This post is an excerpt from our 2023 Geography of Cryptocurrency Report. Download your copy now!

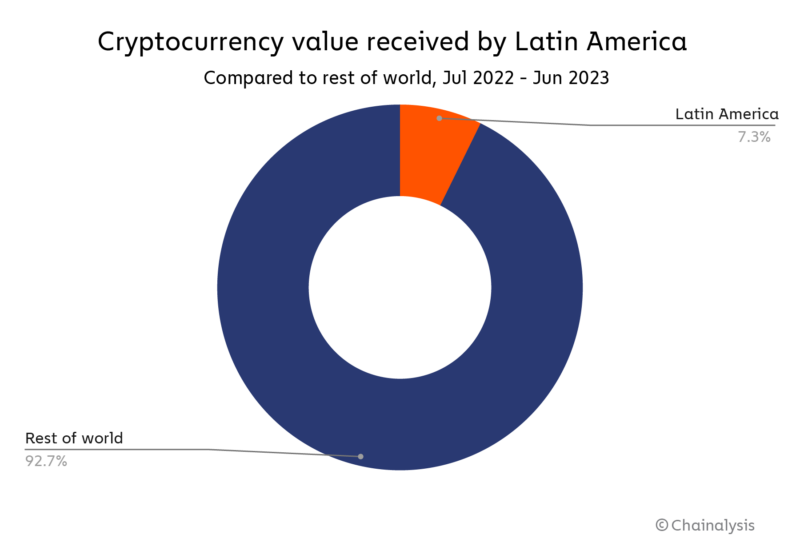

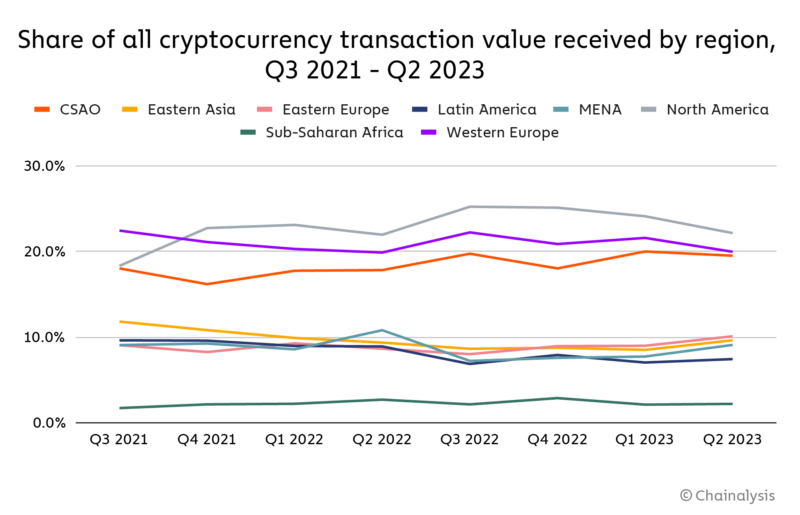

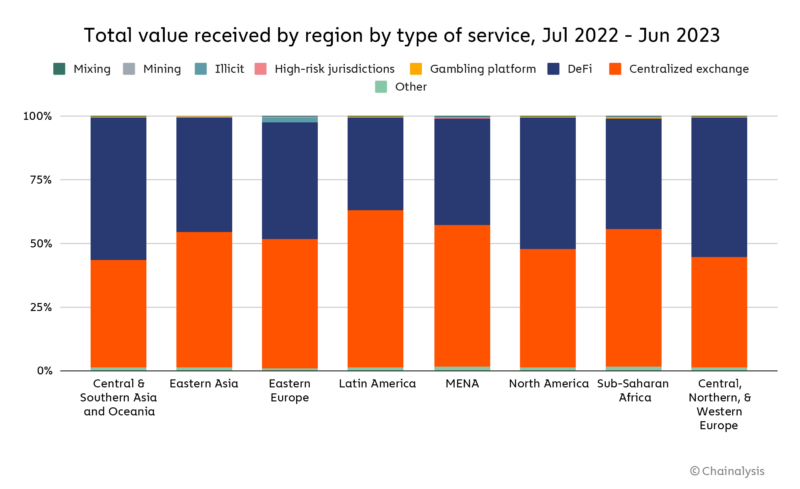

Latin America has the seventh-largest crypto economy of all regions we study, ahead of only Sub-Saharan Africa, but not far behind MENA, Eastern Asia, and Eastern Europe. Its position compared to other regions has held relatively steady over the last two years.

