This post is an excerpt from our 2023 Geography of Cryptocurrency Report. Download your copy now!

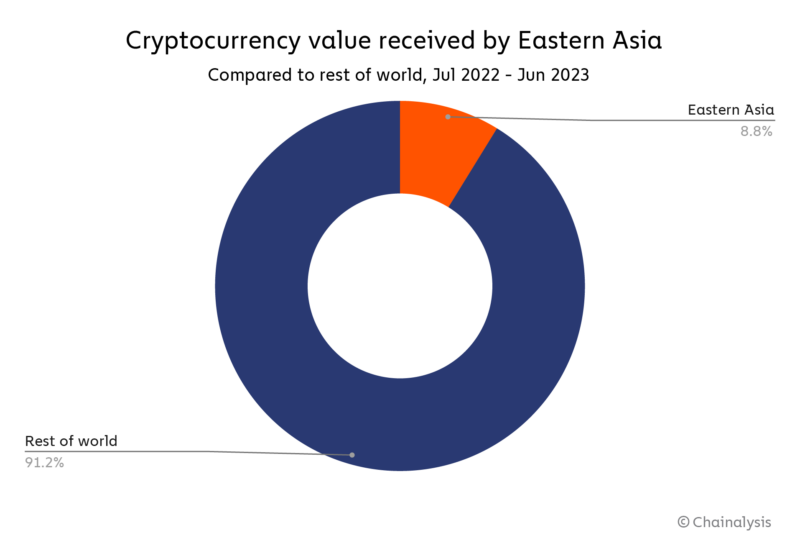

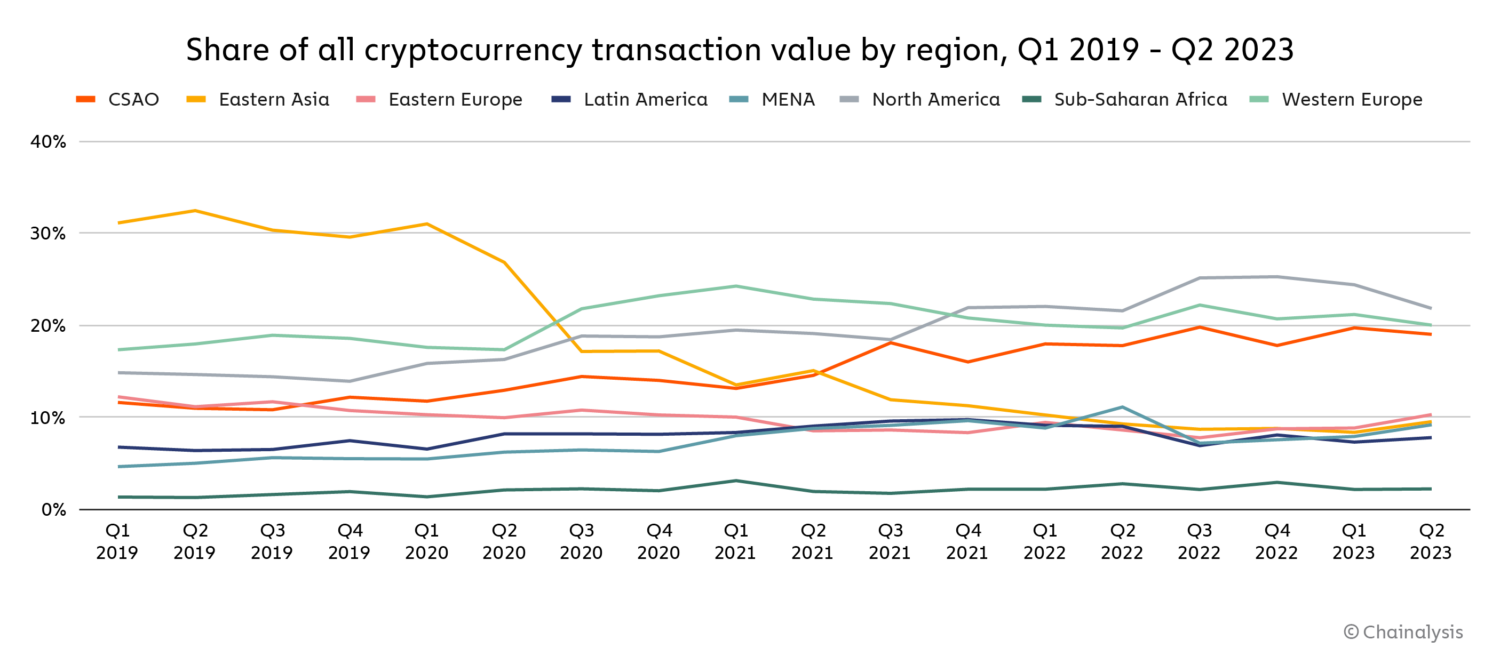

Eastern Asia is the fifth most active crypto market we study, accounting for 8.8% of global crypto activity between July 2022 and June 2023.

