- Eases entry into the crypto market

- Satisfies stringent regulatory requirements

- Enables risk-based approach to compliance

- Helps educate staff and clients on cryptocurrency threats and opportunities while reducing false positive alerts

Chainalysis is the best partner for companies that are new to crypto and seeking to become leaders in the space. They provide the necessary tools and best practices needed to stay ahead of regulatory requirements and illicit activity.”

– Justine Jiang, Chief Compliance Officer, Digital Treasures Center

About Digital Treasures Center

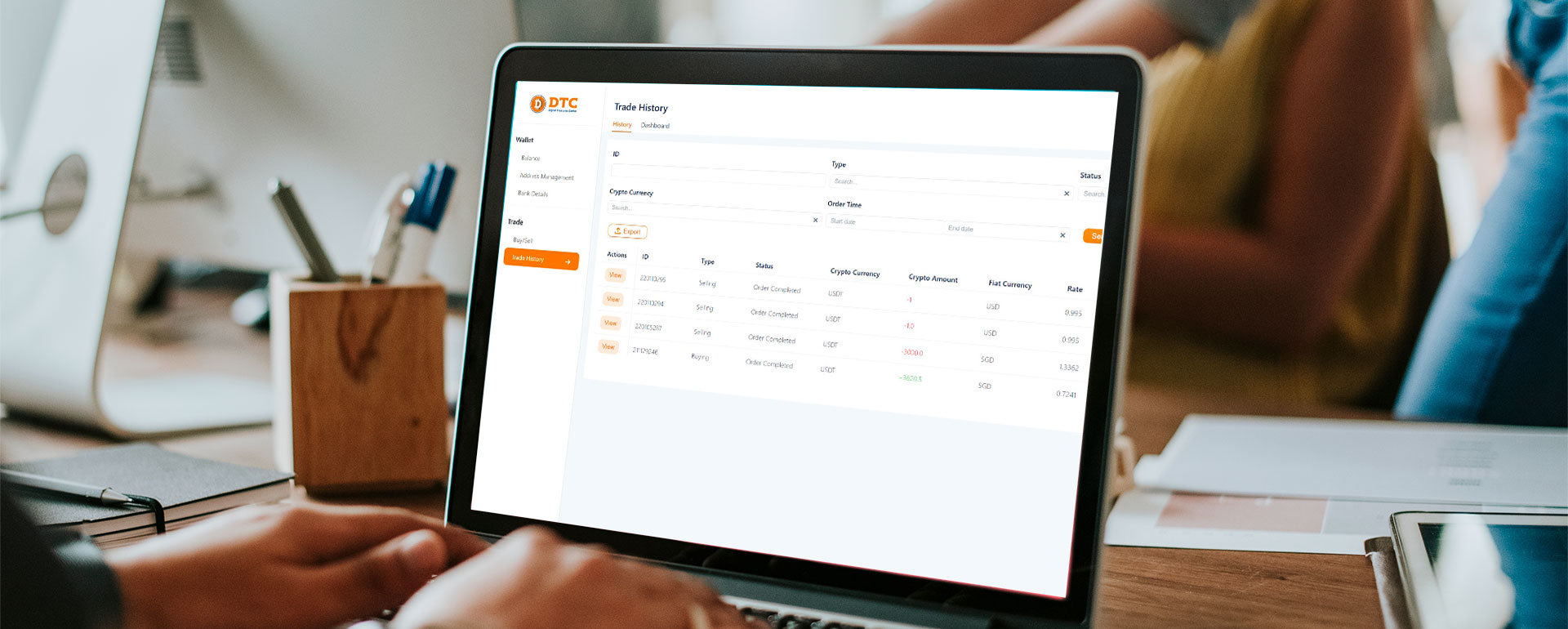

Founded in 2019, Digital Treasures Center (DTC) offers merchants online services for accepting digital payment solutions, including payment settlement, debit card, and digital wallet. The company’s vision is to provide merchants and consumers with a fast, secure and cost-efficient payment solution that satisfies the needs of every party in the supply chain worldwide.

Challenge

From the start, DTC wanted the best solution for transaction monitoring to pave the way for a successful payment solution and in turn gives confidence to merchants and consumers in using crypto as a form of payment method.

Solution

DTC adopted both Chainalysis KYT and Chainalysis Reactor solutions to address its business and regulatory requirements. With these solutions in place, DTC feels confident satisfying regulators and growing its business.

We firmly believe that crypto is the missing ingredient that will make the next-generation payment company successful.”

What Chainalysis functionality or tools do you find most helpful?

Chainalysis KYT helps us understand risk and Chainalysis Reactor helps us investigate potential issues.

With Chainalysis KYT, we use the suggested default alert thresholds because that satisfies our current needs. While we might fine tune it along the way as we grow and scale, its default alerts can already satisfy the industry requirement. This default methodology gives us severe, high and medium risk alerts that are satisfactory to regulators. As our business grows and we gather more data and develop a more sophisticated understanding of our clients and our risk appetite, we might adjust the settings.

Chainalysis Reactor helps us quickly build the transaction chain and understand which transactions are problematic, in turn enabling us to investigate in a more efficient way.

How do you determine the value of Chainalysis to your business?

We’ve used Chainalysis from day one of our operations. We are able to identify any false positives using Reactor and KYT and close a case on the same day, saving our compliance team lots of time. We have integrated Chainalysis with our in-house system so our compliance officers can retrieve all information on our clients and transactions within a single platform. That provides a bigger picture and allows our compliance team to make better decisions while saving them from trying to piece information together from different platforms. Chainalysis’ reputation and its status as the market leader gives assurance that we are using the right tools with the right capabilities to monitor transactions and detect potential illicit activity.