Latin America shows the highest preference for centralized exchanges of any region we study, and tilts slightly away from institutional activity compared to other regions.

While Latin America has a smaller crypto economy than most other regions, grassroots adoption is strong, with three countries ranking in the top 20 of our Global Crypto Adoption Index: Brazil (ninth overall), Argentina (15), and Mexico (16). Cryptocurrency has become an important part of day-to-day life in many countries throughout the region, and in particular those facing currency devaluation. We’ll explore that dynamic in more detail later.

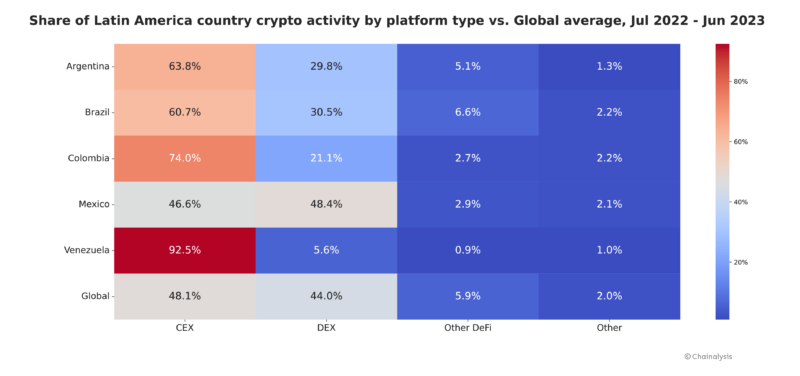

There’s significant variation in crypto usage patterns among countries in Latin America. Check out the heat map below, which compares a few of the region’s biggest crypto-using countries by preferred platform type.

Nearly every country shown devotes a greater share of transaction volume to centralized exchanges than the global average. In Venezuela, a whopping 92.5% of crypto activity goes through these services. Mexico, however, is the lone exception — its platform breakdown is more in line with global averages, with nearly half of all volume being processed through DEXes. This is likely the reason why Mexico devotes a higher share of purchasing activity to altcoins, as DEXes list a far greater number of assets than their centralized counterparts.

Mexico is also an important country to watch for its embrace of cryptocurrency-based remittances. Remittances represent an important area of finance that crypto advocates have long touted as one the technology can make faster and cheaper. Mexico is the world’s second-biggest receiver of remittances, with an estimated $61 billion flowing into the country from overseas per year, mostly from the United States. Daniel Vogel, CEO of Mexican exchange Bitso, says his company processed over $3.3 billion in crypto remittances sent from the U.S to Mexico in 2022, which would represent 5.4% of the total market. Industry participants will likely be interested to see if that share rises in the coming years, both for Mexico and other Latin American countries with large remittance markets.

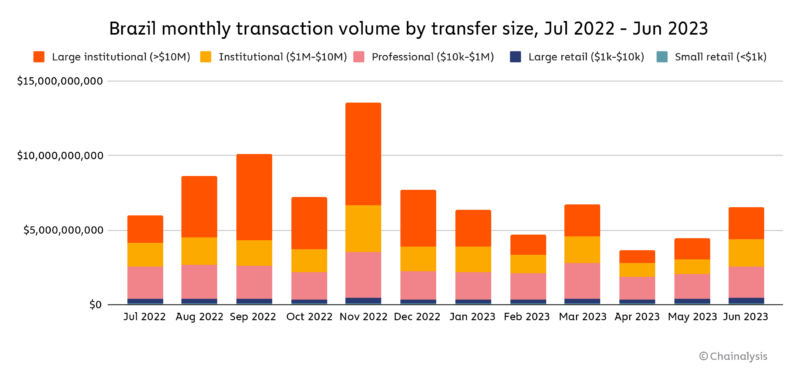

Brazil is another unique market within Latin America. In previous editions of our Geography of Cryptocurrency Report, we’ve written about Brazil’s well-developed institutional crypto market, and the country’s embrace of DeFi and other innovative crypto platform types, putting it more in line with wealthier regions that were earlier to adopt crypto, such as North America and Western Europe, more so than its regional neighbors. Brazil’s market still has those characteristics, but less so than in previous years. As we see below for instance, large institutional-sized transfers have declined, driving an overall downward trend in crypto activity and accounting for a smaller overall share of the remaining activity.