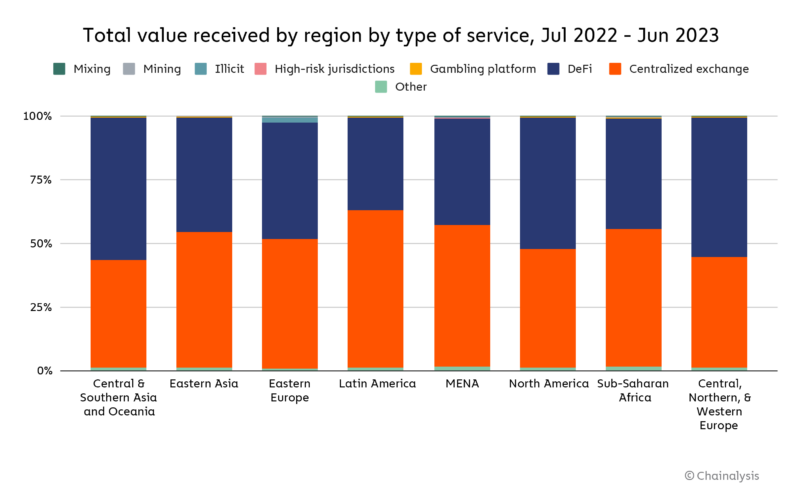

Eastern Asia’s cryptocurrency market appears less driven by institutional activity than larger markets, but it does show a higher propensity for DeFi than similarly sized markets like MENA and Latin America.

Eastern Asia’s decline in cryptocurrency activity over the last few years has been notable – as recently as 2019, Eastern Asia was one of crypto’s top markets by transaction volume, largely powered by China’s huge trading activity and mining sector. But while still substantial, crypto activity in the region at large and China specifically has declined in the last two years, due perhaps in part to a series of bans on virtually all things crypto by the Chinese government.

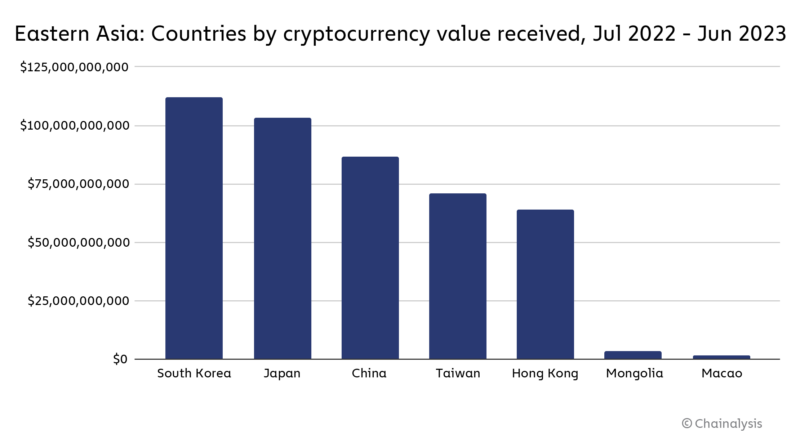

However, a potential tailwind for East Asia comes from Hong Kong, where several crypto initiatives and industry-friendly regulations launched over the past year have fostered bubbling optimism. The increasingly close relationship between China and Hong Kong leads some to speculate that Hong Kong’s growing status as a crypto hub may signal that the Chinese government is reversing course on digital assets, or at least becoming more open to crypto initiatives. As we see above, Hong Kong is an extremely active crypto market by raw transaction volume, with an estimated $64.0 billion in crypto received between July 2022 and June 2023. That’s not far behind China’s $86.4 billion received during the same time period, despite Hong Kong having a population 0.5% the size of mainland China’s.

