoins Act, introduced in July 2023, seeks to provide a clear regulatory framework for the issuance of payment stablecoins as well as protect consumers and foster innovation.

- Responsible Financial Innovation Act, introduced in June 2022 and reintroduced in July 2023: while not exclusively dedicated to stablecoins, a portion of the proposal would subject stablecoin issuers to new prudential financial regulations.

Regardless of which bill rises to the fore, the challenge for policymakers in passing stablecoin legislation will be to strike the right balance between keeping consumers safe and creating a framework that allows crypto markets to continue growing and encourages innovation. Time is also of the essence.

Jason Somensatto, Head of North America Public Policy at Chainalysis, agrees. “There continue to be important debates around the regulation of stablecoins, such as the appropriate role of state regulators in registering and supervising stablecoin issuers. These debates are resolvable and should be solved soon in the interest of global competition and necessary regulation,” he told us.

Somensatto also discussed a clear advantage that stablecoins — and all crypto — provide when compared with fiat currency. “The inherent transparency of blockchain technology empowers global regulators, including those in the U.S., to investigate and combat illicit activities efficiently,” he said. “This transparency can also enhance the enforcement of sanctions, allowing participants throughout the crypto ecosystem to screen for and detect activities involving sanctioned entities.”

DeFi usage declines overall

North America has historically been a heavy adopter of DeFi. However, while the region still leads the world in DeFi usage by raw transaction volume, the share of North American crypto activity attributed to DeFi has fallen significantly over the course of the last year.

The most likely explanation is the market turmoil over the last year. As CoinDesk reported in a recent piece, many DeFi protocols cater to the trading of highly-speculative, recently created assets not available on centralized exchanges — those are typically the first assets investors will pull out of when markets decline. Another potential driver of DeFi’s North American slump is the regulatory uncertainty it faces in the U.S. market.

Though challenging, developing such regulation is imperative as DeFi has many useful real-world applications like trading, asset management, lending, and payments, to name just a few. Coinbase CEO Brian Armstrong shared some DeFi use cases he’s excited about. In addition to the benefits seen with borrowing, lending, payments, and staking, Armstrong is optimistic about web3 innovations like decentralized identity frameworks, which allow users (rather than big tech companies) to own their digital identifiers.

Regulation will be key to crypto’s continued growth in the region

It’s not surprising that crypto activity fell in North America in the last year as both transaction volume and grassroots adoption are down worldwide. Yet, in spite of transaction volume declining, North America still ranked fourth in the 2023 Global Crypto Adoption Index. As the region rebounds from crypto winter, regulation will play an important role in its recovery. The U.S. Congress is working to advance two promising pieces of crypto legislation, and prominent regulators are committed to growing the ecosystem safely. CFTC Commissioner Caroline Pham recently shared that her organization could pilot a program to “support the development of compliant digital asset markets and tokenization.” Proactive approaches like these show promise for the growth of crypto in North America and the world at large.

This material is for informational purposes only, and is not intended to provide legal, tax, financial, or investment advice. Recipients should consult their own advisors before making these types of decisions. Chainalysis has no responsibility or liability for any decision made or any other acts or omissions in connection with Recipient’s use of this material.

Chainalysis does not guarantee or warrant the accuracy, completeness, timeliness, suitability or validity of the information in this report and will not be responsible for any claim attributable to errors, omissions, or other inaccuracies of any part of such material.