- Reduces false positives on transactions by 85%

- Reduces time to add OFAC / SDN by 100%

- Achieves significant time savings by automatically reviewing 90%+ of addresses

- Reduces time to market by 100%

With Chainalysis tools in place, we feel confident offering new coins and services, and expanding our presence in Latin America and other parts of the world.”

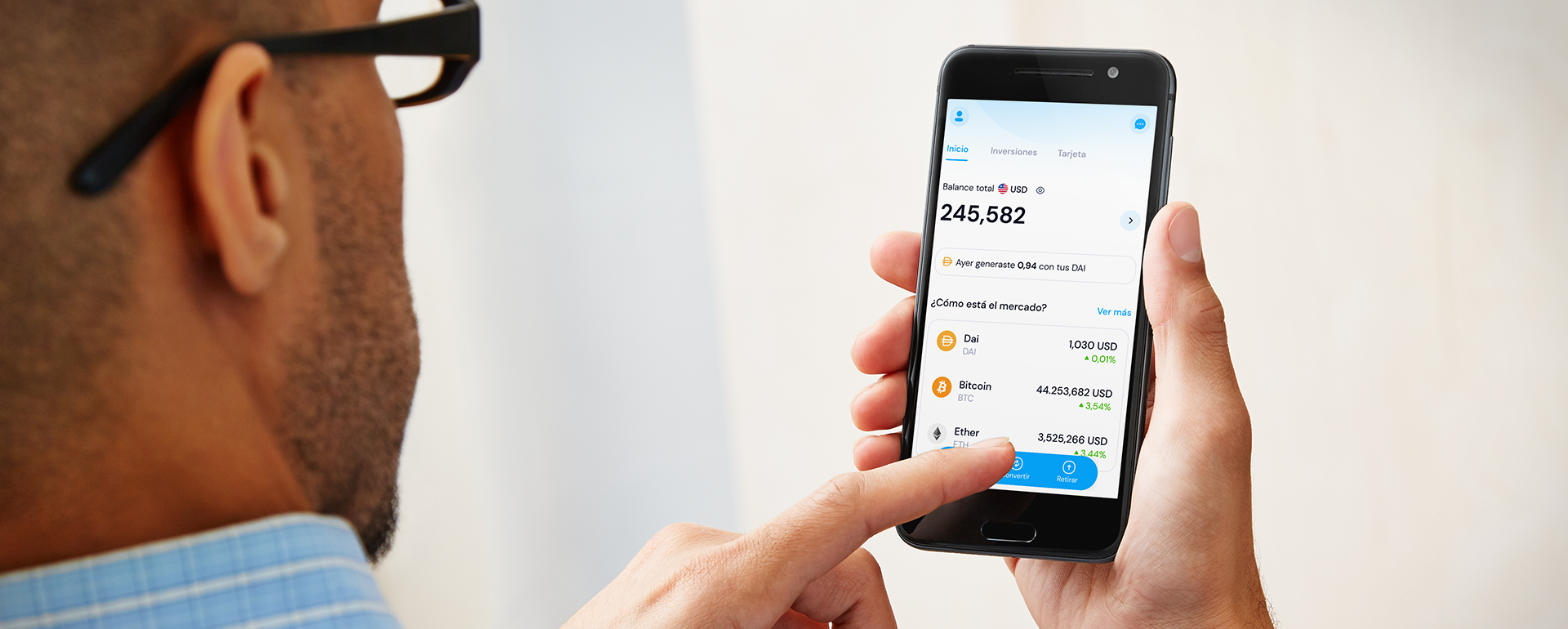

Founded in 2018 and headquartered in Argentina, Buenbit is a rapidly growing cryptocurrency exchange that brings DeFi to everyday users, enabling customers to buy and sell cryptocurrencies and sophisticated users to actively manage their investments and earn interest. The company currently supports 12 assets, adding regularly to its portfolio. Additionally, the company leverages cryptocurrency trading to offer a low-cost, crossborder payment solution. Although Argentina does not currently regulate cryptocurrency, Buenbit is a centralized exchange that needs to cohabit with many regulatory entities, and therefore must have strong monitoring and controls in place.

Challenge

Compliance-minded from the start, Buenbit wanted to support its robust compliance program with sophisticated tools that elevated and automated its compliance program. When evaluating crypto compliance solutions, the company was looking for a tool that could support its compliance program and demonstrate that it is effectively preventing money laundering and terrorism financing. At the same time, Buenbit was thinking beyond compliance to ethics and values. As Erika Gonzalez, Chief Compliance Officer (CCO) at Buenbit, explains, a company’s compliance program will follow the ethics and values that management decides upon for the business.

Solution

While the company looked at several solutions, Chainalysis understands the day-to-day workings of the crypto ecosystem and was better suited than other vendors to help Buenbit support its compliance program and protect its customers. Key decision-making factors were Chainalysis’ easy-to-use UI, the reporting tool, and that the suite of products is designed for different players within the crypto ecosystem – for instance, banks and exchanges.

Crypto is always changing and Chainalysis is one of the best when it comes to keeping up with new coins and changes in the DeFi or regulatory space.”

Unlocking New Revenue Opportunities?

Thanks to Chainalysis, Buenbit can apply more controls for blockchain monitoring and this strengthens its product offerings and helps protect users from any illicit activity. The company can offer the banks it works with an on/off ramp service, and can build trust with regulators by meeting local requirements and international standards with quality reports it generates via Chainalysis. The optimized monitoring workflow enabled by Chainalysis supplies Buenbit with fully auditable data, which is valuable from a compliance standpoint and useful for assessing the company’s financial and operational performance.

Better Prepared for Future Regulatory Scrutiny

While Buenbit is currently regulated In Peru, it soon expects to be regulated in Mexico where it recently started operations. The exchange’s compliance program has been preparing for regulation from the start. However, regulatory bodies always ask whether Buenbit has a transaction monitoring system integrated. According to Gonzalez, “When we tell them we use Chainalysis, they realize we have a robust system in place. Chainalysis is a respected name and automatically validates our transaction monitoring.”