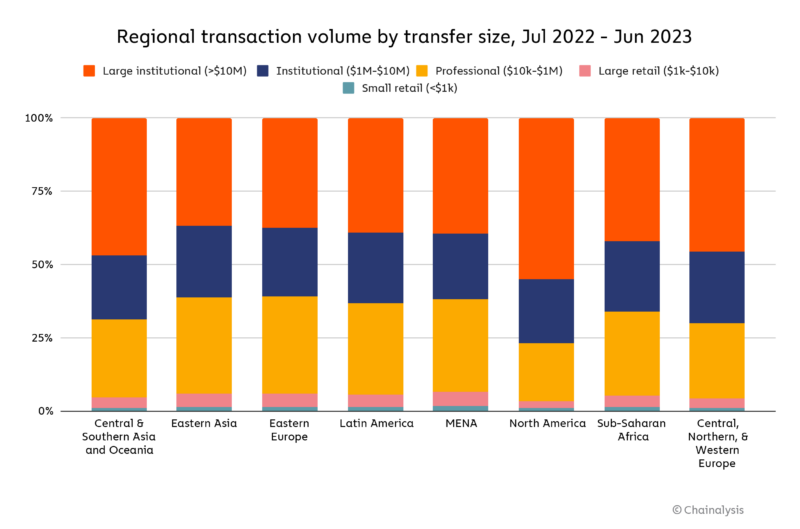

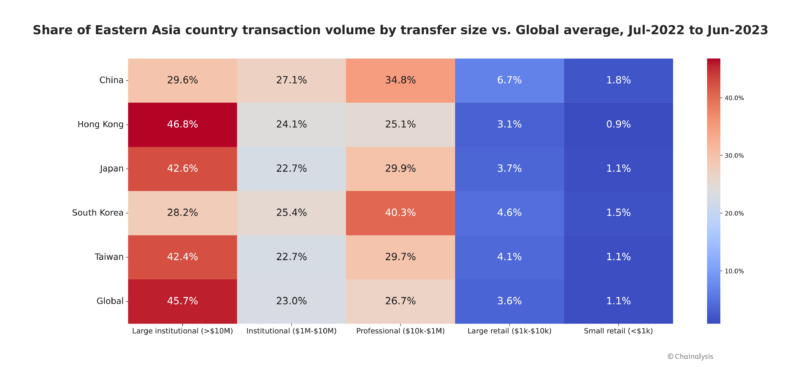

Much of this is driven by Hong Kong’s highly active OTC market. OTCs, or “over-the-counter” trade desks, typically facilitate large transfers for institutional investors and high net worth individuals, which are conducted privately so as to not affect asset prices or broadcast traders’ activity. Hong Kong’s skew toward OTC activity manifests in the city’s breakdown of transaction volume by transaction size, which we show on the chart below alongside that of its regional neighbors and the overall global average.

Hong Kong sees a larger share of transaction volume coming in large institutional transactions of $10 million or more compared to other countries in the region — notably mainland China. On the other end of the spectrum is South Korea, which appears to be the least institutional-driven market in the region based on transaction sizes. That’s likely due to local regulations that make it difficult for financial institutions to trade — South Korea requires a specific type of bank account linked to an individual in order to open a crypto exchange account, which makes it challenging for institutional players to enter the crypto market. Overall, Japan appears to be the Eastern Asia country whose retail versus institutional transaction breakdown is most in line with global averages.

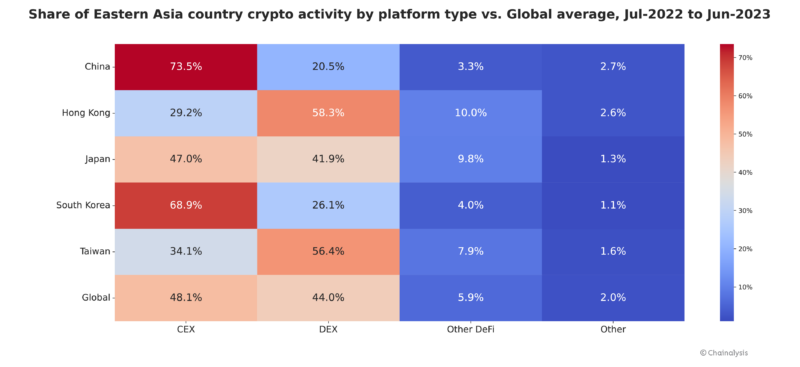

Interesting regional trends emerge when we look at the breakdown of most-used crypto platform types for different Eastern Asia countries.

Again, Japan closely follows global markets, with most activity split close to evenly between centralized exchanges and various types of DeFi protocols. South Korea, on the other hand, sees 68.9% of transaction volume associated with centralized exchanges, and much less with DeFi protocols. One reason for this could be negative sentiment in the country related to the blowup of TerraLuna, which affected a large number of South Korean crypto users — even residents who didn’t lose money likely saw the incident covered heavily in local media. In the wake of TerraLuna, South Korea also passed several new rules governing the conduct of centralized exchanges, including requirements to hold reserve funds. The new rules may have increased South Koreans’ faith in centralized exchanges at a time when DeFi’s reputation took a hit in the country.

China and Hong Kong also show unique breakdowns in most-used crypto platform types, though these numbers should be taken with a grain of salt given the anecdotal evidence that much crypto activity in both countries takes place through OTCs or through informal, grey market peer-to-peer businesses. We’ll explore some of those dynamics more below.

What does Hong Kong’s growing status as a crypto hub say about crypto’s future in China?