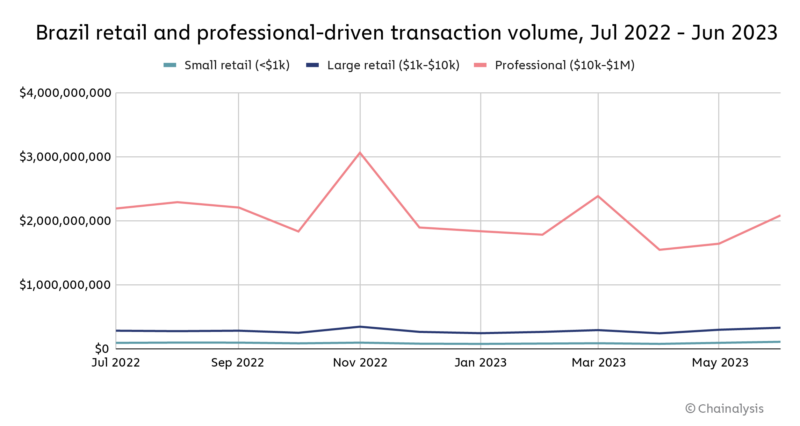

However, there are still some positive takeaways for Brazil’s crypto enthusiasts. For one, while large institutional transactions generally trended down, they appear to be picking back up, with three straight months of growth through June. In addition, even in the months where the decline in large institutional transfers drove overall declines in crypto activity, professional and retail-sized transaction volume stayed relatively even. This is more obvious as expressed on the line chart below.

The data paints an optimistic picture for the Brazilian crypto market. Even in crypto winter, the so-called “middle class” of high-value crypto traders, along with basic retail users, stuck with the asset class. If they continue to trade, it’s not unreasonable to think Brazil’s institutional users will return and perhaps even surpass their previous activity levels if and when we enter another positive market cycle.

