This blog is a preview of our recent webinar on economic flows between cryptocurrency exchanges. You can watch the whole thing here!

Exchanges are the most active, important service category in the cryptocurrency economy, representing 90% of all value sent by services. They come in all shapes and sizes to meet the needs of a variety of users, whether they be a teenager buying their first cryptocurrency or an early believer who’s been trading for years. And most interesting of all, we’re still seeing new exchange business models emerge and continue to develop.

Below is an overview of the world of cryptocurrency exchanges, where we’ll lay out the five most common types, what differentiates them, and who uses them.

Retail exchanges

Retail exchanges are the most widely used type of exchange, catering to everyone from seasoned traders to newcomers buying their first Bitcoin. That means one of the primary ways they differentiate themselves is usability and speed. Retail exchanges typically have intuitive interfaces to make transactions as seamless as possible. They also tend to be custodial, meaning they hold users’ private keys for them so that they don’t have to dig them up and enter them for every transaction. While this adds to the ease of use, it also means users risk losing their holdings if the exchange is hacked — especially if the exchange isn’t insured.

A key differentiator for retail exchanges is whether they let users trade cryptocurrency for fiat currency or only crypto-to-crypto. Crypto-to-fiat exchanges are the easiest places to buy cryptocurrency for the first time, making them the main on-ramp for new users. They also face greater regulatory scrutiny since they’re closer to the mainstream banking world — if users are going to cash out their cryptocurrency and move the resulting fiat into a bank, regulators and compliance officers need ways of verifying that the funds aren’t associated with illicit activity. Examples of retail exchanges allowing crypto-to-fiat trades include Bitstamp, Kraken, and Coinbase.

Exchanges that only allow crypto-to-crypto trades, on the other hand, cater more to experienced users looking to profit from the volatility of the markets, and as such tend to offer a greater variety of trading pairs. CoinBene is a great example of a retail exchange that only allows crypto-to-crypto trading.

Peer-to-peer (P2P) exchanges

Whereas retail exchanges manage all trades centrally in an order book, P2P exchanges facilitate trades between individuals. Users create public listings of how much cryptocurrency they’d like to buy or sell, and other users can respond and negotiate terms with them directly.

Once the terms are settled, the two parties can coordinate the transfer either in person or online via bank transfers, wires, gift cards — whatever they decide. A party selling cryptocurrency can often use the exchange as an escrow service, sending them the cryptocurrency to hold until the seller has received payment, at which point the exchange releases it to the other party. P2P exchanges can be custodial or non-custodial.

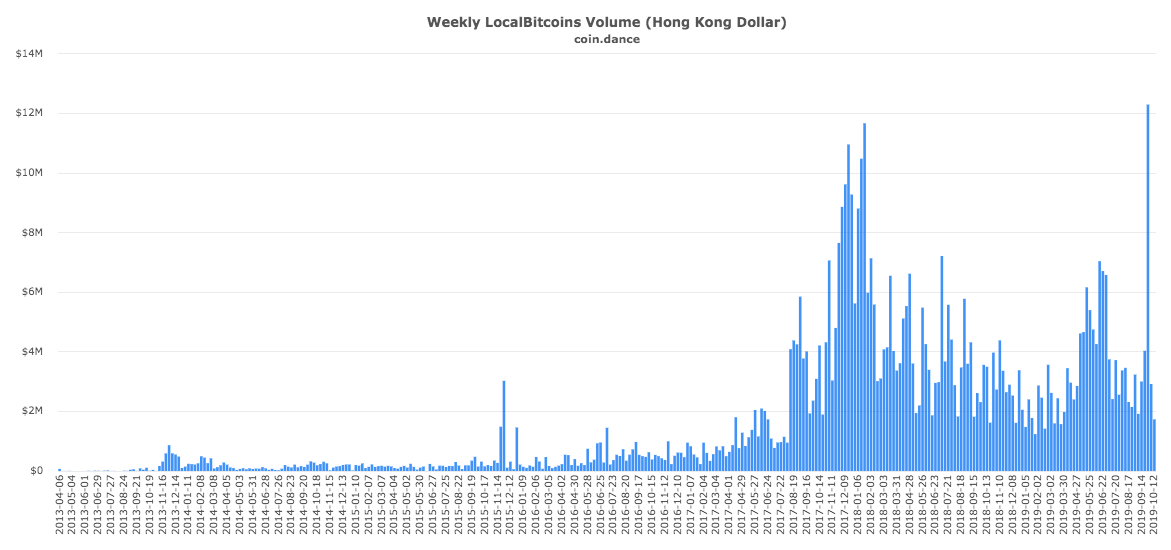

P2P exchanges are especially popular in places without strong traditional banking structure, such as parts of Latin America and Africa, or areas experiencing unrest. For instance, popular P2P exchange LocalBitcoins.com has seen a spike in activity from Hong Kong since protests began in March (though some of the increase may be related to a recent Bitcoin price rally).

Source: Coin.dance

Aside from LocalBitcoins.com, other popular P2P exchanges include Paxful and Remitano.

Decentralized exchanges (DEX)

Decentralized exchanges are a new type of non-custodial, crypto-to-crypto exchange we’ve seen emerge recently. Unlike retail or P2P exchanges, they don’t actually handle funds at all. Instead, decentralized exchanges use networks and protocols to programmatically transfer funds between user’s wallets for direct wallet-to-wallet trading. This gives users more privacy and prevents the possibility of their funds being stolen in a hack of the exchange, since the exchange never actually holds the funds.

The downside is that with such minimal involvement by the exchange, there’s no third party acting as escrow or moderating transactions. Decentralized exchanges are decentralized to the point that if you make a mistake such as sending funds to the wrong address, there’s nothing the exchange can do to help you. This, combined with the fact that they’re typically harder to use from a UI perspective, means that decentralized exchanges have yet to gain greater adoption, resulting in lower liquidity and trade volumes.

Popular decentralized exchanges include Bisq.network, EtherDelta, and RadarRelay.

Instant exchanger

Instant exchangers are another type of non-custodial exchange, but unlike decentralized exchanges, are extremely easy to use. They typically support a wider variety than retail exchanges and convert funds immediately. All users need to do is enter the trade they want to make and the order is filled immediately.

How is this possible? Instant exchangers source cryptocurrencies from a number of custodial, retail exchanges, acting as a nested service on top of them. In this way, instant exchangers give users access to the trading pairs of many different exchanges on one central service. Examples include ShapeShift, Changelly, and SimpleSwap.

Derivatives exchanges

Derivatives like futures and options exist for cryptocurrencies just as they do for traditional financial assets, and there are exchanges that make them available to all. Derivatives are appealing to more advanced traders because they give them more extensive investment options, such as the ability to short a cryptocurrency — with spot trading, you can only bet on the value going up.

Derivatives also let users make highly-leveraged investments, which allow for higher upside. However, there is greater risk to investors because they can lose more than they put in. The increased risk level also opens these types of exchanges up to greater regulatory scrutiny.

While BitMEX offers traditional trading options, its primary focus is on cryptocurrency derivatives. Kraken offers traders access to a derivatives market as well.

How does cryptocurrency flow in and out of exchanges?

Now that you know the key players in the exchange world, the next topic to dive into is how they interact with the wider cryptocurrency economy. What other services — legal and illicit — send the most funds to exchanges? How does that vary by region? What about by size of exchange? You can learn all that and more by watching our Exchanges Webinar.