China’s relationship with cryptocurrency has been one of the most interesting and difficult-to-follow stories in the industry over the last few years. As recently as 2020, the country was home to one of the most active crypto markets in the world, and led all countries in Bitcoin mining by a wide margin. However, China’s government eventually began to crack down on cryptocurrency, with the state-run People’s Bank of China declaring virtually all crypto activity illegal in 2021.

Recent developments, however, have created speculation that the Chinese government may be warming to cryptocurrency and that Hong Kong may be a testing ground for these efforts. Hong Kong functions as a Special Administrative Region of China, meaning it has autonomy over many aspects of policy, including regulation of cryptocurrency. Hong Kong is also already home to a large, OTC-driven local crypto market, as discussed above. Over the last year though, Hong Kong has implemented rules allowing retail crypto trading within a regulated environment. It has also seen Chinese state-owned businesses launch crypto-focused investment funds and collaborate with local crypto businesses.

What is driving crypto adoption in Hong Kong, and what could this imply about the future of crypto in China as a whole? We spoke to founders of two different Hong Kong-based OTC firms to learn more: Merton Lam of CryptoHK, and Dave Chapman of OSL Digital Securities.

Both acknowledged that a diverse array of use cases power crypto adoption in China and Hong Kong. Merton told us a few that he’s seen in his time running CryptoHK. “Different customers have different means. We work with many investment banks, private equity firms, and high net worth individuals. For them, cryptocurrency is part of their investment portfolio. They mostly want Bitcoin and Ether, though some have shown interest in smaller altcoins recently, which is interesting.” Chapman echoed this sentiment, telling us that many institutional investors are bullish on crypto. “The future of digital assets is no longer questionable; it’s widely acknowledged that digital assets are not going away,” he said. “Whether or not traditional finance is ready to accept digital assets as a new asset class, the reality is that many institutional investors are now keen to explore and develop their own digital asset strategies.”

Chapman indicated that similar motivations, such as potential for high returns, drive retail adoption in the region. Merton echoed this, but also pointed to the many foreign users Crypto HK caters to, many of whom are interested in using crypto to move portions of their wealth out of their local currency and banking systems, especially in countries with unstable economies or strict capital controls. “Anecdotally, I hear from other crypto exchanges that many Russians and Ukrainians are coming to Hong Kong to get their money to safety using crypto,” said Merton. “These aren’t multimillionaires either — ordinary people are doing this too.” Moving capital across borders may also be driving some of the interest from mainland Chinese users too. A recent Financial Times article on the Hong Kong OTC market described how some users from mainland China use these services to move money to other countries or to on-ramp from fiat to cryptocurrency, both of which are difficult to do in China.

Similarly, Merton pointed to international business payments as another important use case in the region, as crypto payments can offer several advantages over bank transfers. “It’s much easier for many businesses to, say, pay a supplier via stablecoin transfer than through banks. It can take as long as three days for a SWIFT transaction to settle, and payments can be especially difficult when dealing with counterparties in developing countries such as in South Asia and Africa.” The international payments use case also brings to mind another element worth noting: China has sought to undermine the dominance of the U.S. dollar in international trade, particularly given the power it gives the U.S. to sanction entities around the world, and that goal is one reason for projects such as China’s CBDC, the digital yuan. Given cryptocurrency’s value as a tool for international trade generally, even apart from CBDCs, it’s possible that goal undergirds any potential openness to blockchain technology we’re seeing from the Chinese government.

That of course leads to the question on everyone’s mind: Does Hong Kong’s embrace of cryptocurrency over the last year suggest that the Chinese government is softening on the technology? Chapman is in a unique position to shed light on the question, as OSL recently became one of the first businesses to receive a license under Hong Kong’s new regulatory regime for crypto exchanges. “The promotion of Hong Kong as a potential crypto hub is not necessarily indicative of the Chinese government’s stance on crypto,” he told us. “However, we are seeing a number of Chinese state-backed entities indirectly supporting Hong Kong’s web3 ventures, and this could be viewed as an exploratory approach to understanding digital assets without loosening mainland policies.” In other words, while these developments strengthen Hong Kong’s chances to become a global leader in the regulated digital asset market, it’s too early to say what they mean for China as a whole.

Overall, Hong Kong’s unique crypto market enables a variety of use cases, not just for local users, but for foreigners as well. Moreover, while nothing is for certain, the apparent tacit approval of Hong Kong’s new crypto initiatives could possibly signal that the Chinese government’s stance on cryptocurrency is evolving. That may mean interesting developments are in store for what was once one of the most important countries in the crypto landscape.

This material is for informational purposes only, and is not intended to provide legal, tax, financial, or investment advice. Recipients should consult their own advisors before making these types of decisions. Chainalysis does not guarantee or warrant the accuracy, completeness, timeliness, suitability or validity of the information in this report and will not be responsible for any claim attributable to errors, omissions, or other inaccuracies of any part of such material.