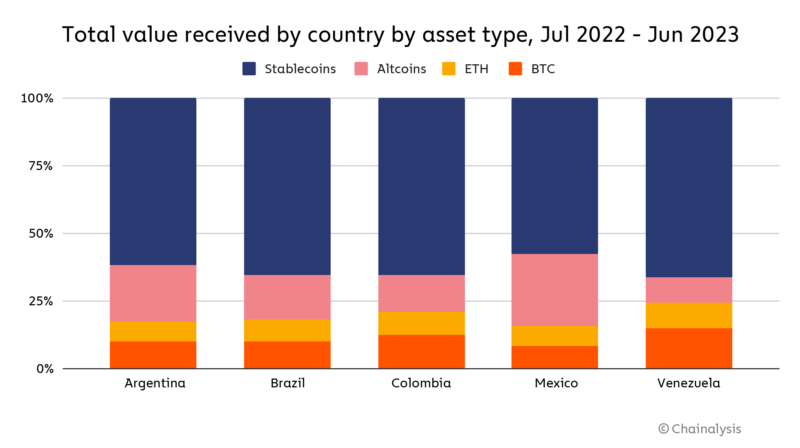

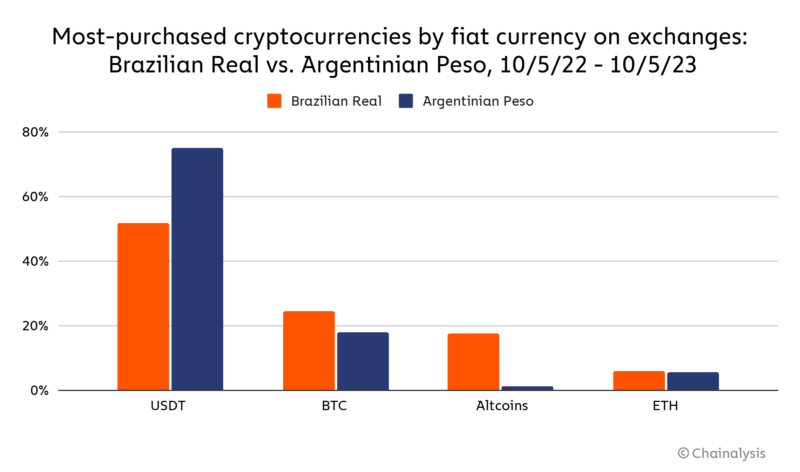

Even with the institutional hiccups, Brazil’s market is still quite different from its less economically secure neighbors. This particularly comes through when we move off-chain and look at exchange order book data. Below, we show the most-purchased assets across a number of exchanges popular in Latin America using the Brazilian Real, compared to the most-purchased assets using the Argentinian peso — Argentina has faced significant currency devaluation over the last year, while Brazil’s currency has been stable.

The data suggests that demand for the stablecoin USDT is much higher in Argentina than in Brazil — as we explore in detail below, this is almost certainly due to the currency devaluation Argentina has faced of late. Meanwhile, Brazilians display a higher demand for Bitcoin and especially altcoins, which are more typically used for long-term investment and speculation.

How crypto provides relief in Argentina’s currency crisis

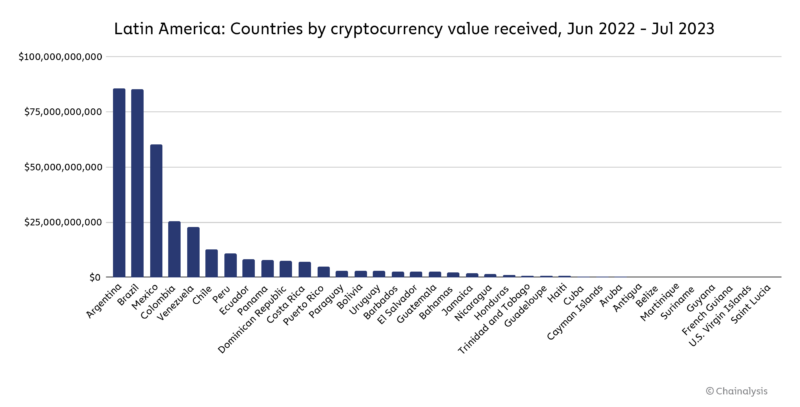

Argentina has faced economic woes for decades, with cycles of extreme currency devaluation periodically hurting residents’ ability to save and making day-to-day financial activity difficult. Unfortunately, Argentina is in the midst of another such cycle, with the Argentinian peso having fallen approximately 51.6% in value in the year leading up to July 2023. During that same time period though, Argentina leads Latin America in raw transaction volume with an estimated $85.4 billion in value received, and is second in the region for grassroots adoption. We spoke with Alfonso Martel Seward, Head of Compliance & AML at Argentina-based cryptocurrency exchange Lemon Cash to learn more about what drives Argentinian cryptocurrency adoption.

Martel Seward indicated that the escape cryptocurrency can provide ordinary residents from the devaluation of the Argentinian peso is the country’s primary driver of adoption. “We have really high inflation, and there are lots of restrictions against buying foreign currencies. That makes crypto a valuable option for saving,” he said. Martel Seward indicated that stablecoins in particular are popular for this use case, and provide a new way of meeting long standing local demand for the U.S. dollar. “You can walk up to any Argentinian person and ask how many pesos to a dollar, and they’ll know,” Martel Seward explained. “As crypto adoption has grown, lots of people here will now get their paycheck and immediately put it into USDT or USDC.”

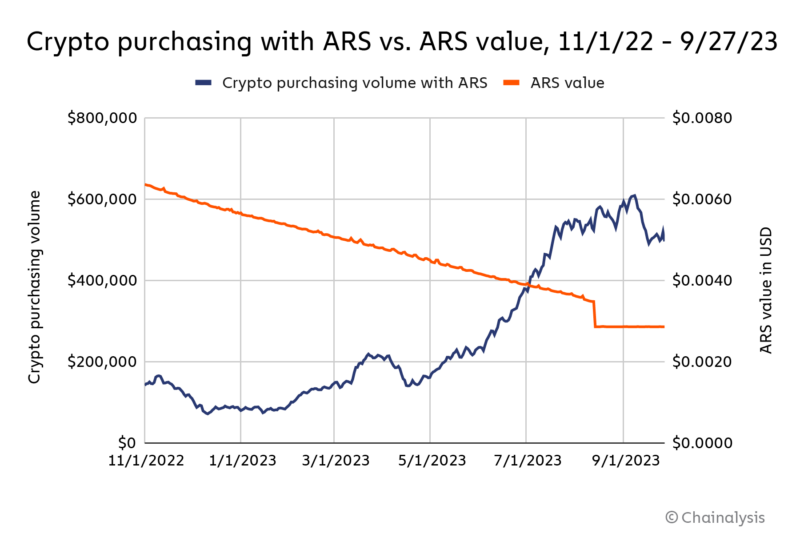

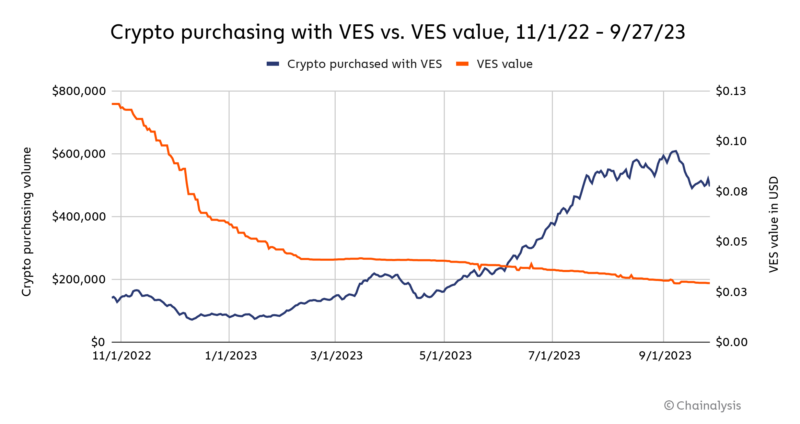

We can see evidence of crypto’s role as a boone against currency devaluation in Argentina on the chart below, which uses order book data from a selection of exchanges popular in the region to compare the value of the Argentinian peso with the volume of crypto purchased with the Argentinain peso over time.

As the Argentinian peso steadily lost value, crypto purchasing trended up, then really spiked in mid-April, around the time Argentina’s inflation crossed 100% for the first time in three decades. We also see a small dropoff in crypto purchasing starting in September, soon after the peso’s value stabilized.

Argentina’s economic conditions don’t just make it difficult for citizens to save. It also makes basic day-to-day commerce hard, as prices can change within a matter of hours. To that end, Lemon Cash offers users a debit card that allows users to draw on their crypto accounts to make purchases at any card-accepting retailer — upon swiping the card, crypto is instantly sold from the user’s account, and the business receives payment in the local currency. These offerings have helped Lemon Cash become a leader in an extremely active cryptocurrency market. “Crypto is mainstream in Argentina — about 5 million people [out of a total population of 45.8 million] use it, and 2 million of them are on Lemon,” said Seward. Lemon Cash’s growth, and crypto’s popularity in Argentina generally, are a testament to the asset class’ unique ability to provide relief during periods of economic hardship.

Venezuela: Cryptocurrency as a weapon against authoritarianism

Like Argentina, Venezuela has seen more than its fair share of economic problems and suffered from severe currency devaluation. However, Venezuela differs from Argentina in one key way: The country is ruled by an authoritarian government. Under the Nicolás Maduro regime, Venezuelans face significant human rights abuses and political repression, and see less opportunity due to government corruption, examples of which include embezzlement from the country’s state-owned oil company.

How can cryptocurrency improve the lives of people subject to both poor economic conditions and the mistreatment of an autocratic regime? We talked to Venezuelan opposition leader Leopoldo López to learn. López is the founder of Venezuelan political party Voluntad Popular, and became a political prisoner in 2014 after leading protests against the Maduro regime, eventually leaving the country in 2020. López is a close associate of Venezuela’s former president-in-exile Juan Guaidó, and worked with Guaidó’s interim government that contested Maduro’s presidency. Since leaving Venezuela, López has continued to push for democracy in Venezuela from abroad, and has embraced cryptocurrency as a tool for furthering that agenda.

López explained to us how cryptocurrency has helped many Venezuelans preserve their savings as its local currency, the bolivar, has lost value. “Venezuela has had one of the worst ever hyperinflation rates at over 1 million percent,” López told us. “Cryptocurrency, particularly stablecoins, has helped many Venezuelans overcome this.” We can see this dynamic in exchange order book data, where purchasing of cryptocurrency using bolivars tends to rise when the bolivar loses value. Though the relationship isn’t as strong as what we see in Argentina or in previous years for Venezuela — there’s a slight delay between the biggest drop in bolivar value and the big stablecoin purchasing spike that starts in April — it’s important to note that other inflation-related metrics, such as consumer prices, did spike at this time.

López also told us about cryptocurrency’s important role in enabling remittances to Venezuela, which have become increasingly important to the country in the last few years. “Until recently, Venezuela wasn’t a country with large migration rates,” he told us. “But since 2014, there’s been a mass exodus due to the complex humanitarian emergency. Over the past ten years, about 25% of the population has left the country.” That exodus has turned remittances into a huge part of Venezuela’s economy, and López tells us that many have turned to stablecoins as an alternative way of fulfilling this need.

The crypto use case most unique to Venezuela, however, is in how it can enable citizens to resist the oppression of the Maduro regime. López told us about one example in particular. During the Covid crisis in 2020, the Guaidó-led interim government hatched a plan to use cryptocurrency to deliver direct aid to doctors and nurses in the country. Cryptocurrency was their best option, as international aid was difficult to deliver via normal means due to the Maduro regime’s corruption and tendency to refuse much-needed financial help on political grounds. “The challenge was how to make a direct cash transfer without interference of the dictatorship — it has full control of the banks and financial system,” he explained. The team got around this by using cryptocurrency wallets to transfer the funds to trusted individuals on the ground — “human ATMs,” as López put it — who then distributed it to doctors and nurses. They also applied KYC checks to recipients based on the records of doctor and nurse unions trusted by the interim government, to ensure that funds went only to medical professionals and not to any sanctioned individuals.

“This program directly helped 65,000 doctors and nurses,” López explained. “Indirectly, it helped hundreds of thousands of people who received care from them. Keep in mind, at this time, the average nurse’s salary was $3 per month and the average doctor’s $5 per month. This program gave both $100 per month. It’s also important to note the emotional impact — for them to know they weren’t alone on the frontlines during the Covid crisis was an important contribution of the program.”

It doesn’t stop there either. López told us that cryptocurrency has become an important tool for those resisting autocratic governments, not just in Venezuela, but around the world. “Crypto has provided an alternative to democracy activists, NGOs, and freedom fighters to overcome censorship and the closing of the civic space,” he said. But he stressed that cryptocurrency on its own isn’t a magic bullet. Off-ramping into fiat will always be difficult in authoritarian countries. “I believe that the true value of cryptocurrency to support democracy movements will be realized only when off-ramping has no dependency at all on the autocratic regime.”

Venezuela’s embrace of cryptocurrency, and its role in aid programs like those led by López and his allies, provide an important reminder of the potential this still-young technology has to foster freedom and improve quality of life in the places that most need both.

This material is for informational purposes only, and is not intended to provide legal, tax, financial, or investment advice. Recipients should consult their own advisors before making these types of decisions. Chainalysis does not guarantee or warrant the accuracy, completeness, timeliness, suitability or validity of the information in this report and will not be responsible for any claim attributable to errors, omissions, or other inaccuracies of any part of such material.